Do banks use ClearScore?

Do banks use ClearScore

Lenders can't see your ClearScore account, and your ClearScore report won't directly affect your credit worthiness. However, your ClearScore account shows Experian data, which lenders do look at.

Do lenders use Experian or ClearScore

Experian is considered more accurate as lenders rely on it for credit evaluations. Not competing services: Clearscore generates revenue through commissions on financial product recommendations, while Experian charges for access to its data.

Does ClearScore work in America

We operate in the UK, South Africa, Australia and Canada and have over 19 million users. Across the globe, we are dedicated to offering exceptional careers for our extraordinary team.

Is ClearScore your real credit score

ClearScore should be as accurate as Experian considering your ClearScore information is pulled from Experian. Thus, ClearScore is considered as accurate as any credit reference agency.

Why is my ClearScore so different to Experian

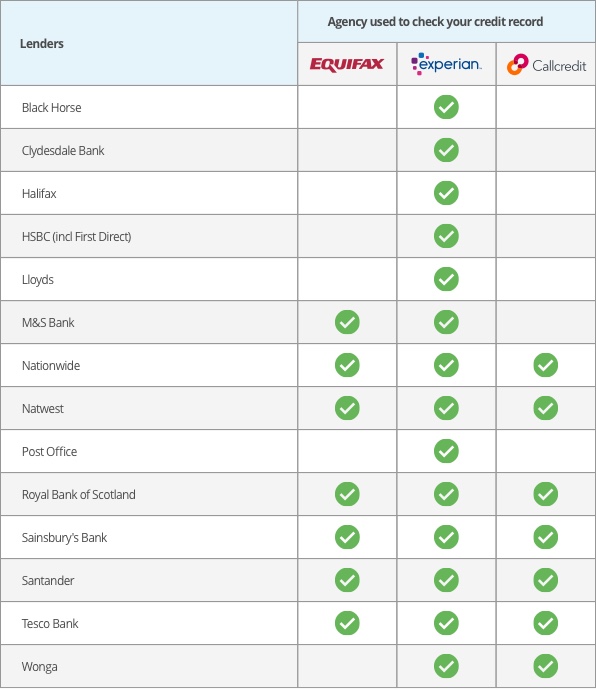

Some lenders report to all three major credit reference agencies, but others report to only one or two. Because of this, each of the three credit reference agencies may have slightly different credit report information for you and you may see different scores as a result.

Which FICO score do banks use

FICO Score 8

While most lenders use the FICO Score 8, mortgage lenders use the following scores: Experian: FICO Score 2, or Fair Isaac Risk Model v2. Equifax: FICO Score 5, or Equifax Beacon 5. TransUnion: FICO Score 4, or TransUnion FICO Risk Score 04.

What is a good credit score with ClearScore

What is a good/bad credit score

| Credit score | Experian band | ClearScore name |

|---|---|---|

| 599 – 615 | Poor | On the up |

| 616 – 633 | Fair | On good ground |

| 634 – 657 | Good | Looking bright |

| 658 – 740 | Excellent | Soaring high |

Is Equifax score the same as ClearScore

ClearScore is different from Experian, Equifax and TransUnion as it doesn't collect the information itself. Instead, it has been created as a way to let consumers access their scores for free, rather than paying the monthly fees charged by the credit reference agencies themselves.

Who uses ClearScore

Experian's score is out of 999, TransUnions' is 710 and Equifax, the CRA that we use here at ClearScore use, have 1000.

Why is my ClearScore different to Equifax

ClearScore is different from Experian, Equifax and TransUnion as it doesn't collect the information itself. Instead, it has been created as a way to let consumers access their scores for free, rather than paying the monthly fees charged by the credit reference agencies themselves.

Is Equifax and ClearScore the same

ClearScore is different from Experian, Equifax and TransUnion as it doesn't collect the information itself. Instead, it has been created as a way to let consumers access their scores for free, rather than paying the monthly fees charged by the credit reference agencies themselves.

What’s a good score on ClearScore

531-670

Clearscore score bands updated in November 2023 to align with the new 1000-point Equifax credit score system. New bands: Poor (0-438), Fair (439-530), Good (531-670), Very Good (671-810), Excellent (811-1000).

What FICO does Wells Fargo use

FICO® Score 9 from Experian®

Simple access via Wells Fargo Online, to help you know where you stand.

Where is the most accurate FICO score

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus.

Why is my Equifax score lower than ClearScore

ClearScore gets your credit score and report from Equifax. Depending on the date of your report, there could be slight differences in the score we have and the one Equifax has.

Is ClearScore the same as TransUnion

ClearScore shows you your TransUnion credit report information and score.

Is ClearScore TransUnion or Equifax

ClearScore gets your credit score and report from Equifax. Depending on the date of your report, there could be slight differences in the score we have and the one Equifax has.

Is ClearScore a hard credit check

No, you can check your credit score and report on ClearScore as often as you like and it won't affect your score at all. When a new report is generated, a 'soft' search will appear on your credit report.

What version of FICO does Chase use

Experian

Chase primarily uses Experian as its credit bureau, but also uses TransUnion and Equifax for certain cards in certain states.

What FICO does Chase use

Experian™

Which credit bureau does Chase use Chase Credit Journey® gives everyone (even those who aren't Chase customers) access to their credit score through Experian™.