Do I build credit if I have a cosigner?

Do you build credit faster with a cosigner

A co-signer can also help you improve your credit score if it is low due to past financial missteps. Payment history accounts for 35 percent of your credit score, so keeping current on the auto loan payments over the loan term could help boost your score — assuming you manage all other debts responsibly.

Cached

Whose credit score is used if I have a cosigner

Whose credit score is used when co-signing In a co-signed loan, the co-signer's credit score has more weightage than the primary borrower. This is because the primary borrower will usually have poor credit and will depend on the co-signer's excellent credit to get lower rates.

Is it better to have a cosigner even if they have bad credit

If your credit history is less than stellar, you might want to consider using a cosigner. Making regular, manageable payments is the key to rebuilding credit and a cosigner can help you secure lower interest rates that could save you hundreds (if not thousands) of dollars over the lifetime of your loan.

Cached

How much does having a cosigner help

If you had a cosigner, you could qualify for a much lower interest rate (so you could keep those thousands of extra dollars in your pocket). The bottom line: A cosigner can not only help you secure better loan terms, but they can also be the difference between getting approved for a car loan and being declined.

How can I build my credit fast

The quickest ways to increase your credit scoreReport your rent and utility payments.Pay off debt if you can.Get a secured credit card.Request a credit limit increase.Become an authorized user.Dispute credit report errors.

Is it easier to get a loan if you have a cosigner

If your cosigner has a good credit score and a history of repaying debts on time, it may be easier for you to get approved for a loan. This is because including a co-applicant lowers the lender's risk when offering you a loan, since it can hold two people accountable for repayment instead of just one.

How much credit does a cosigner get

Being a co-signer itself does not affect your credit score. Your score may, however, be negatively affected if the main account holder misses payments.

Does having a cosigner look bad

Depending on how much debt you already have, the addition of the cosigned loan on your credit reports may make it look like you have more debt than you can handle. As a result, lenders may shy away from you as a borrower.

Is it smart to cosign

The bottom line. The decision to sign on as a co-signer comes down to the trust you have in the primary borrower. If you believe they will meet their payments and are willing to risk your own finances, then helping a friend or family member may be the right thing to do. Otherwise, it is best to say no to this agreement …

What is the lowest credit score to buy a car

In general, you'll need a credit score of at least 600 to qualify for a traditional auto loan, but the minimum credit score required to finance a car loan varies by lender. If your credit score falls into the subprime category, you may need to look for a bad credit car loan.

How to get a 700 credit score in 30 days

Best Credit Cards for Bad Credit.Check Your Credit Reports and Credit Scores. The first step is to know what is being reported about you.Correct Mistakes in Your Credit Reports. Once you have your credit reports, read them carefully.Avoid Late Payments.Pay Down Debt.Add Positive Credit History.Keep Great Credit Habits.

How long does it take to build credit to 700

The time it takes to increase a credit score from 500 to 700 might range from a few months to a few years. Your credit score will increase based on your spending pattern and repayment history. If you do not have a credit card yet, you have a chance to build your credit score.

Can you be denied a loan with a cosigner

You can apply for a private loan, but might end up being unable to qualify without a cosigner. Even if you do have a cosigner, you could be denied.

