Do any mortgage lenders use FICO 9?

Do mortgage lenders use FICO score 9

While most lenders use the FICO Score 8, mortgage lenders use the following scores: Experian: FICO Score 2, or Fair Isaac Risk Model v2. Equifax: FICO Score 5, or Equifax Beacon 5. TransUnion: FICO Score 4, or TransUnion FICO Risk Score 04.

Cached

Does Wells Fargo use FICO 9 for mortgage

Does Wells Fargo use FICO 9 Wells Fargo does use FICO 9 for some of the credit decisions that they make, however that is not the only credit score option that they use or that they make available to customers.

Is FICO 9 widely used

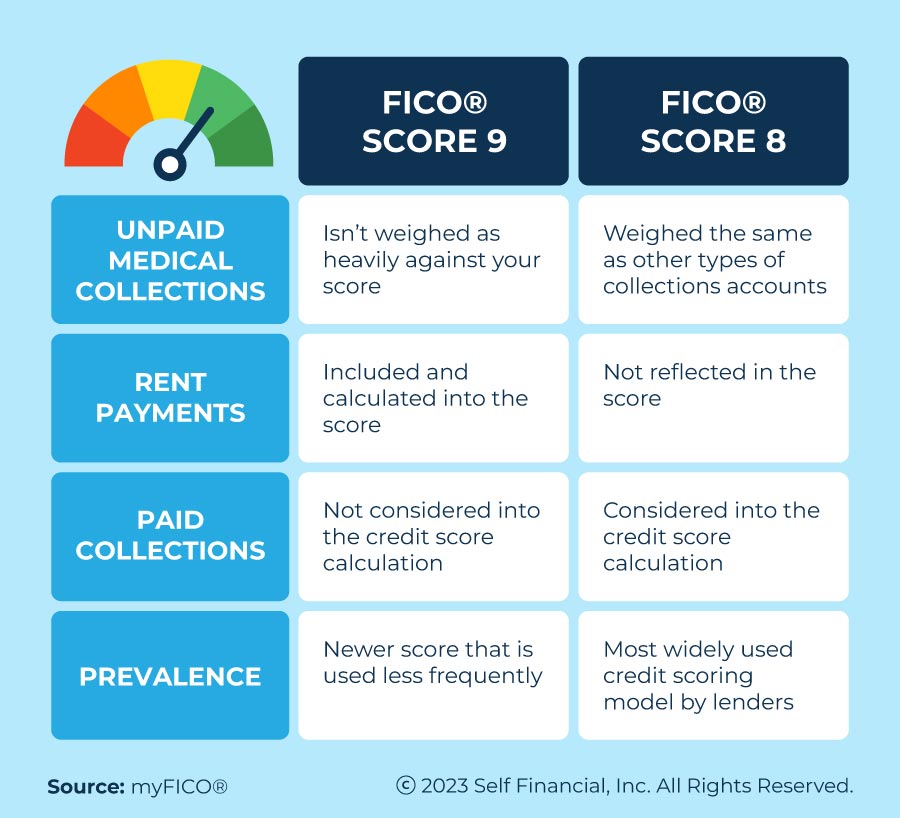

Though the FICO® Score 9 is an updated version of FICO® Score 8, the FICO® Score 8 is still the most widely used base score by lenders, meaning that, while you may have a better credit score from the FICO® Score 9 model, lenders are more likely to still use the previous version.

Cached

Who provides FICO score 9

FICO Score 9 has been available to consumers since 2016. You can purchase it from FICO or possibly get it free from your credit card issuer, a lender or credit counselor through FICO's Open Access program, which allows lenders and credit counselors to share scores used in lending decisions.

Cached

Is FICO 8 or FICO 9 better

FICO 9 is similar to FICO 8 but differs when it comes to collections and rent payments. FICO 9 counts medical collections less harshly than other accounts in collections, so a surgery bill in collections will have less of an impact on your credit score than a credit card bill in collections.

Does Wells Fargo use FICO 8 or FICO 9

Wells Fargo's Credit Close-Up service offers a FICO Score 9 based on your Experian credit report.

What FICO score does Bank of America use for mortgage

600

How Can I Qualify for a Bank of America Mortgage You'll need a FICO credit score of at least 600 and a maximum debt-to-income ratio of 55% to qualify for a mortgage with Bank of America. However, each loan product may have its own requirements. There's no minimum loan amount for most loans.

What is a very good FICO 9 score

740 to 799

What Is a Good Credit Score

| FICO Score Ratings | |

|---|---|

| Very Good | 740 to 799 |

| Good | 670 to 739 |

| Fair | 580 to 669 |

| Very Poor | 300 to 579 |

What is the average FICO 9 score

The average FICO® Score is unchanged from the September 2023 average of 714, but that stability belies the broad economic indicators over that time, which showed that markets and economic conditions were anything but steady through 2023. A credit score of 714 is generally considered good by lenders.

Does TransUnion use FICO 9

The FICO® Score 9 uses information from TransUnion's extensive consumer credit repository to assess a consumer's future risk of severe delinquency.

What FICO score do most banks use

Which Lenders Use Which FICO ScoresEquifax: FICO Score 5 (Equifax Beacon 5.0)Experian: FICO Score 2 (Experian/Fair Isaac Risk Model V2)TransUnion: FICO Score 4 (TransUnion FICO Risk Score 04)

Does Equifax use FICO 8

As an example, FICO Score 5 at Equifax is the FICO Score version previous to FICO Score 8 at Equifax. Other FICO® Score versions, including industry-specific auto and bankcard versions, are also included in the FICO Score products on myFICO.com so you can see what most lenders see when looking at your scores.

What is the most common FICO score used for mortgage

FICO Score 5

The most commonly used FICO Score in the mortgage-lending industry is the FICO Score 5. According to FICO, the majority of lenders pull credit histories from all three major credit reporting agencies as they evaluate mortgage applications. Mortgage lenders may also use FICO Score 2 or FICO Score 4 in their decisions.

What FICO score does Wells Fargo use

FICO® Score 9 from Experian®

Simple access via Wells Fargo Online, to help you know where you stand.

Is FICO 8 the same as FICO 9

FICO 9 is similar to FICO 8 but differs when it comes to collections and rent payments. FICO 9 counts medical collections less harshly than other accounts in collections, so a surgery bill in collections will have less of an impact on your credit score than a credit card bill in collections.

Does anyone have a 900 credit score

Depending on the type of scoring model, a 900 credit score is possible. While the most common FICO and VantageScore models only go up to 850, the FICO Auto Score and FICO Bankcard Score models range from 250 to 900.

Does anyone have a 900 FICO score

Depending on the type of scoring model, a 900 credit score is possible. While the most common FICO and VantageScore models only go up to 850, the FICO Auto Score and FICO Bankcard Score models range from 250 to 900.

What FICO score does Equifax use

Since the information on your credit reports at each bureau can differ, your Equifax credit score and FICO score can differ depending on which credit report is used to calculate the score. The Equifax credit score model uses a numerical range between 280 and 850, and FICO score models use a range between 300 and 850.

Which FICO score is used for mortgage

The commonly used FICO® Scores for mortgage lending are: FICO® Score 2, or Experian/Fair Isaac Risk Model v2. FICO® Score 5, or Equifax Beacon 5. FICO® Score 4, or TransUnion FICO® Risk Score 04.

What FICO score does Rocket mortgage use

There are some other things to keep in mind. If you don't have an existing mortgage with Rocket Mortgage, we require a 640 median FICO® Score. If your loan is with us, the required median FICO® is 580. Additionally, timing is important.