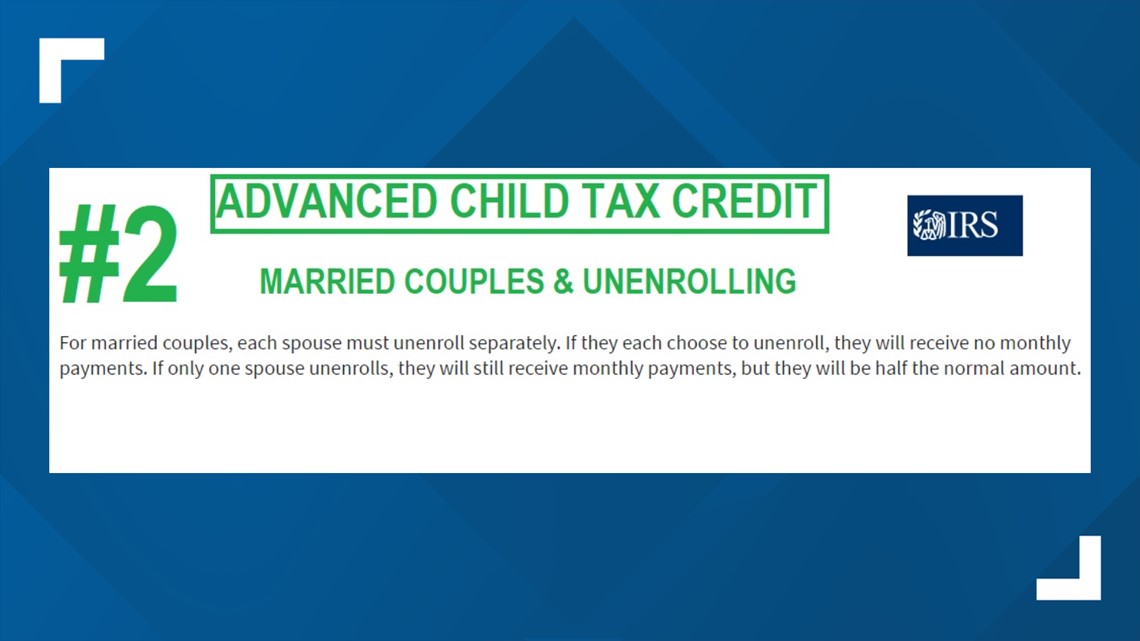

Do both spouses have to opt out of child tax credit payments?

Do both spouses claim child tax credit

If you do not file a joint return with your child's other parent, then only one of you can claim the child as a dependent. When both parents claim the child, the IRS will usually allow the claim for the parent that the child lived with the most during the year.

Can both parents claim child tax credit if they live together

Generally, only one person may claim the child as a qualifying child for purposes of the head of household filing status, the child tax credit/credit for other dependents, the dependent care credit/exclusion for dependent care benefits, the dependency exemption and the EITC.

Can married filing separately take the child tax credit

You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you (and your spouse, if filing a joint return) to work or actively look for work. Generally, you may not take this credit if your filing status is married filing separately.

Do you have to file jointly for child tax credit

A parent can claim the child tax credit if their filing status is Married Filing Separately.

What is the child tax credit for a married couple

The Child Tax Credit begins to be reduced to $2,000 per child if your modified adjusted gross income (AGI) in 2023 exceeds: $150,000 if you are married and filing a joint return, or if you are filing as a qualifying widow or widower; $112,500 if you are filing as head of household; or.

How much is the child tax credit for married couples

$150,000 if married and filing a joint return or if filing as a qualifying widow or widower; $112,500 if filing as head of household; or. $75,000 if you are a single filer or are married and filing a separate return.

Is the child tax credit split between parents

To claim the child tax credit, a parent must have a qualifying dependent child younger than 17 at the end of 2023. However, only one divorced parent is allowed to claim a child as a dependent on their tax return. Parents cannot split or share the tax benefits from a child on their taxes.

How do I stop my ex from claiming my child on taxes

Bottom Line: If your former partner has wrongfully claimed the children as dependents on their tax return, you can file a motion to enforce the divorce decree or separation agreement and get the dependent credits you are owed.

When should a married couple file separately

Usually, it makes sense financially for married couples to file jointly. However, when one spouse has significant medical expenses or miscellaneous itemized deductions, or when both spouses have about the same amount of income, it might be wiser to file separately.

How much is child tax credit for married filing jointly

Child tax credit 2023

For the 2023 tax year, the CTC is worth $2,000 per qualifying dependent child if your modified adjusted gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers).

What is the Child Tax Credit for married filing jointly

Child tax credit 2023

For the 2023 tax year, the CTC is worth $2,000 per qualifying dependent child if your modified adjusted gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers).

What is the difference between married filing separately and jointly Child Tax Credit

Married parents who file separate tax returns can't both claim their children as dependents, which could significantly impact the amount of taxes owed. Typically, married couples who file jointly tend to pay lower taxes or get an increased refund.

Do married couples both claim dependents

Generally, only one taxpayer (or married couple filing jointly) may claim any one person as a dependent. The tax benefits for claiming a dependent cannot be split unless it is detailed in a divorce decree.

What is the difference between married filing separately and jointly child tax credit

Married parents who file separate tax returns can't both claim their children as dependents, which could significantly impact the amount of taxes owed. Typically, married couples who file jointly tend to pay lower taxes or get an increased refund.

What if the other parent received the Child Tax Credit

Yes. You will be able to claim the full amount of the Child Tax Credit for your child on your 2023 tax return even if the other parent received advance Child Tax Credit payments.

Can a stay at home mom claim child on taxes

A stay-at-home mom can claim her child as a dependent even if she has no income. To do so, both spouses must agree that they can claim the child before filing. In most cases, it would be more advantageous for the spouse with income to claim the child.

Can I get the child tax credit if my ex claimed my child

Yes. You will be able to claim the full amount of the Child Tax Credit for your child on your 2023 tax return even if the other parent received advance Child Tax Credit payments.

What happens if someone already claimed your child on taxes

You may receive a letter (CP87A) from us, stating your child was claimed on another return. It will explain what to do, either file an amended return or do nothing. The other person who claimed the dependent will get the same letter.

Is it better to file separately if one spouse makes more money

If one spouse has a large tax bill and the other is due a tax refund, filing separately will protect the refund. The IRS won't apply it to the other spouse's balance due.

What are IRS rules for married filing separately

Married Filing Separately

If you and your spouse file separate returns, you should each report only your own income, deductions, and credits on your individual return. You can file a separate return even if only one of you had income. Community or separate income.