Do goodwill letters to creditors work?

Do creditors have to respond to goodwill letters

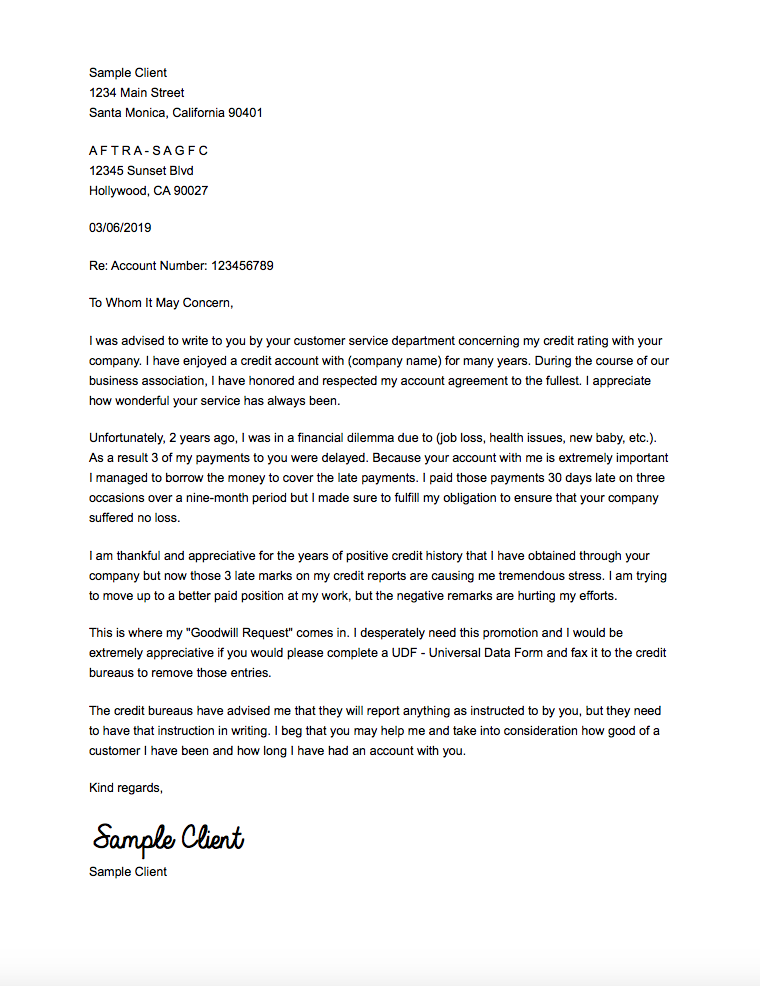

A goodwill letter is a written correspondence that asks creditors to remove negative remarks from your credit reports. Key points: A goodwill letter is more likely to work on smaller negative items, such as late or missed payments. The creditor has no obligation to honor or even respond to a goodwill letter.

CachedSimilar

How well do goodwill letters work

There's no guarantee that a goodwill letter will work, and there's no officially approved formula to follow in order to give yourself the best chance of success. Keep in mind that because creditors aren't required to consider your request, you may get no response at all.

Cached

Do goodwill letters work for collections

On minor issues like late or missed payments, these letters are more effective. Apart from that, a Goodwill letter might occasionally help remove other negative marks from your credit report. A consumer may remove closed accounts, charge off accounts, and paid collections through this letter.

CachedSimilar

Do banks accept goodwill letters

Do goodwill letters work Unfortunately, there's no way to know if sending a goodwill letter will lead to your card issuer removing late payments or other negative marks from your credit report. Some issuers, like Bank of America, state that they don't honor goodwill adjustment requests.

Cached

Can a goodwill letter remove a charge-off

Request a goodwill adjustment: You can write a goodwill letter to your debt owner explaining your situation and asking them to remove the charge-off from your report. If you're lucky, they'll say yes.

What happens when a collector does not answer a debt validation letter

If a debt collector fails to validate the debt in question and continues trying to collect, you have a right under the FDCPA to countersue for up to $1,000 for each violation, plus attorney fees and court costs, as mentioned previously.

Can a creditor remove a late payment

Remember: Accurately reported late payments can't be removed from your credit reports. And you can't pay someone else to remove accurate information from your reports either. But late payments will fall off your credit reports after seven years.

What not to say to collections

If you get an unexpected call from a debt collector, here are several things you should never tell them:Don't Admit the Debt. Even if you think you recognize the debt, don't say anything.Don't provide bank account information or other personal information.Document any agreements you reach with the debt collector.

How do I ask my creditors to remove late payments

The process is easy: simply write a letter to your creditor explaining why you paid late. Ask them to forgive the late payment and assure them it won't happen again. If they do agree to forgive the late payment, your creditor should adjust your credit report accordingly.

How do I remove a charge-off without paying

Having an account charged off does not relieve you of the obligation to repay the debt associated with it. You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also steadily be rebuilt by paying other bills on time.

How do professionals remove charge offs

If there is an incorrect charge-off on your credit report, you'll need to contact the credit bureau directly—and you'll need to do so in writing. You can send them a “dispute” letter that outlines who you are, what information you would like to have removed, and why the information in question is incorrect.

What is the 11 word phrase to stop debt collectors

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase “please cease and desist all calls and contact with me immediately” to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

Do creditors have to prove a debt

In order to win a court case, a debt collector must prove that they have proper ownership of the debt, that you actually owe the debt, and that the amount they claim you owe is correct.

Can a goodwill letter remove late payments

One possible solution: You may be able to remove late payments on your credit reports and start to improve your credit with a “goodwill letter.” A goodwill letter won't always work, but some consumers have reported success. It's worth trying because these derogatory marks on your credit can last seven years.

How do I get a creditor to remove a paid collection

A goodwill deletion is the only way to remove a legitimate paid collection from a credit report. This strategy involves you writing a letter to your lender. In the letter, you need to explain your circumstances and why you would like the record of the paid collection to be removed from your credit report.

What is the 11 word credit loophole

In case you are wondering what the 11 word phrase to stop debt collectors is supposed to be its “Please cease and desist all calls and contact with me immediately.”

What is the 7 7 rule for collections

Consumers are well-protected when it comes to debt collection. One of the most rigorous rules in their favor is the 7-in-7 rule. This rule states that a creditor must not contact the person who owes them money more than seven times within a 7-day period.

Can you legally remove late payments from credit report

Can you remove late payments from your credit reports If you act quickly by paying within 30 days of the original due date, a late payment will generally not be recorded on your credit reports. After 30 days, you can only remove falsely reported late payments.

Is it illegal for a creditor to remove late payments

We've heard from some readers who have said their credit card issuers say it's “illegal” for them to remove late payments, or provide other similar reasons. It's not illegal for a creditor or lender to change any information on your credit reports — including late payment history.

What is the 609 loophole

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports.