Do business credit cards have perks?

Do I gain a credit score buying things with business credit card

On the other hand, your business credit card has the potential to boost your personal credit score — as long as you use your business credit card responsibly, and as long as your credit card issuer reports that activity to the consumer credit card bureaus.

Can I use my business credit card for personal use

It's not illegal to use a business credit card for personal expenses. But that doesn't mean it's a good idea. Most credit card issuers don't allow small-business owners to put personal expenses on a business credit card. If you do, it's possible you could be breaking the terms of your cardmember agreement.

Why is business credit better than personal credit

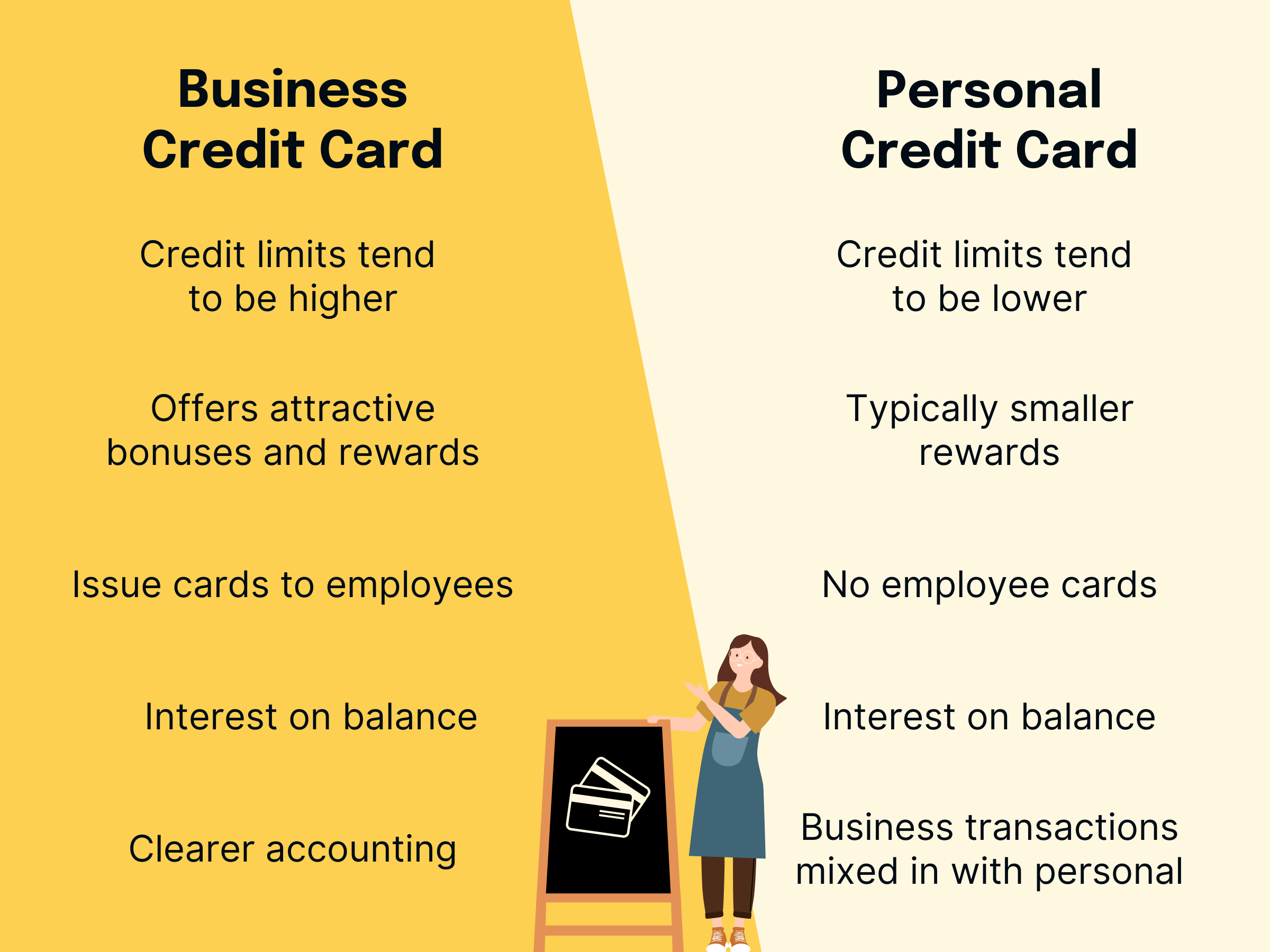

Higher credit limits

Small business credit cards and lines of credit often come with more business benefits than personal credit accounts. You are more likely to receive bonus rewards on phone bills, online advertising, or office supplies, for instance.

