Do adopted children qualify for child Tax credit?

Are adopted kids a tax write off

The maximum adoption credit taxpayers can claim on their 2023 tax return is $14,440 per eligible child. Taxpayers should complete Form 8839, Qualified Adoption Expenses. They use this form to figure how much credit they can claim on their tax return. An eligible child must be younger than 18.

Cached

Can I claim adopted child as dependent

You can claim an adopted child if the adoption has been legally finalized. Adopted and foster children are treated the same as biological dependents for tax purposes.

Cached

What is the adoption tax credit refundability act

Oct 03 2023

Bob Casey and 23 of his Senate colleagues in sponsoring the Adoption Tax Credit Refundability Act – legislation to make the existing federal tax credit for adoption expenses fully refundable and ensure that more families can benefit from this critical support.

What is the IRS adoption credit for 2023

For adoptions finalized in 2023 (tax returns claimed in 2024), the maximum amount a family can receive as credit is $15,950 per adopted child. For adoptions finalized in 2023 (tax returns claimed in 2023), the maximum amount a family can receive as credit is $14,890 per adopted child.

Cached

Do you get a monthly check when you adopt a child in California

Maintenance Payments:

The adoptive parents are free to allocate this money in any manner they deem appropriate. This subsidy comes in the form of a monthly payment. Eligibility for the adoption support subsidy will be determined using the criteria in the above “eligibility” section.

What qualifies for lifetime learning credit

To be eligible for LLC, the student must: Be enrolled or taking courses at an eligible educational institution. Be taking higher education course or courses to get a degree or other recognized education credential or to get or improve job skills. Be enrolled for at least one academic period* beginning in the tax year.

Can a child still receive Social Security benefits if adopted

Since the relationship between the adoptive parent and the adopted child is viewed no differently than the relationship between a parent and natural child under the law, the adopted child is entitled to survivor benefits just as a natural child is entitled.

How does fafsa work for adopted kids

Normally, Federal Pell Grants are awarded solely based on financial need. However, students who are in foster care, aged out of foster care or were adopted out of foster care or an orphanage after reaching age 13 are considered automatically independent on the Free Application for Federal Student Aid (FAFSA).

