Do credit cards charge a fee?

Are fees charged on credit cards

While credit cards are a great asset, they often come with numerous fees that can add up to significant charges if you miss a payment, spend over your limit or take other actions outside of normal purchases.

What is a typical credit card fee

The quick answer: the average credit card processing fee cost for card-present transactions ranges from 1.70% – 2.05% for Visa, Mastercard and Discover. The average credit card fee cost for card-not-present transactions ranges from 2.25% – 2.50%.

How can I pay my credit card without fees

How to Avoid Finance Charges. The easiest way to avoid finance charges is to pay your balance in full and on time every month. Credit cards are required to give you what's called a grace period, which is the span of time between the end of your billing cycle and when the payment is due on your balance.

How can you avoid credit card fees

For most credit cards, if you pay your balance on time and in full each billing cycle, you can avoid paying interest charges on new purchases. Keep in mind that if you carried a balance from one billing cycle to the next, you may still owe interest even if you then pay the new balance in full.

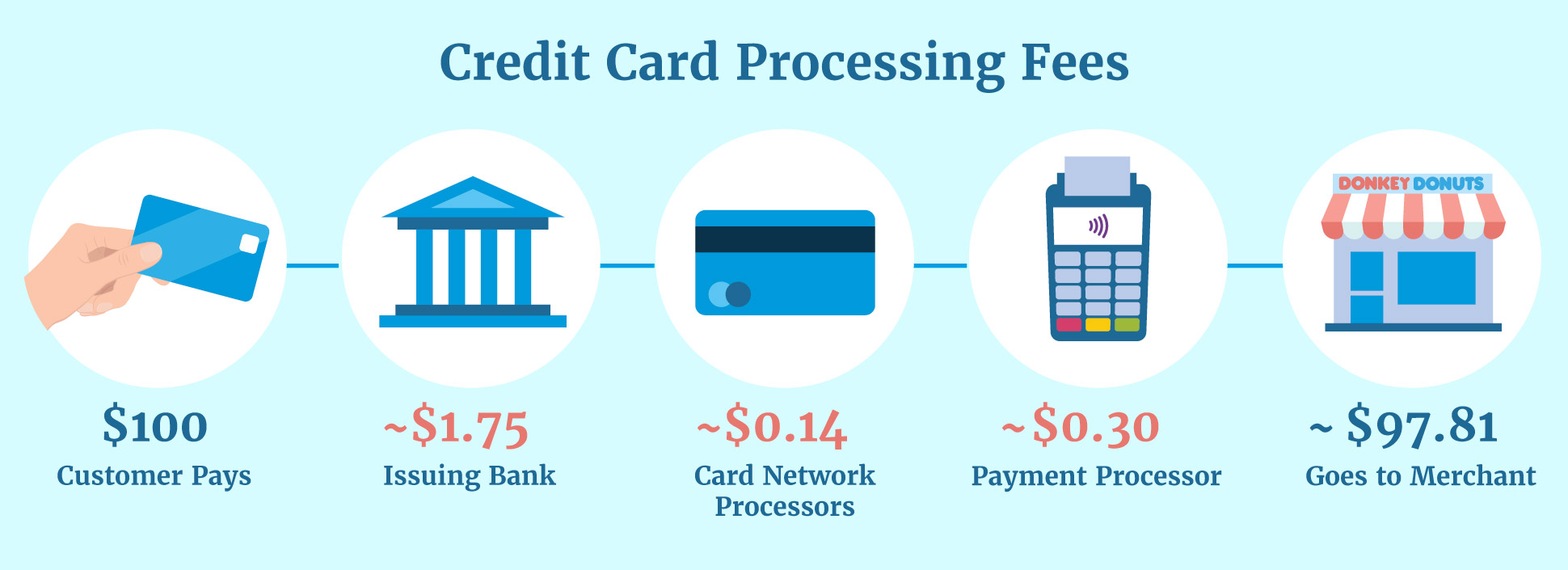

How much do merchants get charged for credit card transactions

1.5% to 3.5%

Credit card processing fees will typically cost a business 1.5% to 3.5% of each transaction's total. For a sale of $100, that means you could pay $1.50 to $3.50 in credit card fees.

