Do creditors see Experian boost?

What is the disadvantage of Experian boost

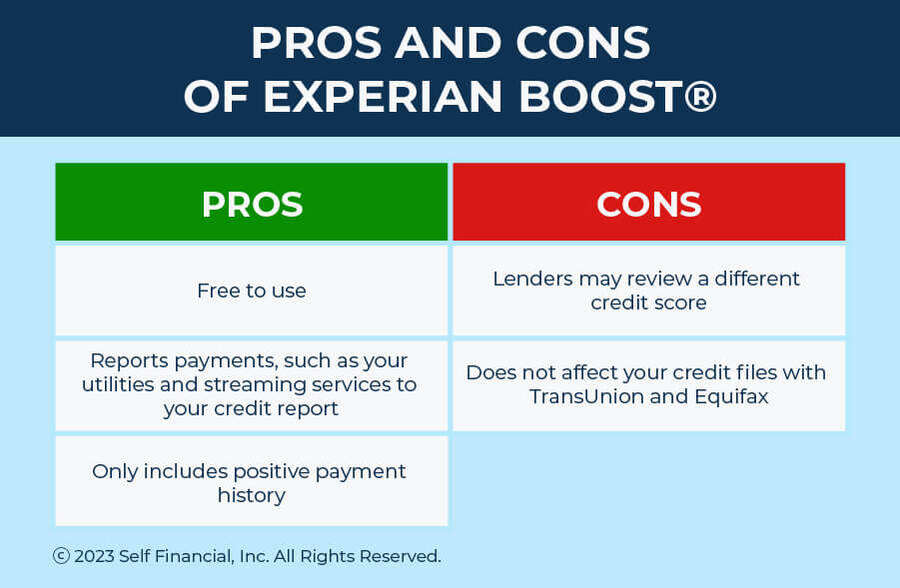

The most significant disadvantage to Experian Boost is that it only affects your Experian credit score. If a lender pulls your credit score from Equifax or TransUnion, your credit boost won't appear. Also, some lenders who use Experian still choose to exclude Experian Boost data.

Cached

Does Experian boost affect other credit scores

Experian Boost data won't have any impact on your other credit reports. It's hard to predict which credit bureau a lender will query. If they pull your credit history and score from TransUnion or Equifax, the Experian Boost data will not help you.

Cached

Do creditors use Experian

Experian and Equifax are the two largest credit bureaus in the United States. Both companies collect credit information on individual consumers, which they sell to lenders and others. Lenders, in turn, use the information in the reports to assess a prospective borrower's creditworthiness.

How many points does Experian boost raise your credit score

13 points

Most people get an instant increase in their FICO® Score with Experian Boost. People receiving a boost instantly raise their FICO® Score by an average of 13 points with Experian Boost.

Is Experian boost or credit karma more accurate

Credit Karma: Which is more accurate for your credit scores You may be surprised to know that the simple answer is that both are accurate. Read on to find out what's different between the two companies, how they get your credit scores, and why you have more than one credit score to begin with.

What happens if I remove Experian boost

If you decide you no longer want to use Experian Boost, you can disconnect your linked accounts. But the associated payment history will be removed and your credit scores may drop.

Do creditors use FICO or Experian

The two main companies that produce and maintain credit scoring models are FICO® and VantageScore. Lenders most commonly use the FICO® Score to make lending decisions, and in particular, the FICO® Score 8 is the most popular version for general use.

Do lenders look at Equifax or Experian

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion.

Does Experian boost actually make a difference

Most people who try Experian Boost see their credit scores improve immediately. Average users boosted their FICO® Score☉ 8 based on Experian data by 13 points. Some may not see improved scores or approval odds. Not all lenders use credit information impacted by Experian Boost.

How to raise credit score 100 points in 30 days

Quick checklist: how to raise your credit score in 30 daysMake sure your credit report is accurate.Sign up for Credit Karma.Pay bills on time.Use credit cards responsibly.Pay down a credit card or loan.Increase your credit limit on current cards.Make payments two times a month.Consolidate your debt.

Why is my Experian score 100 points higher than Credit Karma

Why is my Experian credit score different from Credit Karma To recap, Credit Karma provides your Equifax and TransUnion credit scores, which are different from your Experian credit score.

Is Experian boost permanent

Experian Boost also isn't permanent. If you decide it isn't for you, you can remove your data via Boost at any time.

Is Experian or Credit Karma more accurate

Experian vs. Credit Karma: Which is more accurate for your credit scores You may be surprised to know that the simple answer is that both are accurate. Read on to find out what's different between the two companies, how they get your credit scores, and why you have more than one credit score to begin with.

Which credit score do creditors look at the most

FICO ® Scores

FICO ® Scores are the most widely used credit scores—90% of top lenders use FICO ® Scores.

Is Experian more accurate than FICO

Experian's advantage over FICO is that the information it provides is far more detailed and thorough than a simple number. A pair of borrowers could both have 700 FICO Scores but vastly different credit histories.

Is Experian usually higher or lower than Equifax

The main difference is Experian grades it between 0 – 1000, while Equifax grades the score between 0 – 1200. This means that there is not only a clear 200 point difference between these two bureaus but the “perfect scores” are also different, which is 1000 as reported by Experian and 1200 as reported by Equifax.

Do lenders look at Experian or TransUnion

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

Can my credit score go up 200 points in a month

There are several actions you may take that can provide you a quick boost to your credit score in a short length of time, even though there are no short cuts to developing a strong credit history and score. In fact, some individuals' credit scores may increase by as much as 200 points in just 30 days.

How to get a 900 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How to get a 700 credit score in 30 days

Best Credit Cards for Bad Credit.Check Your Credit Reports and Credit Scores. The first step is to know what is being reported about you.Correct Mistakes in Your Credit Reports. Once you have your credit reports, read them carefully.Avoid Late Payments.Pay Down Debt.Add Positive Credit History.Keep Great Credit Habits.