Do I have to put crypto on taxes if I lost money?

Do I pay taxes on crypto if I lost money

Yes, cryptocurrency losses can be used to offset taxes on gains from the sale of any capital asset, including stocks, real estate and even other cryptocurrency sold at a profit.

Cached

Do I have to report losses on crypto

You need to report crypto — even without forms

In 2023, Congress passed the infrastructure bill, requiring digital currency “brokers” to send Form 1099-B, which reports an asset's profit or loss, annually.

What happens if I don’t report crypto losses

Taxpayers are required to report all cryptocurrency transactions, including buying, selling, and trading, on their tax returns. Failure to report these transactions can result in penalties and interest.

Cached

Do I have to report crypto on taxes if I didn’t sell

If you only bought but didn't sell crypto during the year, electing to hold it in a wallet or on a crypto platform, you won't owe any taxes on the purchase. Much like you wouldn't owe taxes for buying and holding stocks for your portfolio.

Cached

Do you have to report crypto under $600

However, you still need to report your earnings to the IRS even if you earned less than $600, the company says. The IRS can also see your cryptocurrency activity when it subpoenas virtual trading platforms, Chandrasekera says.

Should I sell crypto at a loss

Do I have to pay taxes if I sell crypto at a loss Selling cryptocurrency at a loss can reduce your tax bill by offsetting capital gains from cryptocurrency, stocks, and other assets.

Do I need to report losses

You don't have to report gains or losses on any stocks or other securities until they are sold. Gains on appreciated holdings that you still own are not reportable until you sell them, at which time you realize a gain or loss.

Do I need to report crypto if I didn’t make a profit

No, you do not need to report crypto if you don't sell. Because cryptocurrency and other digital assets are treated as property, taxable events only occur when you realize capital gains or losses through events such as swapping, trading, selling for fiat, or other methods of disposal.

Will the IRS know if I don’t report crypto

If, after the deadline to report and any extensions have passed, you still have not properly reported your crypto gains on Form 8938, you can face additional fines and penalties. After an initial failure to file, the IRS will notify any taxpayer who hasn't completed their annual return or reports.

Do I have to report crypto if I made less than 10k

Regardless of whether you had a gain or loss, these transactions need to be reported on your tax return on Form 8949. When you receive cryptocurrency from mining, staking, airdrops, or a payment for goods or services, you have income that needs to be reported on your tax return.

Can I sell crypto at a loss and buy it back immediately

If US investors buy back their crypto assets immediately after a sale, this constitutes a crypto wash sale. The simplest way to bypass the wash sale rule is to wait 30 days after selling an asset and then before buying back.

Is it illegal to not report losses on taxes

While you don't have to sell an asset whose value has nosedived, ridding your portfolio of dead weight can help you at tax time. In addition, federal tax law requires you to report capital losses when filing.

How much losses can you write off

Tax Loss Carryovers

If your net losses in your taxable investment accounts exceed your net gains for the year, you will have no reportable income from your security sales. You may then write off up to $3,000 worth of net losses against other forms of income such as wages or taxable dividends and interest for the year.

How do you write off crypto losses

When you sell your crypto at a loss, it can be used to offset other capital gains in the current tax year, and potentially in future years, too. If your capital losses are greater than your gains, up to $3,000 of them can then be deducted from your taxable income ($1,500 if you're married, filing separately).

Do I need to report $100 crypto gain

The $100 difference would be considered a capital gain and subject to capital gains tax, which is typically taxed at a lower rate than ordinary income. If you sold your crypto for less than what you paid for it, that would be considered a capital loss.

Do I have to report crypto under $600

You must report income, gain, or loss from all taxable transactions involving virtual currency on your Federal income tax return for the taxable year of the transaction, regardless of the amount or whether you receive a payee statement or information return.

What happens if you buy crypto and it goes negative

What happens if my crypto goes negative Your bank reverses the deposit or purchase and the cash value of this transfer/purchase is returned to your bank or card issuer. This negative balance will always equal the cash value of your original transaction even if the cryptocurrency value fluctuates. Then you lose.

How long can you carry crypto losses

"While remaining losses cannot be claimed this year, they can be carried forward to future years and claimed on future tax returns," he said. Still, it's important to remember that you had to have realized the loss for any of this to apply. This means you had to sell your crypto.

