Do credit cards use FICO or TransUnion?

Do banks use TransUnion or FICO

Most lenders use the FICO credit score when assessing your creditworthiness for a loan.

Cached

Do credit cards look at FICO or credit score

That's because FICO Scores are the most widely used scoring models — used by 90% of the top lenders in the U.S. In other words, when you go to apply for a new credit card or take out a loan, you can almost be sure that the card issuer or lender will look at your FICO Score to determine your creditworthiness.

Do credit card companies use FICO score

FICO ® Bankcard Scores or FICO ® Score 8 are the score versions used by many credit card issuers. Your credit card issuer can pull your score from any or all three bureaus.

Cached

Which credit bureau is most used for credit cards

The conclusion was that Experian is the most popular choice by lenders. Using this information, you can prepare which credit report you should focus on to maximize your chances of approval success. With that said, other key findings include: Capital One pulls from any credit bureau with relatively equal likelihood.

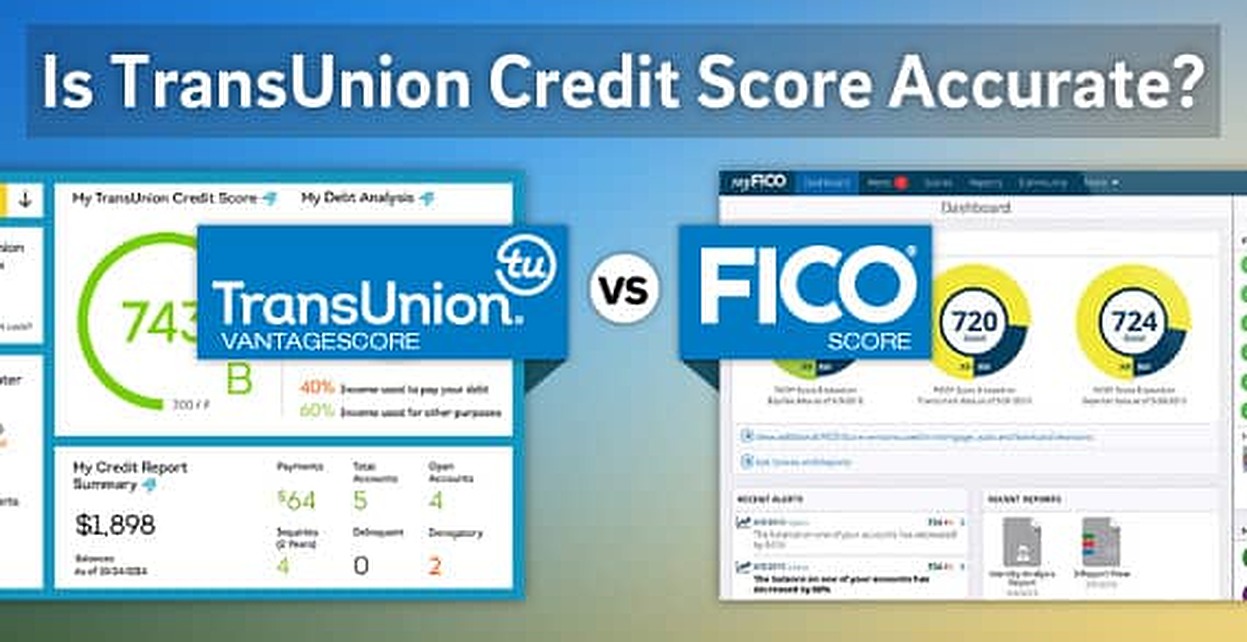

Which is more accurate FICO or TransUnion

Which credit score matters the most While there's no exact answer to which credit score matters most, lenders have a clear favorite: FICO® Scores are used in over 90% of lending decisions.

Does FICO matter more than TransUnion

The Three Bureaus and FICO

For example, an apartment manager who checks your credit may only look at Experian while a credit card company might only look at TransUnion. FICO was developed as an alternative to these bureaus. Many lenders prefer FICO because it paints a more holistic picture of the potential borrower.

Which credit score is most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus. In this article, you will learn: Different types of credit scores.

How far off is Credit Karma

Well, the credit score and report information on Credit Karma is accurate, as two of the three credit agencies are reporting it. Equifax and TransUnion are the ones giving the reports and scores. Credit Karma also offers VantageScores, but they are separate from the other two credit bureaus.

Which credit score is the most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus.

Which credit score is the hardest

Here are FICO's basic credit score ranges:Exceptional Credit: 800 to 850.Very Good Credit: 740 to 799.Good Credit: 670 to 739.Fair Credit: 580 to 669.Poor Credit: Under 580.

Why is my FICO score so different from TransUnion

Because there are varied scoring models, you'll likely have different scores from different providers. Lenders use many different types of credit scores to make lending decisions. The score you see when you check it may not be the same as the one used by your lender.

Which of the 3 credit scores is most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus.

Is TransUnion always the lowest score

Is TransUnion always the lowest score No, TransUnion credit scores are not always the lowest score. However, as users report, it is often lower than most other credit scores they have. Depending on the credit bureau and the scoring algorithm, your credit scores may change.

Which of the 3 credit scores is usually the highest

Which credit score matters the most While there's no exact answer to which credit score matters most, lenders have a clear favorite: FICO® Scores are used in over 90% of lending decisions.

Why is my FICO score higher than my credit score

Why is my FICO® score different from my credit score Your FICO Score is a credit score. But if your FICO score is different from another of your credit scores, it may be that the score you're viewing was calculated using one of the other scoring models that exist.

Why is my FICO score 100 points higher than Credit Karma

Some lenders report to all three major credit bureaus, but others report to only one or two. Because of this difference in reporting, each of the three credit bureaus may have slightly different credit report information for you and you may see different scores as a result.

Is TransUnion or FICO more accurate

While there's no exact answer to which credit score matters most, lenders have a clear favorite: FICO® Scores are used in over 90% of lending decisions.

Is FICO or TransUnion more accurate

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

Is TransUnion more important than FICO

The Three Bureaus and FICO

For example, an apartment manager who checks your credit may only look at Experian while a credit card company might only look at TransUnion. FICO was developed as an alternative to these bureaus. Many lenders prefer FICO because it paints a more holistic picture of the potential borrower.

Which FICO score is most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus. In this article, you will learn: Different types of credit scores.