Do I need a 1098 T for Lifetime Learning credit?

What form do I use for Lifetime Learning Credit

Use Form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. There are two education credits. The American Opportunity Credit, part of which may be refundable. The Lifetime Learning Credit, which is nonrefundable.

What happens if you don’t have a 1098-T

You should contact your school and have them send you one. You may be able to claim one of the credits without a Form 1098-T if one of the following exceptions applies: The school isn't required to send a Form 1098-T.

Can you take tuition deduction and Lifetime Learning Credit

You can claim these two benefits on the same return but not for the same student or the same qualified expenses. See "No Double Benefits Allowed" for more information on claiming one or more education benefits.

Do student loans count towards Lifetime Learning Credit

As with the American Opportunity Tax Credit, the IRS allows you to claim the Lifetime Learning Credit even if you use a qualified student loan to pay for your tuition.

What line on 1040 is Lifetime Learning Credit

Complete the Adjusted Qualified Education Expenses Worksheet in the Instructions for Form 8863 to determine what amount to enter on line 27 for the American Opportunity Credit or line 31 for the Lifetime Learning Credit.

Is the Lifetime Learning Credit an itemized deduction

You can deduct this amount from the total amount of federal tax you need to pay when you file your tax return. The Lifetime Learning Tax Credit is equal to up to 20% of the first $10,000 spent on qualified higher education expenses.

Why would a student not receive a 1098-T

Why didn't I receive a Form 1098-T You may have received more scholarships and/or grants than the amount of qualified tuition and fees paid; the University is not required to produce a Form 1098-T.

Do all students get a 1098-T

Not all students are eligible to receive a 1098-T. Forms will not be issued under the following circumstances: The amount paid for qualified tuition and related expenses* in the calendar year is less than or equal to the total scholarships disbursed that year.

What is deductible for Lifetime Learning Credit

You can deduct this amount from the total amount of federal tax you need to pay when you file your tax return. The Lifetime Learning Tax Credit is equal to up to 20% of the first $10,000 spent on qualified higher education expenses.

What is the difference between tuition deduction and Lifetime Learning Credit

The AOTC can only be used for undergraduate expenses, while the Lifetime Learning Credit is more flexible. The AOTC can only be claimed for four tax years; the Lifetime Learning Credit can be claimed an unlimited number of times.

Why am I not eligible for the Lifetime Learning Credit

The Lifetime Learning Tax Credit is not available when: The taxpayer claimed the AOTC during the same tax year. The taxpayer pays for college expenses for someone who is not a dependent. The taxpayer files federal income tax returns as married filing separately.

How do I maximize my Lifetime Learning Credit

To maximize the Lifetime Learning Credit, one should see if they are eligible for the credit, then take the maximum qualifying education expenses and claim the full credit amount for each eligible student. One may also consider combining this credit with other education-related tax credits.

How does the lifetime learning tax credit work

The maximum credit you can claim is 20% of up to $10,000 in eligible costs or $2,000. You can include the cost of tuition, fees and any books or supplies you are required to purchase directly from the school, so long as it's a condition of enrollment.

What is the difference between Lifetime Learning Credit and tuition deduction

The AOTC can only be used for undergraduate expenses, while the Lifetime Learning Credit is more flexible. The AOTC can only be claimed for four tax years; the Lifetime Learning Credit can be claimed an unlimited number of times.

How do I claim my 1040 Lifetime Learning Credit

To claim the lifetime learning credit complete Form 8863 and submitting it with your Form 1040 or 1040-SR. Enter the credit on Schedule 3 (Form 1040 or 1040-SR), line 3.

