Do cashiers checks clear immediately?

How long do cashier’s checks take to clear

one business day

Usually one business day for government and cashier's checks and checks from the same bank that holds your account. The first $200 or so of a personal check is usually available one business day after the day you deposited the check.

Cached

Do cashier’s checks go through immediately

You may pay with cash or, if you are a customer of the bank, the funds will be withdrawn immediately from your account. The bank will then print the check to the person or business you have indicated in the amount you requested. It only takes a few minutes, and you can use the check right away.

Cached

Do you have to wait for a cashier’s check to clear at the bank

Federal regulations require banks to make funds deposited in an account by cashier's, certified, or teller's checks available for withdrawal not later than the business day after the banking day on which the deposit takes place, the same as for cash deposits, but only if certain conditions are met.

Cached

Do banks put a hold on a cashier’s check

Do banks put a hold on cashier's checks A bank can place a hold on a cashier's check if it has reasonable cause to believe that the check is uncollectible from the paying bank. Banks can also place a hold on cashier's check funds if the total amount of cashier's checks deposited in a single day exceeds $5,525.

Why is there a 7 day hold on a cashier’s check

Banks place holds on checks to make sure that the check payer has the bank funds necessary to clear it. In addition to protecting your bank, a hold can protect you from spending funds from a check that is later returned unpaid. That's important because it could help you avoid accidental overdrafts and related fees.

How long does it take for a $10000 cashier’s check to clear

Time It Takes For Checks To Clear

| Type of Check | Time To Clear |

|---|---|

| Cashier's Checks | Can clear on the next business day, unless a bank suspects there might be fraud, then could be several weeks |

| Money Orders | Can clear on the next business day, unless a bank suspects there might be fraud, then could be several weeks |

What is the maximum amount for a cashier’s check

Cashier's checks are good for large purchases.

Cashier's checks are typically used for larger purchases. Although the policy may change from bank to bank, generally there's no upper limit for a cashier's check.