What is the disadvantage of being a cosigner

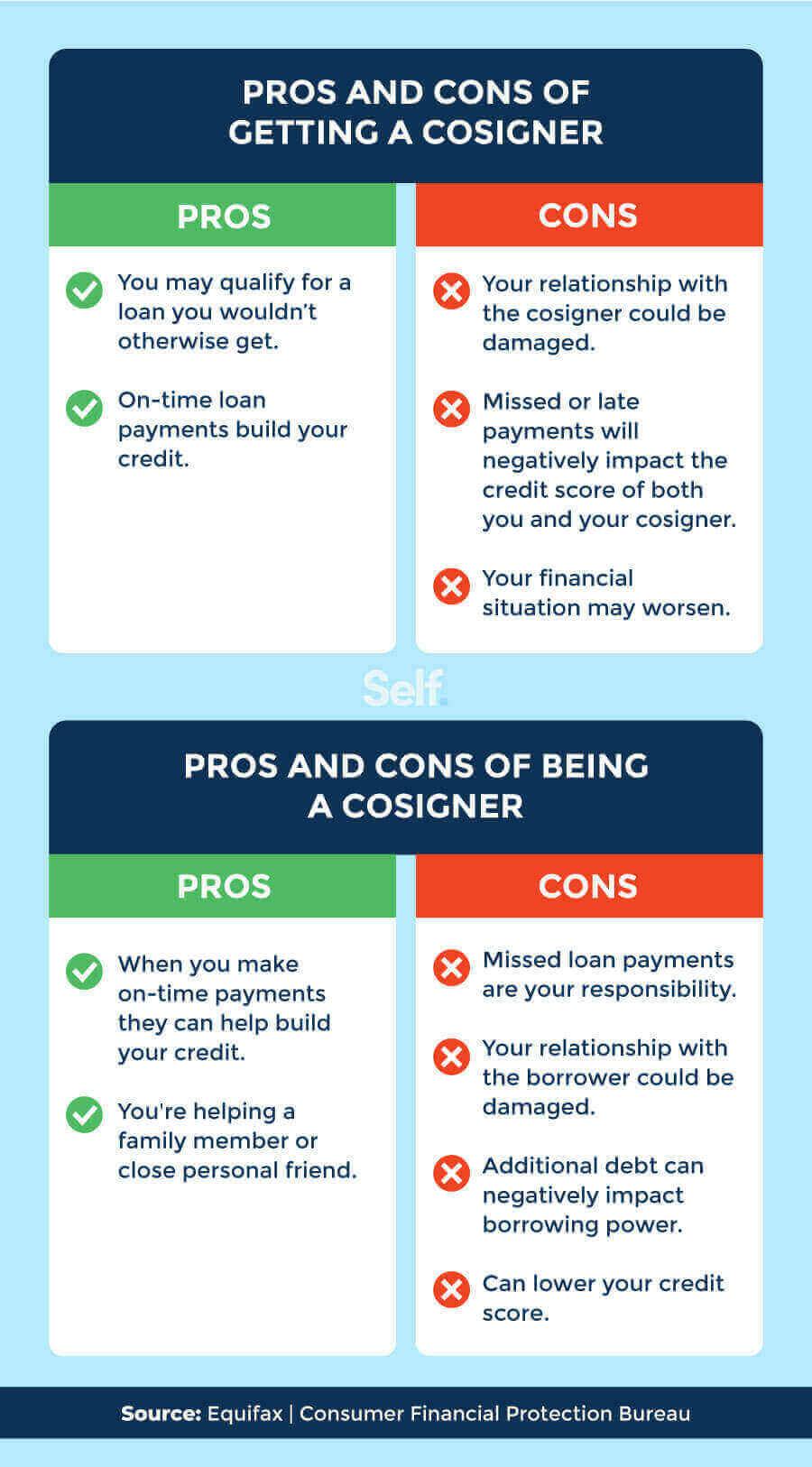

Risks of Cosigning. Credit is at stake for both cosigners. If one person fails to pay, the other signer is pressured to pay the other person's part to protect both of their credit scores. Relationships can be tarnished if one of the cosigners aren't responsible with their payments.

Can you cosign with a 700 credit score

Cosigners are usually required to have: Excellent credit—often with a credit score above 700. A good debt-to-income ratio. A steady income.

Why is it risky to be a co signer

The lender can sue the cosigner for interest, late fees, and any attorney's fees involved in collection. If the primary borrower falls on hard times financially and cannot make payments, AND the cosigner fails to make the payments, the lender may also decide to pursue garnishment of the wages of the cosigner.

Will Cosigning affect me buying a car

Cosigning an auto loan doesn't disqualify you from obtaining financing of your own — you can still get approved for an auto loan if you have a solid credit history and can afford your car payments.

What credit score do I need to buy a $20000 car

Key Takeaways. Your credit score is a major factor in whether you'll be approved for a car loan. Some lenders use specialized credit scores, such as a FICO Auto Score. In general, you'll need at least prime credit, meaning a credit score of 661 or up, to get a loan at a good interest rate.

How long does it take to get a 600 credit score

Average Recovery Time

The good news is that when your score is low, each positive change you make is likely to have a significant impact. For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use.

How long does it take to go from 550 to 750 credit score

How Long Does It Take to Fix Credit The good news is that when your score is low, each positive change you make is likely to have a significant impact. For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use.