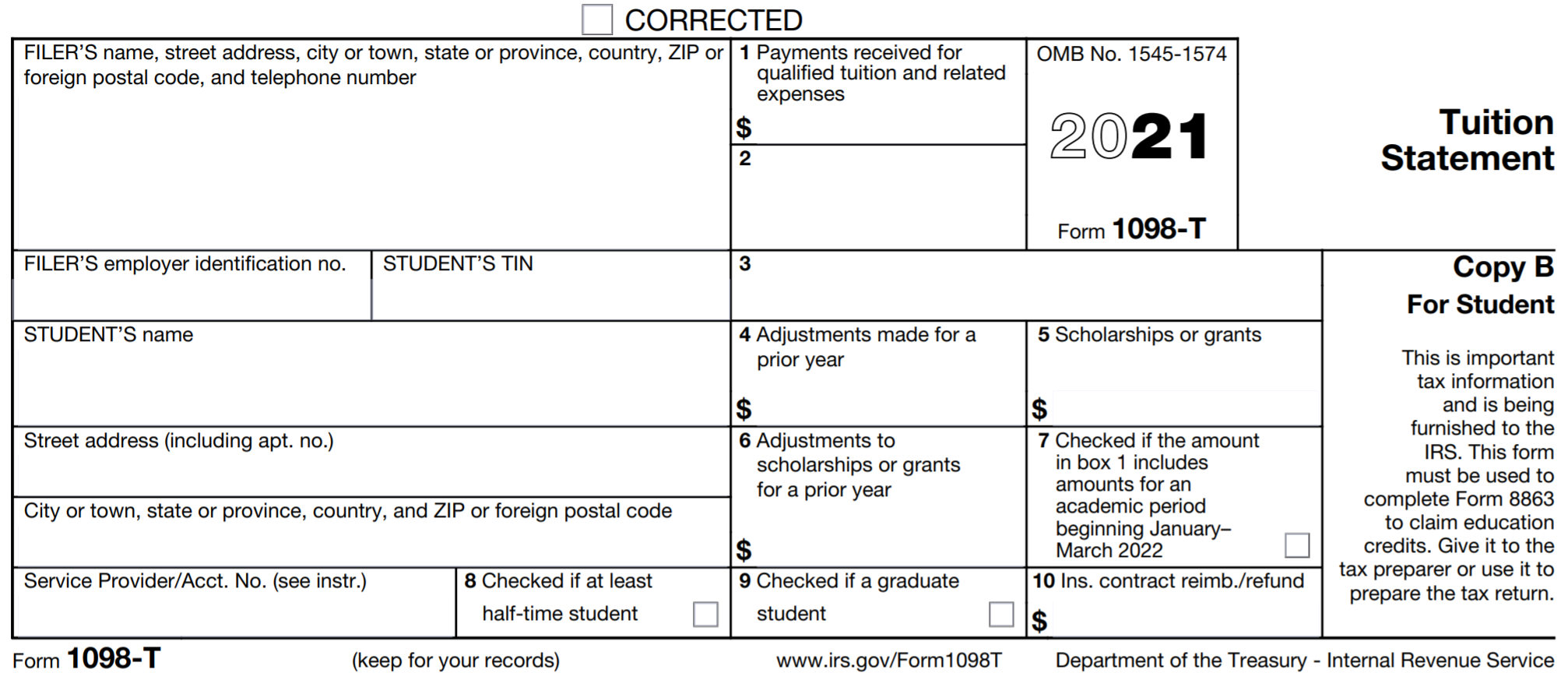

Who claims the 1098-T parent or student

Eligible educational institutions file Form 1098-T for each student they enroll and for whom a reportable transaction is made. Insurers file this form for each individual to whom they made reimbursements or refunds of qualified tuition and related expenses.

How do I know if I need to file 1098-T

College students or their parents who paid qualified tuition and college expenses during the tax year will need Form 1098-T from their school if they want to claim certain education credits.

How do I know if I need a 1098-T

You must file Form 1098-T if you are an eligible educational institution. An eligible educational institution that is a governmental unit, or an agency or instrumentality of a governmental unit, is subject to the reporting requirements of Form 1098-T.

Where does Lifetime Learning Credit go on 1040

To claim the lifetime learning credit complete Form 8863 and submitting it with your Form 1040 or 1040-SR. Enter the credit on Schedule 3 (Form 1040 or 1040-SR), line 3.

Can I claim the Lifetime Learning Credit for myself

If that sounds like you, we've got good news: With the lifetime learning credit (LLC), the IRS allows you to claim up to $2,000 for qualified education expenses (QEEs) for yourself, your spouse, or a dependent.