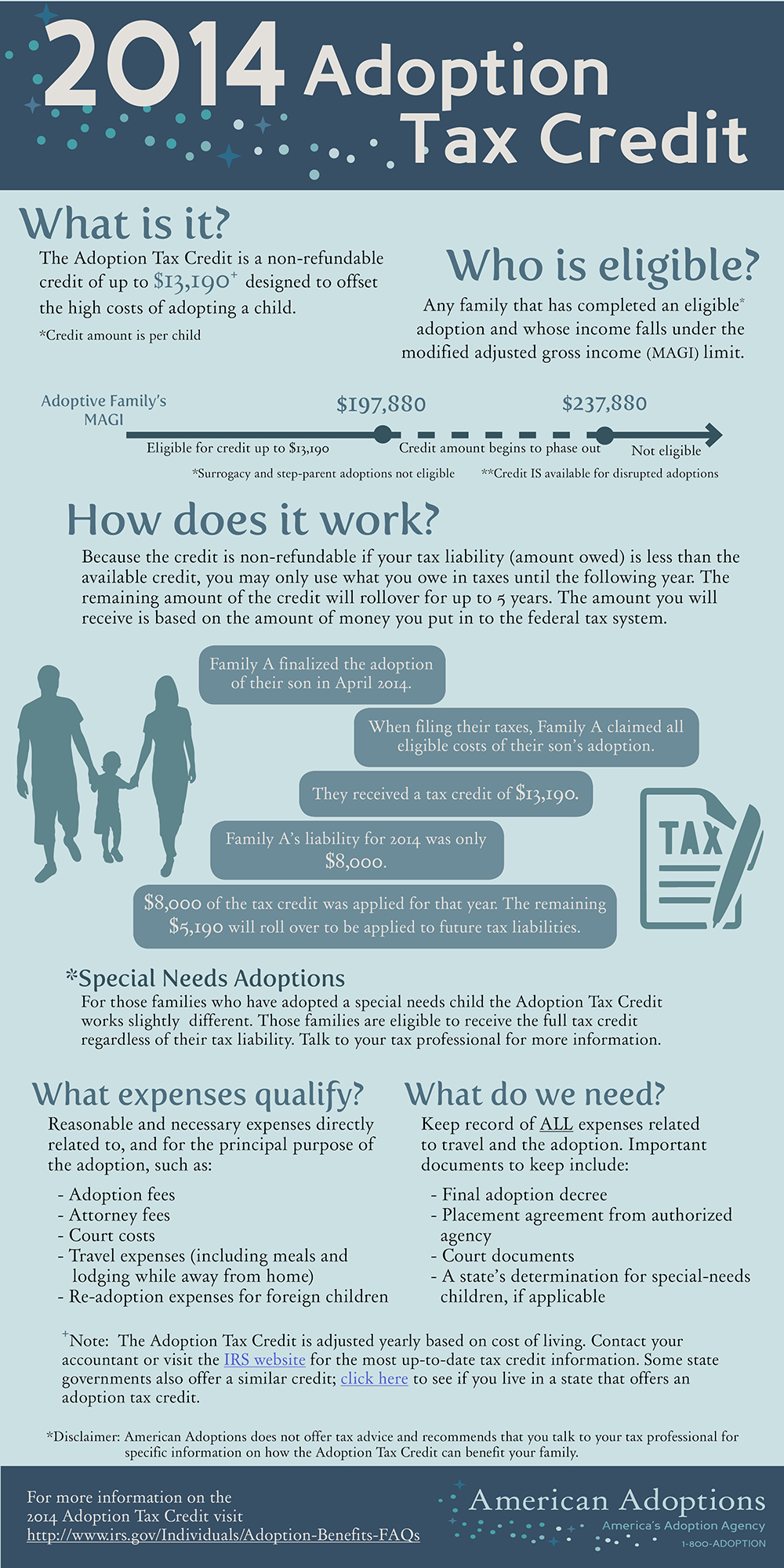

What is a qualified adoption expense

Qualified adoption expenses

Reasonable and necessary adoption fees, Court costs and attorney fees, Traveling expenses (including amounts spent for meals and lodging while away from home), and. Other expenses that are directly related to and for the principal purpose of the legal adoption of an eligible child.

What is full refundability child tax credit

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than $200,000 ($400,000 if filing a joint return). Parents and guardians with higher incomes may be eligible to claim a partial credit.

How do you calculate the adoption credit

Use California Resident Income Tax Return (Form 540) .Take the qualifying costs for the child.Multiply the cost by 50% to get your credit amount.Do not enter more than $2,500 on line 43 or 44.

How much is the adoption tax credit in California

Overview. If you adopted a child in California you can claim a credit for 50% of the cost. The child must have been both of the following: A U.S. citizen or legal resident.

What are the benefits of adoption

The Benefits of Adopting a ChildFulfilling lifelong dreams of raising a child.Experiencing the joy and blessing of adding a child to your family.Building new meaningful relationships.Adopting a more regular schedule.Experiencing new cultural traditions.Exposing yourself to new activities and interests.

Why am I not eligible for the Lifetime Learning Credit

The Lifetime Learning Tax Credit is not available when: The taxpayer claimed the AOTC during the same tax year. The taxpayer pays for college expenses for someone who is not a dependent. The taxpayer files federal income tax returns as married filing separately.

Who is eligible for American Opportunity and Lifetime learning credits

To be eligible for AOTC, the student must: Be pursuing a degree or other recognized education credential. Be enrolled at least half time for at least one academic period* beginning in the tax year. Not have finished the first four years of higher education at the beginning of the tax year.

When a child is adopted is the Social Security number the same

What if my child is adopted We can assign your adopted child an SSN before the adoption is complete, but you may want to wait until the adoption is finalized. Then, you can apply for the number using your child's new name, with your name as parent.

Are adopted children automatically citizens

The Child Citizenship Act of 2000, effective February 27, 2001 grants an adopted child, immigrating to the United States, "automatic" citizenship. The parent may apply for proof that the child is a U.S. citizen.

Are adopted kids independent on the FAFSA

Since July 2009, children who were adopted from foster care at age 13 or older are considered on the Free Application for Federal Student Aid (FAFSA) to be an independent student, which means they don't have to count family income and are more likely to qualify for financial aid.

Can my adopted child get my Social Security benefits

When a parent receives Social Security retirement or disability benefits, or dies, their child may also receive benefits. Under certain circumstances, a stepchild, adopted child, or dependent grandchild or step-grandchild also may qualify. To receive benefits, the child must be unmarried and: Younger than age 18.

How do I claim adoption tax credit on Turbotax

How can I claim the adoption tax credit To claim the adoption credit, complete Form 8839 and attach it to your Form 1040. You no longer need to attach adoption documentation with your federal tax return but should keep the documentation for your records.