Do business credit cards offer protection

That means that there is no extra protection for purchases that you make with a business credit card. That said, other guarantees or insurance which is often offered with personal credit cards can offer more protection for purchases than you can get by making them through other methods, such as with a debit card.

How to build credit with EIN number

If you want to build business credit quickly here are five simple steps.Step 1 – Choose the Right Business Structure.Step 2 – Obtain a Federal Tax ID Number (EIN)Step 3 – Open a Business Bank Account.Step 4 – Establish Credit with Vendors/Suppliers Who Report.Step 5 – Monitor Your Business Credit Reports.

Does owning a business build your credit

Why establish business credit For business owners, having a separate legal entity, such as a corporation or limited liability company, provides the unique ability to create a credit identity with business credit reporting agencies, also known as a business credit profile.

Is it illegal to pay personal expenses from business account

Using company funds as a personal piggy bank for one's own benefit is not only a breach of fiduciary duty, but also unlawful. For one thing, according to the IRS, personal expenses are not eligible as business expense deductions.

What expenses can be put on business card

However, the two most common expense categories for business cards are advertising and promotional expenses, and office supplies.

Can my LLC affect my personal credit

Situations Affecting Personal Credit

There are a few situations when a bankruptcy filed by a corporation, limited partnership, or LLC might affect your personal credit report. If an LLC has debts in its name, only the credit of the LLC is affected. The exception is if a member of the LLC guarantees the loan.

Does an LLC have its own credit score

Does an LLC Have Its Own Credit Score With The Rating Agencies Yes, a business has its own credit score and credit report. When you start your business and start applying for credit, your personal credit history and score will be taken into account.

Which of the following is a disadvantage of business credit

Some disadvantages of business credit cards are the potential for expensive annual fees and the likelihood of a personal credit inquiry as well as personal liability for unpaid balances. Business credit cards can also have high interest rates, and they typically provide fewer user protections than consumer cards.

Why not use personal credit card for business

“When you're using your personal credit card for business purposes, you're increasing the utilization of your overall credit and that can negatively impact your credit score,” Christensen says. “That can put your personal credit at risk, especially if the business runs into hard times, and you make some late payments.”

Can I get credit using my EIN

Yes, you can use just an Employer Identification Number (EIN) to get a credit card if you are applying for a corporate credit card or certain co-branded business credit cards. Most business credit card issuers will require a Social Security number because they will require a personal guarantee on the debt.

Does an EIN have its own credit score

While your personal credit score is tied to your Social Security number, your business credit score is tied to an EIN. This helps you keep your personal financial information private while you build and maintain your business credit score.

What credit score does an LLC start with

You're aiming for a score of at least 75 in order to start getting favorable terms and taking advantage of having a strong business credit rating. The basic steps to start the process of establishing credit for your LLC are as follows: Get an EIN from the IRS. Register for a D-U-N-S number.

How fast does business credit build

between one to three years

For new businesses, it usually takes between one to three years to build enough credit to be eligible for small business loans. If you continue to pay back your loans on time, your small business credit will continue to grow.

Can I use my LLC for personal expenses

You can deduct on your individual tax return certain expenses you pay personally conducting LLC business, such as automobile and home office expenses. The LLC agreement must indicate that the members are required to cover these expenses. You should check your agreement and change it if necessary.

Can I use LLC funds for personal expenses

Using company funds as a personal piggy bank for one's own benefit is not only a breach of fiduciary duty, but also unlawful. For one thing, according to the IRS, personal expenses are not eligible as business expense deductions.

What should you not put on a business card

10 Things You Should Never Put on a Business CardHard-to-Read Text.Clutter and Fluff.Hobbies or Personal Interests.Typos, Spelling and Punctuation Errors.Handwritten Information.Inappropriate Slang or Jargon.Outdated or Incorrect Contact Details.Jokes and Sarcasm.

Is it illegal to use business funds for personal use

Using company funds as a personal piggy bank for one's own benefit is not only a breach of fiduciary duty, but also unlawful. For one thing, according to the IRS, personal expenses are not eligible as business expense deductions.