Do I have to pay taxes if I sell on Ticketmaster?

Is selling tickets on Ticketmaster taxable

Will I receive a Form 1099-K for tickets that I sell on Ticketmaster If your gross transactional amount reaches federal or state thresholds in a calendar year, you'll get a Form 1099-K from Ticketmaster to use when filing your taxes. Starting in 2023, the federal threshold is $600.

Cached

What percentage does Ticketmaster take on resale

a 15%

The only issue is that neither Ticketmaster or StubHub discloses this fee until sellers are in the process of listing their tickets. According to sellers, both resale services take a 15% commission from ticket sales at this point in time.

Cached

Do I need a tax ID number to sell tickets on Ticketmaster

Ticketmaster is a ticket sales and distribution platform that allows event organizers to sell and fulfill ticket transactions. If you are using a point of sale (POS) system to process your ticket transactions, you will still need to provide tax information to Ticketmaster.

Do you have to pay taxes on selling tickets on StubHub

When do you pay taxes on your StubHub sales You'll pay taxes on your earnings the year StubHub actually sends you the funds — which might be the year after you sold your ticket. According to CPA Tim Owens, in tax terms, the transaction occurs when you receive the funds.

Cached

What is the $600 rule for 1099

The new ”$600 rule”

Under the new rules set forth by the IRS, if you got paid more than $600 for the transaction of goods and services through third-party payment platforms, you will receive a 1099-K for reporting the income.

Do I have to do anything after my tickets sell on Ticketmaster

Once your tickets sell, you'll have to verify your account before we begin to process your payment. Visit the FAQ How do I verify the two Ticketmaster deposits to get paid by direct deposit for more information. We'll deposit your payout typically within 5-7 business days after your tickets are sold.

Does Ticketmaster make money on Resales

To understand just how much Ticketmaster stands to profit in a typical concert scenario, just look at the following calculation from the investigation: Resale tickets are particularly lucrative for Ticketmaster because the company charges fees twice on the same ticket.

Why are Ticketmaster Resale tickets so expensive

Service Fee and Order Processing Fee

In almost all cases, Ticketmaster adds a service fee (also known as a convenience charge) to the face value price, or in the case of a resale ticket to the listing price, of each ticket. The service fee varies by event based on our agreement with each individual client.

What happens if I sell more than $600 on eBay

(WTVO) — The Internal Revenue Service wants their share of your eBay profits. As of 2023, if you sell over $600 worth of products in 2023, you will need to report it to the IRS on a Form 1099-K, which eBay will send you. In prior years, the tax reporting only applied if a seller sold more than $20,000.

Do you get a 1099 for selling tickets

Ticketmaster is required to file a Form 1099-K report with the IRS when the gross revenue received from transactions on our U.S. marketplaces meets or exceeds $600 in a calendar year per seller. For fans who meet or exceed this $600 threshold, Ticketmaster will provide a copy of the Form 1099-K.

How do I report ticket sales on tax return

Assuming the taxpayer sold the extra ticket at a gain, the sale would be reported on Schedule D. If the sale was at a loss, the transaction would be reported as “other income” and the loss would not be allowed since personal losses are not deductible.

How much can you make 1099 without paying taxes

$600

While the Internal Revenue Service will require clients and businesses to issue the 1099 form when the payments they make for the tax year are over $600, there is no such requirement for reporting income. As an independent contractor, you have to report all income regardless of the amount when you file taxes.

