Do hard inquiries affect credit score immediately?

Does your credit score drop immediately after a hard inquiry

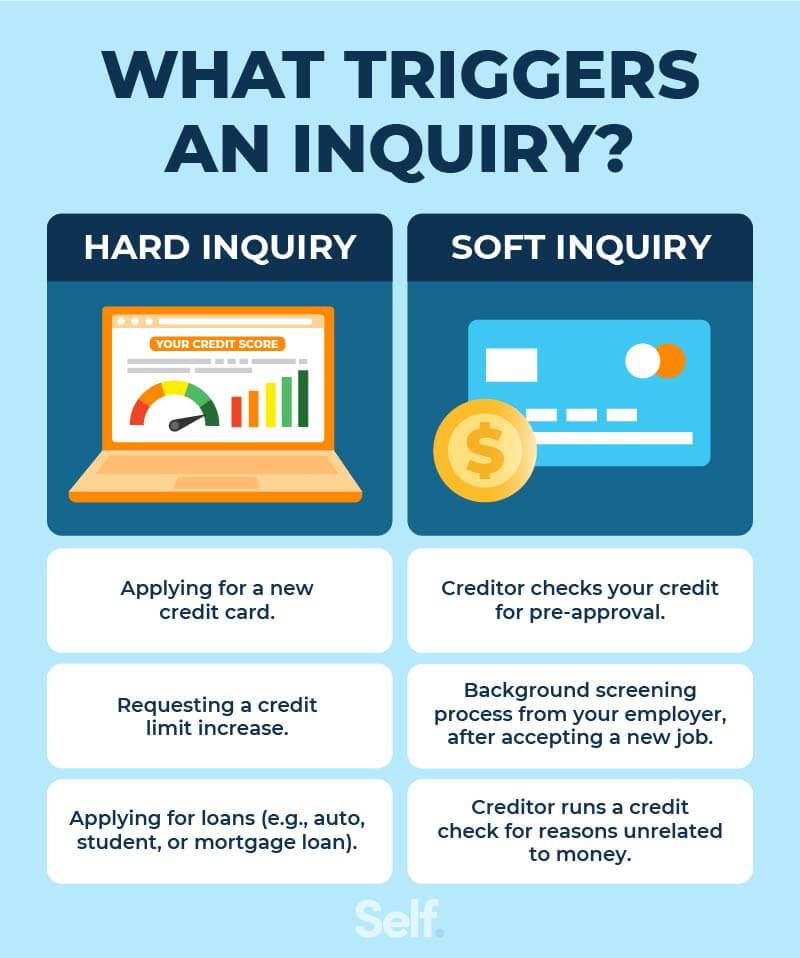

Hard inquiries happen when you apply for a new loan or credit card and the lender pulls your credit reports to determine if you qualify. In most cases, hard inquiries have very little if any impact on your credit scores—and they have no effect after one year from the date the inquiry was made.

Is 3 hard inquiries bad

A single hard inquiry will drop your score by no more than five points. Often no points are subtracted. However, multiple hard inquiries can deplete your score by as much as 10 points each time they happen.

Cached

How many hard inquiries can you have before it affects your credit

There's no such thing as “too many” hard credit inquiries, but multiple applications for new credit accounts within a short time frame could point to a risky borrower. Rate shopping for a particular loan, however, may be treated as a single inquiry and have minimal impact on your creditworthiness.

Cached

How many hard inquiries are bad

In general, six or more hard inquiries are often seen as too many. Based on the data, this number corresponds to being eight times more likely than average to declare bankruptcy. This heightened credit risk can damage a person's credit options and lower one's credit score.

Why did my credit score drop 100 points after a hard inquiry

If your score drastically drops 100 points, chances are there is simply an error on the report. According to the Federal Trade Commission (FTC), one in every five consumers have errors on at least one of their three credit reports. That means that there is a high chance you may have an error in your report.

Why did my credit score drop 50 points after a hard inquiry

In most cases, it's a new derogatory account reporting, or a credit card has been closed thus affecting your overall debt-to-credit utilization, or your credit card usage has significantly increase, thus negatively impacting your debt-to-credit utilization.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How many points will my credit score go down with 3 hard inquiries

While a hard inquiry does impact your credit scores, it typically only causes them to drop by about five points, according to credit-scoring company FICO®. And if you have a good credit history, the impact may be even less.

How do you get rid of hard inquiries fast

The only way to get hard inquiries removed from your credit report in a single day is to dispute them as errors.

Why do I have 3 hard inquiries

Sometimes when you apply for credit, each application triggers a hard inquiry. That's how credit card applications work, for example. That means applying for multiple credit cards over a short period of time will lead to multiple hard inquiries.

Is A 650 A good credit score

A FICO® Score of 650 places you within a population of consumers whose credit may be seen as Fair. Your 650 FICO® Score is lower than the average U.S. credit score. Statistically speaking, 28% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

Why did my credit score drop 40 points after paying off debt

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

Why is my credit score going down if I pay everything on time

A short credit history gives less to base a judgment on about how you manage your credit, and can cause your credit score to be lower. A combination of these and other issues can add up to high credit risk and poor credit scores even when all of your payments have been on time.

How long does it take to go from 550 to 750 credit score

How Long Does It Take to Fix Credit The good news is that when your score is low, each positive change you make is likely to have a significant impact. For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use.

How fast can I add 100 points to my credit score

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

Why did my credit score drop 40 points for a hard inquiry

You recently applied for credit

If you applied for a credit card or are shopping around for a loan, a hard inquiry can appear on your credit report, which temporarily lower a score. Hard inquiries happen when a lender or company reviews your report with the intent to make a lending decision.

How many points is a hard inquiry

five points

How does a hard inquiry affect credit While a hard inquiry does impact your credit scores, it typically only causes them to drop by about five points, according to credit-scoring company FICO®. And if you have a good credit history, the impact may be even less.

Can a lender remove a hard inquiry

If you did apply for a credit account or authorize a hard inquiry, you can't remove it from your reports. It remains on your credit reports as part of an accurate representation of your credit history. If that's the case, it should fall off your reports after about two years.

Is 850 credit score rare

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2023.

How rare is a 750 credit score

Your credit score helps lenders decide if you qualify for products like credit cards and loans, and your interest rate. You are one of the 46% of Americans who had a score of 750 or above in 2023, according to credit scoring company FICO. Here's how your 750 credit score can affect your financial life.