Do Apple Card monthly installments use credit limit?

What is the credit limit for Apple Card financing

The Apple Card credit limit is usually around $2,500 to start, according to forum posts, and some cardholders report limits as high as $20,000. Marcus by Goldman Sachs does not include any specific Apple Card credit limit information in the card's terms, though.

Can I pay off Apple Card monthly installments early

If you already paid your Apple Card balance, you can make an early payment toward your Apple Card Monthly Installments. At card.apple.com, click Payments in the sidebar. Click Pay Installments Early at the bottom of the page.

Why am i not eligible for Apple Card monthly installments

ACMI is not available for purchases made online at the following special stores: Apple Employee Purchase Plan, participating corporate Employee Purchase Programs, Apple at Work for small businesses, Government, and Veterans and Military Purchase Programs, or on refurbished devices.

Does the Apple credit card have to be paid in full every month

If you don't pay your monthly balance in full by your due date, interest begins to accrue. Interest is charged on the unpaid portion of your monthly balance and begins to accrue on new purchases until you pay the monthly balance in full.

Does financing with Apple Card hurt your credit

If you apply for Apple Card and your application is approved, there's no impact to your credit score until you accept your offer. If you accept your offer, a hard inquiry is made. This may impact your credit score.

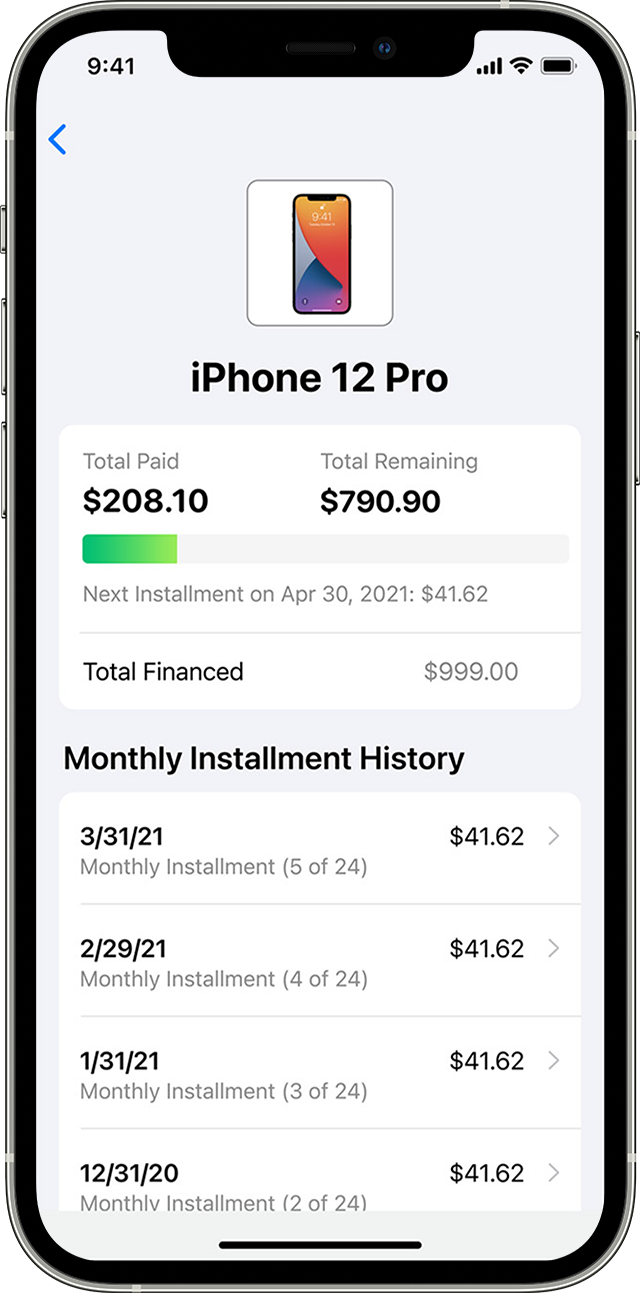

How do Apple installment plans work

The total amount that you finance for your new device is divided into interest-free monthly installments. Each installment is included in your Apple Card minimum payment and is due every month for the duration of the installment plan. The total amount that you finance increases if you buy an AppleCare+ plan.

Can I pay my Apple installment in full

Open the Wallet app and tap Apple Card. Tap the more button , then tap Monthly Installments. If you have multiple monthly installments, you see the balance for all of your monthly installments. Tap Pay Early, then tap Continue.

How does Apple monthly payments work

Your monthly installment is automatically added to the minimum payment due on your Apple Card — including any associated AppleCare+ coverage. If you share your card with a Co‑Owner, 4 you're both responsible for the monthly installment payment.

How do I qualify for Apple monthly payments

GeneralCredit check required.Must be at least 18 years old (or the legal age of majority in your jurisdiction of residence) to enroll in iPhone Installments.An eligible iPhone includes iPhones that are designated for inclusion in iPhone Installments by Apple.Minimum financed amount may apply.

Does Apple Card financing affect credit score

If you apply for Apple Card and your application is approved, there's no impact to your credit score until you accept your offer. If you accept your offer, a hard inquiry is made. This may impact your credit score.

How does monthly pay work with Apple Card

Your monthly installment is automatically added to the minimum payment due on your Apple Card — including any associated AppleCare+ coverage. If you share your card with a Co‑Owner, 4 you're both responsible for the monthly installment payment.

How does installment balance work on Apple Card

The total amount that you finance for your new device is divided into interest-free monthly installments. Each installment is included in your Apple Card minimum payment and is due every month for the duration of the installment plan. The total amount that you finance increases if you buy an AppleCare+ plan.

Is financing with Apple Card good

Is financing your phone with the Apple Card worth it In many cases, it can be a good idea to finance your new iPhone with the Apple Card. Not only will you earn 3% cash back on your purchase, but you can also save on interest charges and pay off the phone over time.

What are the requirements for Apple installment

GeneralCredit check required.Must be at least 18 years old (or the legal age of majority in your jurisdiction of residence) to enroll in iPhone Payments.An eligible iPhone includes any iPhone that is designated for inclusion in iPhone Payments by Apple.Minimum financed amount may apply.

How does Apple installment plan work

Your monthly installment is automatically added to the minimum payment due on your Apple Card — including any associated AppleCare+ coverage. If you share your card with a Co‑Owner, 4 you're both responsible for the monthly installment payment.

What credit score do you need for the Apple credit card

660

There are multiple FICO Score versions available for lenders to use. Apple Card uses FICO Score 9. FICO Score 9 ranges from 300 to 850, with scores above 660 considered favorable for credit approval.

How does Apple Pay monthly installment work

The total amount that you finance for your new device is divided into interest-free monthly installments. Each installment is included in your Apple Card minimum payment and is due every month for the duration of the installment plan. The total amount that you finance increases if you buy an AppleCare+ plan.

Does financing with Apple build credit

The factor that affects your credit score is what percentage of your available credit do you use. If the loan from Apple is the only credit you have, you are using 100% of your available credit when you take the loan, so, yes, it will lower your credit score.

Does Apple Pay card run your credit

If you apply for Apple Card and your application is approved, there's no impact to your credit score until you accept your offer. If you accept your offer, a hard inquiry is made. This may impact your credit score.

Is it better to pay iPhone in full or monthly

Paying off early does not really save you anything, since the loan is at 0% interest. You don't have to trade the phone at 12 months, you can keep it and pay the entire 24. Either way, you are paying the same for the phone if you purchased it all at once, or make the 24 month payments.