How much can you make without reporting to IRS

Tax Year 2023 Filing Thresholds by Filing Status

| Filing Status | Taxpayer age at the end of 2023 | A taxpayer must file a return if their gross income was at least: |

|---|---|---|

| single | under 65 | $12,950 |

| single | 65 or older | $14,700 |

| head of household | under 65 | $19,400 |

| head of household | 65 or older | $21,150 |

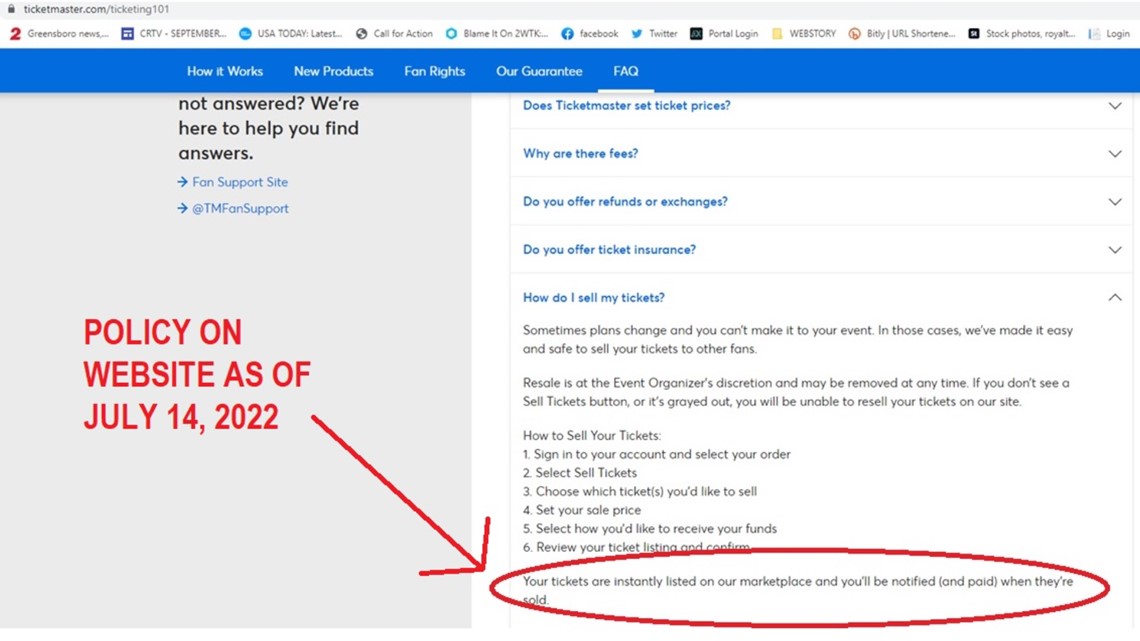

Can I buy tickets on Ticketmaster and then resell them

Select Tickets to Sell

If you purchased tickets from Ticketmaster and the Event Organizer has enabled resale for your event, you can list your tickets from your account or enter your ticket barcode.

Do resale tickets show up on Ticketmaster

When do I get my Resale-tickets Once you have purchased tickets, you will see the order as usual in your Ticketmaster account.

Is it good to sell tickets on Ticketmaster

Unlike posting to an unprotected forum or navigating a third-party resale site, when you list your tickets on Ticketmaster, you get a 100% guarantee that transferring your tickets to a buyer is safe and legitimate.

How long does it take Ticketmaster to pay you

We'll deposit your payout typically within 5-7 business days after your tickets are sold. If your tickets sell by barcode, we'll deposit your payout typically within 5-7 business days after the event takes place.

How can I sell something without paying taxes

The rule of thumb is that if you used the items and then sold them for less than you bought them for, then you owe no taxes on the sale. However, if you sold an antique or collectible that had appreciated since you first acquired it, you likely would be on the hook for taxes on the profit.

What is the $600 threshold for taxes

The new "$600 rule"

Under the new rules set forth by the IRS, if you got paid more than $600 for the transaction of goods and services through third-party payment platforms, you will receive a 1099-K for reporting the income.

Do I have to pay taxes on personal items I sell

The gain on the sale of a personal item is taxable. You must report the transaction (gain on sale) on Form 8949, Sales and Other Dispositions of Capital AssetsPDF, and Form 1040, U.S. Individual Income Tax Return, Schedule D, Capital Gains and LossesPDF.