How much does a credit card cost per month

Typical Costs for Credit Card Processing

The monthly fee may range from $9.95 to $20. The per-transaction fee can range from 0.18% plus $0.10 to $0.50% plus $0.10. Let's take a look at some examples from popular payment processors from our list of the best credit card processing companies.

Do credit cards have hidden fees

Hidden fees come in the form of annual fees, late payment fees, interest charges, and more. Every credit card comes with hidden fees in the form of annual fees, late payment fees, interest charges, that will only cost you more in the long run if you trigger them.

Why does my credit card have a fee

Why Does My Credit Card Have an Annual Fee An annual fee is one of the ways credit card companies can earn a profit. The fee may cover some or all of the card's extra benefits, such as miles, points, or cash back.

How do I avoid payment processing fees

Implementing a surcharge program is an effective way to eliminate processing fees. Surcharge programs pass the cost of these fees onto the consumer. They can avoid these fees by paying with cash or debit instead. The best way to implement a surcharge program is through Nadapayments.

Can I pass on credit card fees to customers

With surcharging, merchants are able to automatically pass credit card fees to their customers when a credit card is used at checkout. Credit card surcharging allows businesses to pass on the financial burden of credit card processing fees by attaching an extra fee to each customer's credit card transaction.

Is a credit card free

Credit card cost varies based on the credit card and how you use your credit card. You may be able to use a credit card for absolutely free. Or, on the opposite end of the spectrum, your credit card could charge fees for having the privilege to use it.

How can I avoid paying credit card fees

You can avoid finance charges in the short term by choosing a credit card that offers 0 percent APR on purchases, balance transfers or both for a limited time. Many 0 percent interest cards are also no annual fee cards.

How much is a credit card per month

Average Minimum Payment Due: $110.50. Average Individual Credit Card Debt: $5,525. Average Household Credit Card Debt: $8,006. Average Annual Percentage Rate: 14.54% (V)

Is it legal to charge customers a processing fee

In most states, companies can legally add a surcharge to your bill if you pay with a credit card. The fee might be a certain percentage on top of the purchase amount, which the companies can use to cover their credit card processing costs.

Is it illegal to charge a credit card processing fee

If you're wondering if it is legal to charge credit card fees, the short answer is yes. The practice of surcharging was outlawed for several decades until 2013 when a class action lawsuit permitted merchants in several U.S. states to implement surcharges in their businesses.

What states is it illegal to charge a credit card fee

States that prohibit credit card surcharges and convenience fees. Ten states prohibit credit card surcharges and convenience fees: California, Colorado, Connecticut, Florida, Kansas, Maine, Massachusetts, New York, Oklahoma and Texas.

How much does it cost a merchant to accept a credit card

Credit card processing fees will typically cost a business 1.5% to 3.5% of each transaction's total. For a sale of $100, that means you could pay $1.50 to $3.50 in credit card fees.

Why does a credit card cost you money

An annual fee is one of the ways credit card companies can earn a profit. The fee may cover some or all of the card's extra benefits, such as miles, points, or cash back.

What is the minimum payment on a $1000 credit card

Method 1: Percent of the Balance + Finance Charge

1 So, for example, 1% of your balance plus the interest that has accrued. Let's say your balance is $1,000 and your annual percentage rate (APR) is 24%. Your minimum payment would be 1%—$10—plus your monthly finance charge—$20—for a total minimum payment of $30.

What’s the minimum payment on a $5000 credit card

The minimum payment on a $5,000 credit card balance is at least $50, plus any fees, interest, and past-due amounts, if applicable. If you were late making a payment for the previous billing period, the credit card company may also add a late fee on top of your standard minimum payment.