Do you have to declare losses

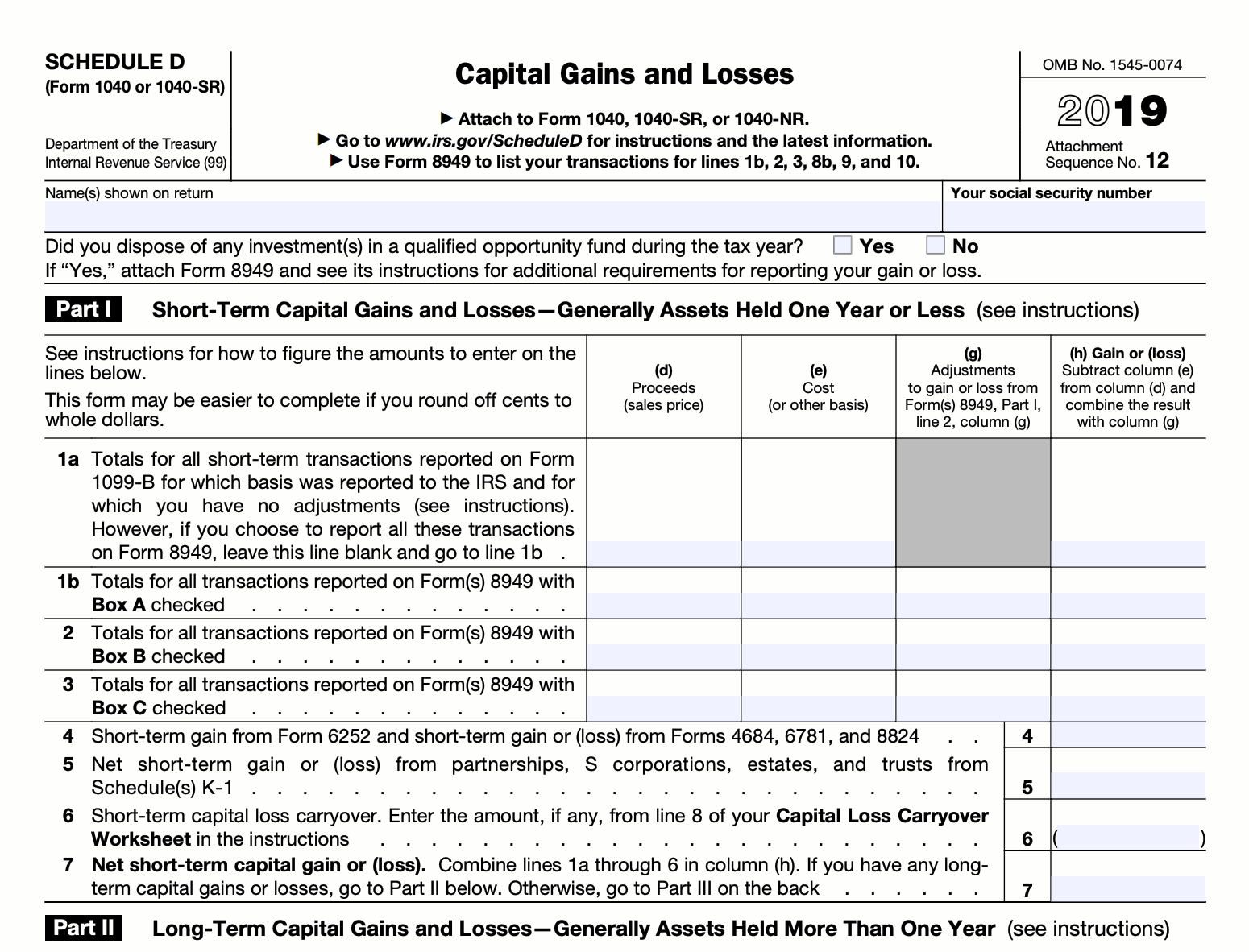

If you experienced capital gains or losses, you must report them using Form 8949 when you file taxes. Selling an asset, even at a loss, has crucial tax implications, so the IRS requires you to report it.

Do you get a tax break if you lose money on stocks

The IRS allows you to deduct from your taxable income a capital loss, for example, from a stock or other investment that has lost money. Here are the ground rules: An investment loss has to be realized. In other words, you need to have sold your stock to claim a deduction.