Will a cashier’s check bounce

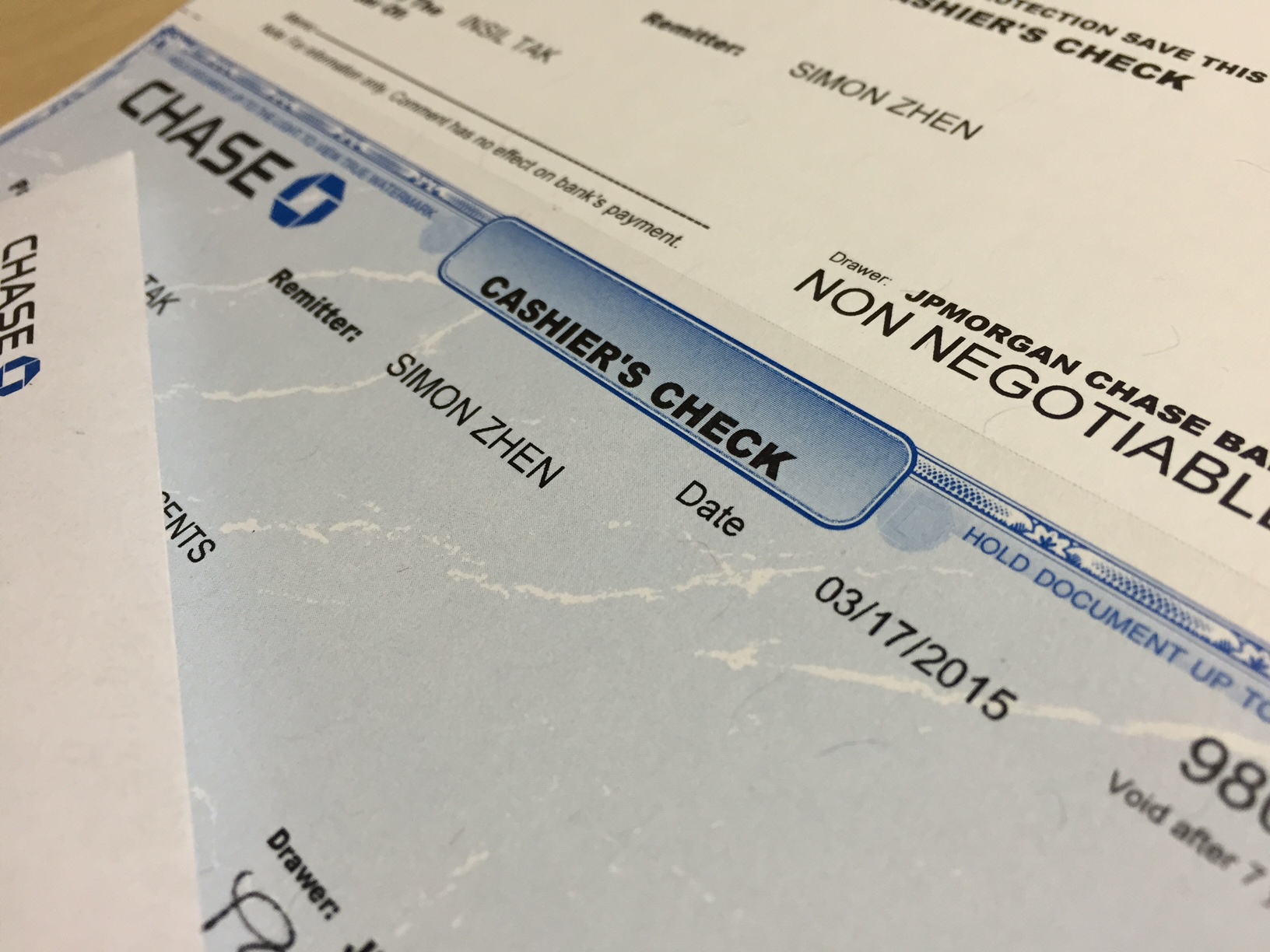

Cashier's checks are NOT the same as cash!

Just because the money appears to be available in your account doesn't mean that the check has cleared and is legitimate. Counterfeit cashier's checks can look very authentic. The bank may still bounce the check if it's a forgery!

How long does a bank have to hold a cashier’s check

There's no set or specified expiration date for cashier's checks.

What is the biggest amount for a cashier’s check

Cashier's checks are typically used for larger purchases. Although the policy may change from bank to bank, generally there's no upper limit for a cashier's check.

What happens when you deposit over $10000 cashiers check

However, for individual cashier's checks, money orders or traveler's checks that exceed $10,000, the institution that issues the check in exchange for currency is required to report the transaction to the government, so the bank where the check is being deposited doesn't need to.

How long does it take for a $30000 cashier’s check to clear

Time It Takes For Checks To Clear

| Type of Check | Time To Clear |

|---|---|

| Cashier's Checks | Can clear on the next business day, unless a bank suspects there might be fraud, then could be several weeks |

| Money Orders | Can clear on the next business day, unless a bank suspects there might be fraud, then could be several weeks |

Can a cashier’s check be declined

Instead, it must pay the check to the holder. As a rule, the only time a bank may refuse to pay its cashier's check is when the bank has its own defense against paying the item and the person attempting to enforce payment is not a holder in due course.

What is the downside of cashier’s check

Disadvantages of Cashier's Checks

Cashier's checks are more secure than other types of check payments, but they can still be targets for fraud. Scammers can create seemingly authentic-looking cashier's checks to pay you with that are only revealed as fake when you try to deposit them at your bank.

How long does it take for a $30000 cashiers check to clear

Time It Takes For Checks To Clear

| Type of Check | Time To Clear |

|---|---|

| Cashier's Checks | Can clear on the next business day, unless a bank suspects there might be fraud, then could be several weeks |

| Money Orders | Can clear on the next business day, unless a bank suspects there might be fraud, then could be several weeks |

What is the largest amount for a cashier’s check

Cashier's checks are typically used for larger purchases. Although the policy may change from bank to bank, generally there's no upper limit for a cashier's check.

How long does a $20000 cashier’s check take to clear

Time It Takes For Checks To Clear

| Type of Check | Time To Clear |

|---|---|

| Cashier's Checks | Can clear on the next business day, unless a bank suspects there might be fraud, then could be several weeks |

| Money Orders | Can clear on the next business day, unless a bank suspects there might be fraud, then could be several weeks |