Do I have to claim Advance Child Tax Credit?

What happens if I don’t claim advance Child Tax Credit

If you took neither action, you may need to repay to the IRS the amount of advance Child Tax Credit payments you received that are based on that child when you file your 2023 tax return. This is because a qualifying child is one who lives with you for more than half the year, among other factors.

Do I have to report advance Child Tax Credit

Advance Child Tax Credit payments are not income and will not be reported as income on your 2023 tax return. Advance Child Tax Credit payments are advance payments of your tax year 2023 Child Tax Credit.

Cached

How will the advance Child Tax Credit affect my taxes

These payments are an advance of your 2023 Child Tax Credit. The amount that you receive will be reconciled to the amount that you are eligible for when you prepare your 2023 tax return in 2023. Most families will receive about one-half of their tax credit through the advance payments.

Cached

Who should claim the advance Child Tax Credit

Any individual that does not turn 18 before January 1, 2023 and who meets all of the following criteria: The individual is the taxpayer's son, daughter, stepchild, or an eligible foster child, brother, sister, stepsibling, half-sibling, or a descendant of any of them (ex. grandchild, niece, or nephew);

Cached

Can you still opt out of advance child tax credit

An individual may opt-out or unenroll from receiving advance payments and claim the entire credit when they file their 2023 return. A taxpayer may consider this option if they do not want to worry about paying back any amount next year, updating their information through the IRS portal, or adjusting their withholding.

Do I need to file Schedule 8812

You should complete file IRS Schedule 8812 (Form 1040) when you complete your IRS tax forms each year. Claim your child tax credit along with your other credits for 2023 by April 18, 2023. Those that miss the deadline can have an extension. However, it is recommended that you file taxes by the deadline.

What is the letter 6419 for Child Tax Credit

To help taxpayers reconcile and receive 2023 CTC, the IRS is sending Letter 6419, Advance Child Tax Credit Reconciliation from late December 2023 through January 2023. Taxpayers should keep this, and any other IRS letters about advance CTC payments, with their tax records.

Will the IRS take my Child Tax Credit if I owe taxes

Will any of my advance Child Tax Credit payments be reduced if I owe taxes from previous years or other federal or state debts No. Advance Child Tax Credit payments will not be reduced (that is, offset) for overdue taxes from previous years or other federal or state debts that you owe.

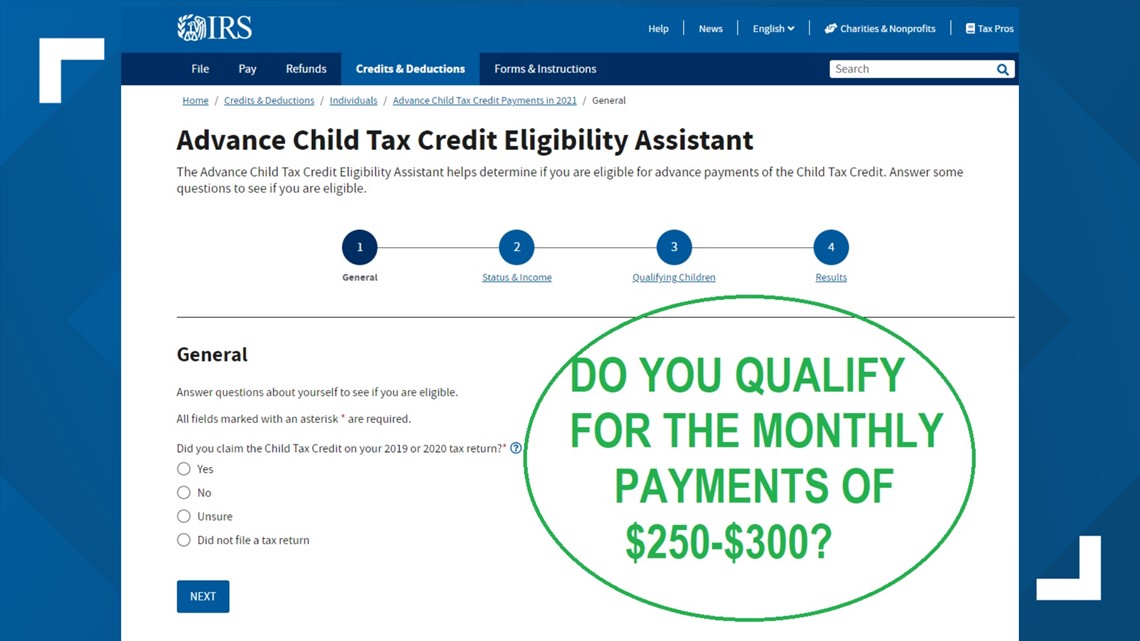

How much were the advance child tax credits

Starting July 15, 2023, eligible families will automatically begin to receive the first half of the CTC through advance monthly payments of $250 to $300 per child that will be paid directly by the Internal Revenue Service (IRS) through the end of the year.

What is the difference between the Child Tax Credit and the additional Child Tax Credit

Remind students that the child tax credit is a nonrefundable credit that allows qualifying taxpayers to reduce their tax liability. If a taxpayer is not able to use the entire credit from the maximum $1,000 per qualifying child, they may be eligible for the additional child tax credit, which is a refundable tax credit.

How do I opt out of Advctc

To stop advanced payments, families must unenroll three days before the first Thursday of the next month, according to the IRS. To opt out of the upcoming July 15 payment, families need to use the portal to unenroll by June 28, 2023.

How do I file taxes with no income for Child Tax Credit

You do not need income to be eligible for the Child Tax Credit if your main home is in the United States for more than half the year. If you do not have income, and do not meet the main home requirement, you will not be able to benefit from the Child Tax Credit because the credit will not be refundable.

Why am I being asked to fill out Schedule 8812

More In Forms and Instructions

Use Schedule 8812 (Form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2023, and to figure any additional tax owed if you received excess advance child tax credit payments during 2023.

What do I put for Schedule 8812

Use Schedule 8812 (Form 1040) to figure your child tax credit (CTC), credit for other dependents (ODC), and additional child tax credit (ACTC). The CTC and ODC are nonrefundable credits.

Is letter 6419 required to file taxes

The IRS Letter 6419 tells taxpayers who received monthly advance child tax credit payments how much they received. You'll need this info to accurately prepare your 2023 tax return.

What happens if I don’t have a 6419 letter

You can also contact the IRS via phone at 1-800-829-1040. If you did receive the letter — but lost or misplaced it — the process will be the same. Contact the IRS or access the CTC portal as soon as possible to make sure you can file accurate taxes.

What is the letter 6419 for child tax credit

To help taxpayers reconcile and receive 2023 CTC, the IRS is sending Letter 6419, Advance Child Tax Credit Reconciliation from late December 2023 through January 2023. Taxpayers should keep this, and any other IRS letters about advance CTC payments, with their tax records.

Is the IRS offsetting tax refunds 2023

(updated May 16, 2023) All or part of your refund may be offset to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans.

Will the IRS take my Child Tax Credit for back taxes

No. Advance Child Tax Credit payments will not be reduced (that is, offset) for overdue taxes from previous years or other federal or state debts that you owe.

How do I claim Child Tax Credit

No application is needed to use this program. However, you must file your taxes using the guidelines posted on the Schedule 8812 (Form 1040 or 1040A, Child tax Credit page. Based on the tax information you provided, the IRS will determine if you qualify and automatically enroll you for advance payments in 2023.