Did Lehman Brothers sell credit default swaps?

Did Lehman Brothers issue credit default swaps

COUNTERPARTY CREDIT RISK IN THE CREDIT DEFAULT SWAP MARKET

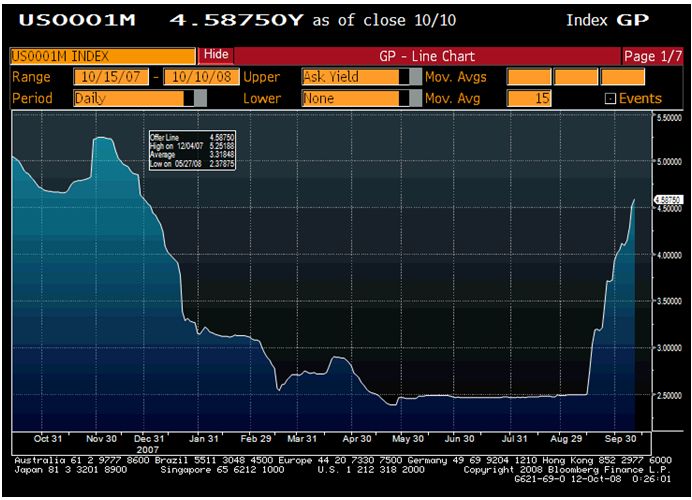

The failure of Lehman Brothers revealed that counterparty credit risk – the risk of default by a major credit protection issuer or dealer in the credit default swap (CDS) market – is non-negligible.

Who bought the credit default swaps

Typically, credit default swaps are the domain of institutional investors, such as hedge funds or banks. However, retail investors can also invest in swaps through exchange-traded funds (ETFs) and mutual funds.

Cached

Who bought credit default swaps in 2008

The investment bank owed $600 billion in debt. Of that, $400 billion was “covered” by credit default swaps. That debt was only worth 8.62 cents on the dollar. The companies that sold the swaps were American International Group, Pacific Investment Management Company, and hedge fund, Citadel.

Cached

Did Lehman Brothers buy CDS

Many investment banks were involved, but the biggest casualty was Lehman Brothers investment bank, which owed $600 billion in debt, out of which $400 billion was covered by CDS.

Cached

Who is the largest credit default swap dealer

Goldman Sachs regained the top spot for dealers of US mutual funds trading single-name credit default swaps (CDSs), as Morgan Stanley, which had briefly taken the lead in the fourth quarter of last year, saw some of its key clients reduce their books during Q1 2023.

What happened with credit default swaps in 2008

Credit default swaps played a large role in the financial crisis of 2008 for many of the same reasons described above. Large banks which traded in CDS's were forced to declare bankruptcy when a large number of the underlying credit instruments defaulted at once, sending shockwaves throughout the United States economy.

Who are the largest credit default swap dealers

Goldman Sachs regained the top spot for dealers of US mutual funds trading single-name credit default swaps (CDSs), as Morgan Stanley, which had briefly taken the lead in the fourth quarter of last year, saw some of its key clients reduce their books during Q1 2023.

Did Goldman Sachs buy credit default swaps

Goldman Sachs…purchased credit default swaps and other protection from third parties that would have paid Goldman Sachs slightly more than the difference had A.I.G. defaulted on its obligations,” the report states (page 16).

What happened to credit default swaps in 2008

Credit default swaps played a large role in the financial crisis of 2008 for many of the same reasons described above. Large banks which traded in CDS's were forced to declare bankruptcy when a large number of the underlying credit instruments defaulted at once, sending shockwaves throughout the United States economy.

Are credit default swaps still legal

Credit default swaps are not illegal, but they are regulated by the Securities and Exchange Commission and the Commodity Futures Trading Commission under the Dodd-Frank Act.

How many CDs were sold in 2008

361 million CDs

Despite the growth of online music sales, CDs remain by far the most popular format, although that hold is slipping; 361 million CDs were sold in 2008, down almost 20 percent from the previous year. About 84 percent of all album purchases were CDs, down from 90 percent the year before.

Why did they sell their credit default swaps

Credit default swaps are sold to investors to mitigate the risks of underlying asset defaults. They were highly used in the past to reduce the risks of investing in mortgage-backed securities and fixed income products, which contributed to the Financial Crisis of 2007-2008 and the European Sovereign Debt Crisis.

Did Michael Burry buy or sell credit default swaps

Through the purchase of credit default swaps from Goldman Sachs GS (an agreement that the seller of CDS will compensate the buyer in the event of a default) and other big banks on the mortgage bond market, Burry made a windfall profit of $100 million in the months following the housing crisis of 2008.

Who is the largest seller of credit default swaps

The biggest CDS market is for governments. Brazil tops the charts, with an daily notional average of $350 million trades each day, based on DTCC data. Credit Suisse's CDS were the most actively traded on the corporate front in the last quarter of 2023, with $100 million traded each day, DTCC data shows.

Who sold the most CDs ever

Perhaps unsurprisingly, British rock band The Beatles are top of the list for best-selling artists worldwide, with 183 million units certified sales.

What is the highest selling CD of all time

Thriller

Michael Jackson's Thriller, estimated to have sold 70 million copies worldwide, is the best-selling album ever. Jackson also currently has the highest number of albums on the list with five, Celine Dion has four, while the Beatles, Pink Floyd, Madonna and Whitney Houston each have three.

How much money did Michael Burry make from credit default swaps

Through the purchase of credit default swaps from Goldman Sachs GS (an agreement that the seller of CDS will compensate the buyer in the event of a default) and other big banks on the mortgage bond market, Burry made a windfall profit of $100 million in the months following the housing crisis of 2008.

What is the biggest selling single of all time

White Christmas

According to Guinness World Records, Irving Berlin's "White Christmas" (1942) as performed by Bing Crosby is the best-selling single worldwide, with estimated sales of over 50 million copies.

How many CDs does Kevin Gates have

| Kevin Gates discography | |

|---|---|

| Studio albums | 3 |

| EPs | 3 |

| Singles | 35 |

| Mixtapes | 17 |

What was the first CD to sell a million copies in 1985

Brothers in Arms

The first artist to sell a million copies on CD was Dire Straits, with its 1985 album Brothers in Arms.