Do I have to use Credit Karma for TurboTax?

Do I have to do Credit Karma after TurboTax

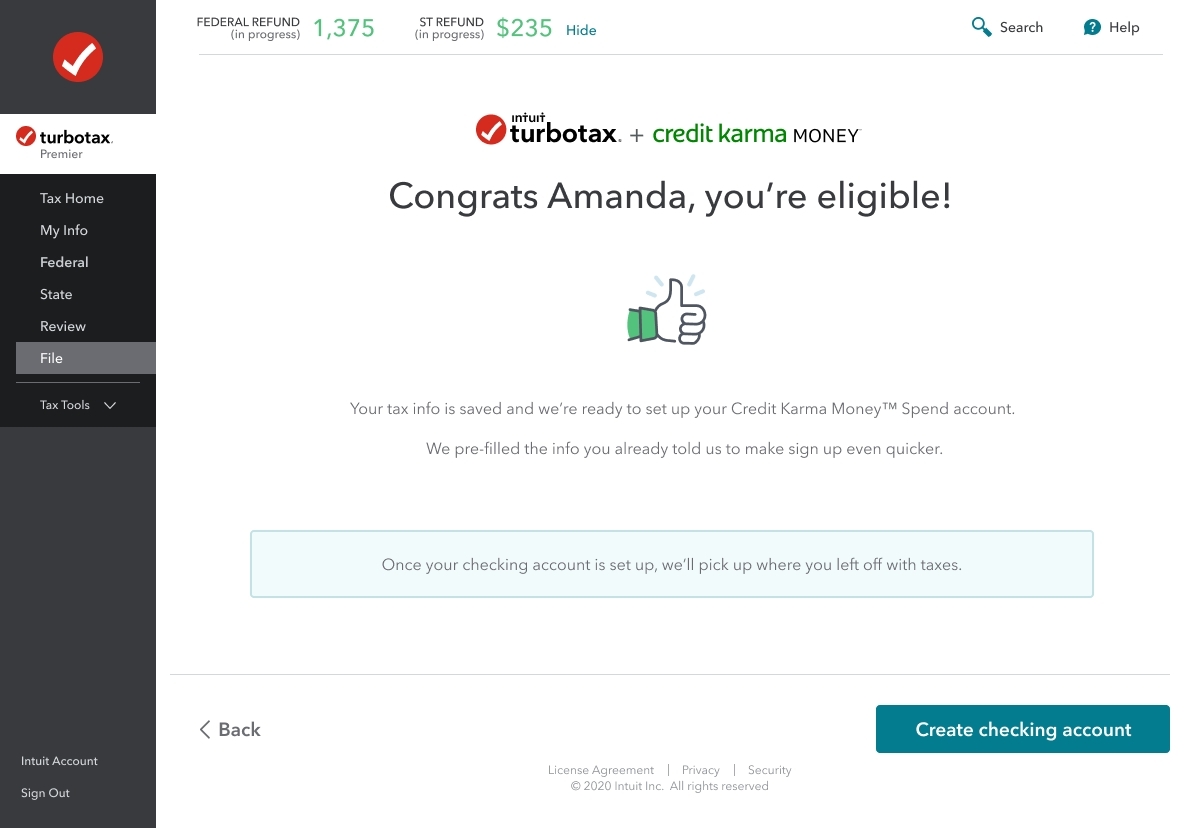

It is required that the TurboTax filer be the Credit Karma Money primary account holder. Make sure you are using your own Credit Karma account, or sign up for Credit Karma to open a Credit Karma Money Spend account and/or Save account.

Cached

Why does TurboTax send me to Credit Karma

Users are taken to the Credit Karma Money experience from within TurboTax and can open their account then continue with their TurboTax filing, all in a few clicks. This integration will enable TurboTax filers to do more with their refunds with Credit Karma Money.

Cached

Should I use Credit Karma for my tax return

Credit Karma offers a free, online tax preparation program that you can access from your web browser or phone. All you need is a Credit Karma account. It's a worthy competitor to popular services like TurboTax and H&R Block, especially since it costs $0 to file a federal and state return.

