Do credit cards have compound interest?

How do I avoid compound interest on my credit card

The best way to avoid paying interest on your credit card is to pay off the balance in full every month. You can also avoid other fees, such as late charges, by paying your credit card bill on time.

Cached

How is compound interest calculated on credit cards

Compound interest and credit cardsDivide the 25% purchase APR by days in a year. 0.25 / 365 = 0.00068493 daily periodic rate.Multiply that number by the average daily balance. 0.00068493 x $5,000 = $3.42465753.Multiply by the number of days in your billing cycle to get your monthly interest charge.

Cached

How much interest will I pay on 3000 credit card

For example, let's assume a credit card with a $3,000 balance carries an APR of 20%. To determine how much interest will build up daily, take the $3,000 balance, multiply by 0.2, and then divide by 365. You'll get a total of 1.64, meaning you'll pay $1.64 per day in interest for carrying that $3,000 balance.

Is 1% per month the same as 12% per annum

Simply divide your APY by 12 (for each month of the year) to find the percent interest your account earns per month. For example: A 12% APY would give you a 1% monthly interest rate (12 divided by 12 is 1). A 1% APY would give you a 0.083% monthly interest rate (1 divided by 12 is 0.083).

Does paying $1 a day stop compound interest

Paying more frequently, such as weekly or daily, won't make any difference unless you're paying more. There's no magic trick to stopping compound interest.

Which is better daily or monthly compounding

The Bottom Line. Earning interest compounded daily versus monthly can give you more bang for your savings buck, so to speak. Though the difference between daily and monthly compounding may be negligible, choosing daily compounding can still put a little more money in your pocket.

What kind of loans use compound interest

Loans: Student loans, personal loans and mortgages all tend to calculate interest based on a compounding formula. Mortgages often compound interest daily. With that in mind, the longer you have a loan, the more interest you're going to pay.

How can I pay off $50000 in debt in one year

What it takes to pay off $50,000 in debt in one year in 5 stepsThe benefits of paying off all your debt in a year.Tips to pay off $50,000 of debt in a year.Create a budget and track all expenses.Be mindful of debt fatigue.Prioritize paying high-interest debt first.Get a higher-paying new job.Freelance on the side.

What is the minimum payment on a $5000 credit card balance

The minimum payment on a $5,000 credit card balance is at least $50, plus any fees, interest, and past-due amounts, if applicable. If you were late making a payment for the previous billing period, the credit card company may also add a late fee on top of your standard minimum payment.

What is 6% compounded monthly

Also, an interest rate compounded more frequently tends to appear lower. For this reason, lenders often like to present interest rates compounded monthly instead of annually. For example, a 6% mortgage interest rate amounts to a monthly 0.5% interest rate.

How much interest will 50000 earn in a year

An investor with $50,000 to invest for interest can earn from about $195 to about $2,300 in a year at current rates. The difference depends mostly on the level of risk and liquidity that is acceptable to the investor.

What is 1% a day compounded for a year

The more you can deposit, the more you'll earn long-term as your deposits and interest accumulate. Here's how the calculation would look for a $100 deposit without additional deposits after one year: $100 ( 1 + ( 1% ÷ 365 ) )365×1 = $101.01.

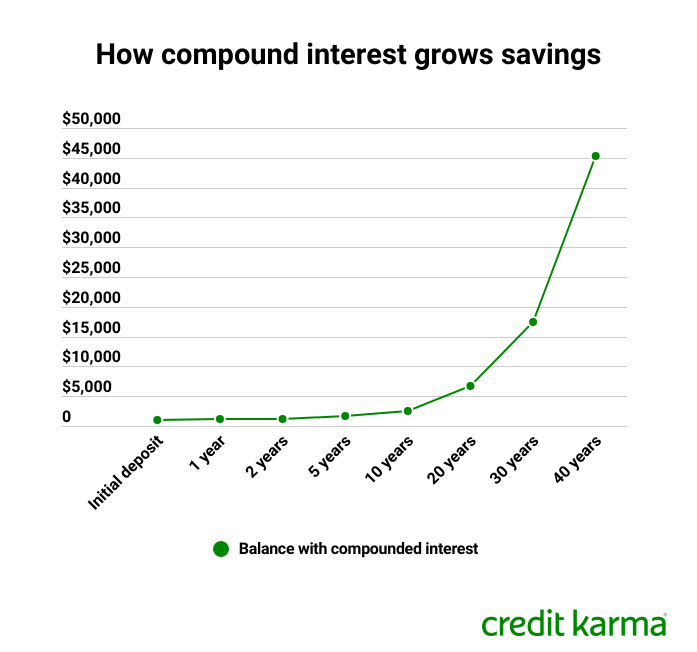

Can you live off of compound interest

When it comes to retirement accounts, consider sticking with low-risk, long-term investments. Buying and holding helps investors avoid short-term capital gains taxes and risks. And by saving up small amounts over a long period of time and earning compound interest, living off of interest is possible.

What does 3% interest compounded daily mean

Daily compounded interest means interest is accumulated daily and is calculated by charging interest on principal plus interest earned daily; therefore, it is higher than interest compounded on a monthly/quarterly basis due to the high frequency of compounding.

What does 5% a year compounded daily mean

For example, if you had $5,000 in a money market account with an interest rate of 5% that compounded daily, you would earn $0.68 in interest your first day.

What is an example of a compound interest credit card

Here's a simple example of how compounding works. If you owed $5,000 at a 17% interest rate, about $2.32 would accrue on day one. The next day, the interest wouldn't be charged on $5,000. It would be charged on a $5,002.32 balance this time, instead of a $5,000 balance.

What banks offer compound interest

Summary: The Best Compound Interest Accounts

| Account | Average Returns | Link |

|---|---|---|

| High Yield Savings Account | 3% – 4% | CIT Bank |

| Money Market | 3% – 5% | CIT Bank |

| I Bonds | 6.89% | TreasuryDirect |

| T Bills | 4.5% – 6% | TreasuryDirect |

Is $30,000 in debt a lot

Many people would likely say $30,000 is a considerable amount of money. Paying off that much debt may feel overwhelming, but it is possible. With careful planning and calculated actions, you can slowly work toward paying off your debt. Follow these steps to get started on your debt-payoff journey.

How long does it take to pay off $100,000 in debt

While the standard repayment term for federal loans is 10 years, it takes anywhere between 13 and 20 years on average to repay $100k in student loans. Here are some different scenarios to consider, depending on your financial situation and goals.

Should I pay off my credit card in full or leave a small balance

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.