Do credit sales go to accounts receivable?

How does credit sales affect accounts receivable

Remember, a debit to accounts receivable increases the account, which is an asset on a balance sheet. Then, when the customer pays cash on the receivable, the company would debit cash and credit accounts receivable. A credit to accounts receivable decreases the account.

Cached

Where does credit sales go

Credit Sales: Sales, whether cash or credit, will come in profit & loss a/c under the income side with the sale value of goods. Debtors: Debtors are current assets.

Cached

Are credit sales recorded as debit accounts receivable

Credit sales are recorded by crediting an Accounts Receivable. True or False False. They are recorded by increasing (debiting) Accounts Receivable.

Does net credit sales affect accounts receivable

As a result, the number for net credit sales is frequently used to determine accounts receivable turnover. These sales are comparable to net sales on the income statement in that they reflect gross sales less returns, allowances, and discounts.

How is credit sales accounted

Credit sales are recorded on the company's income statement and the balance sheet. On the income statement, one must register the sale as a rise in sales revenue, cost of goods sold, and expenses.

Is credit sales same as receivables

You can find a company's credit sales on the "short-term assets" section of a balance sheet. Because companies don't receive payments from credit sales for many weeks or even months, credit sales appear as accounts receivables, a component of short-term assets on the balance sheet.

Are credit sales sales on account

Definition of Sale on Credit

A sale on credit is revenue earned by a company when it sells goods and allows the buyer to pay at a later date. This is also referred to as a sale on account.

What is the difference between credit sales and accounts receivable

Credit sale is a source of income and is recorded in the income statement, particularly for a specific period. In contrast, accounts receivable is a type of short-term asset, recorded in the balance sheet of the book of accounts. This is the sum of total amount payable , so not specific for a particular period.

Are credit sales recorded as debit or credit

Sales are recorded as a credit because the offsetting side of the journal entry is a debit – usually to either the cash or accounts receivable account. In essence, the debit increases one of the asset accounts, while the credit increases shareholders' equity.

What type of account is credit sales

Credit sales are payments that are not made until several days or weeks after a product has been delivered. Short-term credit arrangements appear on a firm's balance sheet as accounts receivable and differ from payments made immediately in cash.

How do you record credit sales

Q: How do we record credit sales Ans: Credit sales are reported on both the income statement and the company's balance sheet. On the income statement, the sale is recorded as an increase in sales revenue, cost of goods sold, and possibly expenses.

When should credit sales be recorded

Credit sales are recorded when a company has delivered a product or service to a customer (and thus has “earned” the revenue per accrual accounting standards).

What is the difference between credit sales and AR

Credit sale is a source of income and is recorded in the income statement, particularly for a specific period. In contrast, accounts receivable is a type of short-term asset, recorded in the balance sheet of the book of accounts. This is the sum of total amount payable , so not specific for a particular period.

What is credit sales divided by accounts receivable

The accounts receivable turnover ratio is a simple metric that is used to measure how effective a business is at collecting debt and extending credit. It is calculated by dividing net credit sales by average accounts receivable. The higher the ratio, the better the business is at managing customer credit.

Is accounts receivable stays the same and credit sales go up

Question: QUESTION 2 If accounts receivable stays the same, and credit sales go up the average collection period will go up.

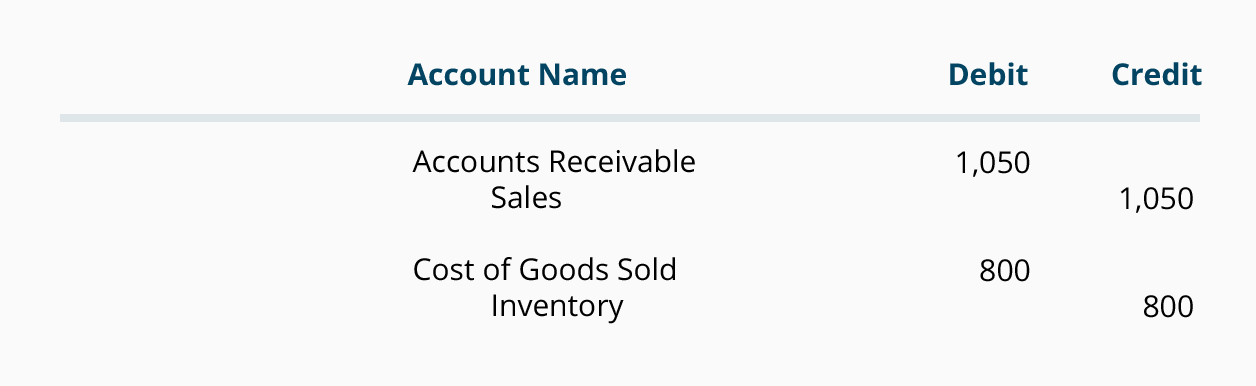

What is the entry for credit sales

A credit sales journal entry is a type of accounting entry that is used to record the sale of merchandise on credit. The entry is made by debiting the Accounts Receivable and crediting the Sales account. The amount of the sale is typically recorded in the journal as well.

What is the accounting entry for credit sales

Your credit sales journal entry should debit your Accounts Receivable account, which is the amount the customer has charged to their credit. And, you will credit your Sales Tax Payable and Revenue accounts.

How do you calculate accounts receivable from credit sales

Follow these steps to calculate accounts receivable:Add up all charges.Find the average.Calculate net credit sales.Divide net credit sales by average accounts receivable.Create an invoice.Send regular statements.Record payments.

How do you treat credit sales

The credit sale is reported on the balance sheet as an increase in accounts receivable, with a decrease in inventory. A change is reported to stockholder's equity for the amount of the net income earned.

What is the relation between net credit sales and accounts receivable

Net credit sales are sales where the cash is collected at a later date. The formula for net credit sales is = Sales on credit – Sales returns – Sales allowances. Average accounts receivable is the sum of starting and ending accounts receivable over a time period (such as monthly or quarterly), divided by 2.