Is Credit Karma and TurboTax the same company

The company now offers tax filing through TurboTax—another product provided by Credit Karma's current parent company, Intuit. TurboTax is one of the easiest to use tax software platforms, but it often charges a fee to file your taxes—unlike Credit Karma Tax, which was completely free for all users.

Cached

How do I unlink Credit Karma and TurboTax

How can I unlink my accounts You can unlink your Turbo Tax account in your Security Settings by navigating to the My Profile section. You can then click on “Unlink all accounts” to unlink your accounts. Keep in mind, once unlinked, you won't be able to relink the accounts.

Does TurboTax give you your full refund

TURBOTAX ONLINE GUARANTEES

Maximum Refund Guarantee / Maximum Tax Savings Guarantee – or Your Money Back – Individual Returns: If you get a larger refund or smaller tax due from another tax preparation method by filing an amended return, we'll refund the applicable TurboTax federal and/or state purchase price paid.

Does TurboTax give you an accurate refund

TURBOTAX ONLINE GUARANTEES

100% Accurate Calculations Guarantee – Individual Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest.

How do I remove Credit Karma exclusive TurboTax

You can unlink your Turbo Tax account in your Security Settings by navigating to the My Profile section. You can then click on “Unlink all accounts” to unlink your accounts.

Will it hurt my credit if I use Credit Karma

Checking your free credit scores on Credit Karma doesn't hurt your credit. These credit score checks are known as soft inquiries, which don't affect your credit at all. Hard inquiries (also known as “hard pulls”) generally happen when a lender checks your credit while reviewing your application for a financial product.

How much does TurboTax cost

TurboTax Plan Prices

| Products Offered | Price | Additional State Fees |

|---|---|---|

| Free Edition | Free | Free |

| Deluxe | $59 and Up | $59 and Up Per State |

| Premier | $89 and Up | $59 and Up Per State |

| Self-Employed | $119 and Up | $59 and Up Per State |

Jun 1, 2023

What happens when you deactivate Credit Karma

Keep in mind, if you cancel your Credit Karma membership, then you'll no longer have access to the tools and information on Credit Karma, such as any previous credit scores or report history from TransUnion and Equifax.

How do I turn off Credit Karma

Log in to your Credit Karma account. Go to Profile & Settings in the top right hand corner. Click on My Profile. Click Close my account.

How fast does TurboTax get you your money

within 21 days

Your entire federal and state refunds (minus any TurboTax fees) will be loaded into the account as soon as the IRS or state tax authorities distributes your refund (typically within 21 days from IRS acceptance).

How quickly does TurboTax refund take

Most refunds will be issued in less than 21 days. You can start checking the status of your refund within 24 hours after you have e-filed your return.

How long does it take for refund to be approved TurboTax

21 days

Once the IRS accepts your return, they still need to approve your refund before they send it to you. Typically it takes 21 days to receive your refund after the IRS accepts your return. In the meantime, you can check your e-file status online with TurboTax.

Why is TurboTax making me pay for Deluxe

If we detect that your tax situation requires expanded coverage, like deductions for owning a home, unemployment income, or self-employment income, we'll prompt you to upgrade to a version that supports the forms you need so we can maximize your tax deductions and ensure you file an accurate return.

How many points off is Credit Karma

In some cases, as seen in an example below, Credit Karma may be off by 20 to 25 points.

How do I opt out of Credit Karma

If you feel that Credit Karma isn't for you, you're able to close your account by proceeding through the following steps:Log in to your Credit Karma account.Go to Profile & Settings in the top right hand corner.Click on My Profile.Click Close my account.

Is it cheaper to buy TurboTax or do it online

TurboTax is the most expensive option for filing taxes online, but offers a high-quality user interface and access to experts. It's especially valuable for self-employed filers who use QuickBooks integration.

What is cheaper H&R Block or TurboTax

You might choose H&R Block if you want a premium experience for a lower price. H&R Block's DIY filing options are less expensive than TurboTax's across, and the company edged out TurboTax in our overall ratings.