Do closed accounts hurt your credit score?

Is it good to have closed accounts on your credit report

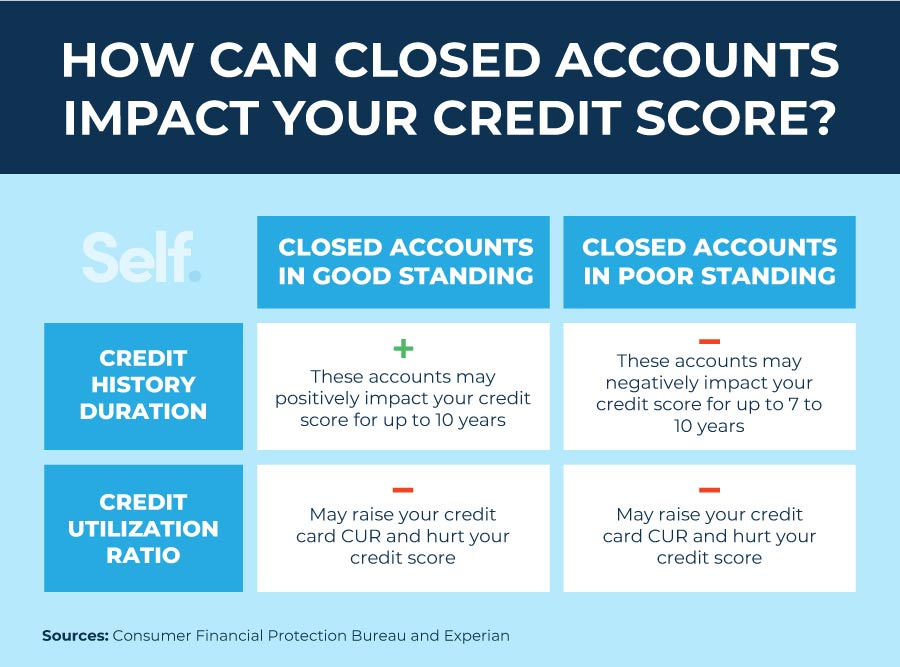

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn't.

Cached

Do closed accounts look bad on your credit

Closed accounts that were never late can remain on your credit report for up to 10 years from the date they were closed. If the accounts you mentioned are showing as potentially negative, it's likely due to delinquencies noted in the history of the account.

Cached

Do lenders see closed accounts

If you wrote to your creditor, canceled your account and got acknowledgement that the account was closed, it should come as no surprise that it shows up as “closed” on your credit reports. Closed accounts in good standing will typically remain on your report for 10 years.

Cached

What is the best way to remove closed accounts from credit report

Closed accounts can be removed from your credit report in three main ways: (1) dispute any inaccuracies, (2) write a formal goodwill letter requesting removal or (3) simply wait for the closed accounts to be removed over time.

Do closed accounts affect buying a house

In closing, for most applicants, a collection account does not prevent you from getting approved for a mortgage but you need to find the right lender and program.

How much does credit score drop with closed account

While the closed account will still count toward your credit age in that part of the equation, if you close a credit card you may lose points in the credit utilization scoring factor, which counts for 30% of your FICO score.

How long will a closed account stay on credit

10 years

An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. This generally helps your credit score. Accounts with adverse information may stay on your credit report for up to seven years.

How long does it take a closed account to come off credit

How Long Do Closed Accounts Stay on Your Credit Report Generally speaking, if an account's payment history helps your credit score, it will stay on your credit reports for 10 years after it is closed.

Why is closing an account bad

Closing an account may save you money in annual fees, or reduce the risk of fraud on those accounts, but closing the wrong accounts could actually harm your credit score. Check your credit reports online to see your account status before you close accounts to help your credit score.

Should I pay off a 5 year old collection

The best way is to pay

Most people would probably agree that paying off the old debt is the honorable and ethical thing to do. Plus, a past-due debt could come back to bite you even if the statute of limitations runs out and you no longer technically owe the bill.

How long does it take closed accounts to fall off credit report

An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. This generally helps your credit score. Accounts with adverse information may stay on your credit report for up to seven years.

Should I pay off closed accounts

Paying a closed or charged off account will not typically result in immediate improvement to your credit scores, but can help improve your scores over time.

Why did my credit score drop when I close an account

You closed your credit card. Closing a credit card account, especially your oldest one, hurts your credit score because it lowers the overall credit limit available to you (remember you want a high limit) and it brings down the overall average age of your accounts.

How do I remove closed accounts from my credit report

Closed accounts can be removed from your credit report in three main ways: (1) dispute any inaccuracies, (2) write a formal goodwill letter requesting removal or (3) simply wait for the closed accounts to be removed over time.

Will collections go away after 7 years

The short answer: Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due.

What happens if you never pay collections

If you ignore a debt in collections, you can be sued and have your bank account or wages garnished or may even lose property like your home. You'll also hurt your credit score. If you aren't paying because you don't have the money, remember that you still have options!

How many points will my credit score drop with a closed account

While the closed account will still count toward your credit age in that part of the equation, if you close a credit card you may lose points in the credit utilization scoring factor, which counts for 30% of your FICO score.

Do closed accounts ever go away

Closed accounts may remain on your credit reports for seven to 10 years, and can help or hurt your credit over that time depending on how you managed the account when it was open.

Is having a lot of closed accounts bad

Remember, the presence of this type of account on your credit report is a positive. As TransUnion and Experian note, a closed account that shows a positive history of payments is likely to help your credit score. Generally, a closed account with negative history can continue to hurt your credit score for seven years.

Do I still owe money on a closed account

Once your credit card is closed, you can no longer use that credit card, but you are still responsible for paying any balance you still owe to the creditor. In most situations, creditors will not reopen closed accounts.