Do I need a lawyer for transfer of equity?

What do I need to do to transfer equity

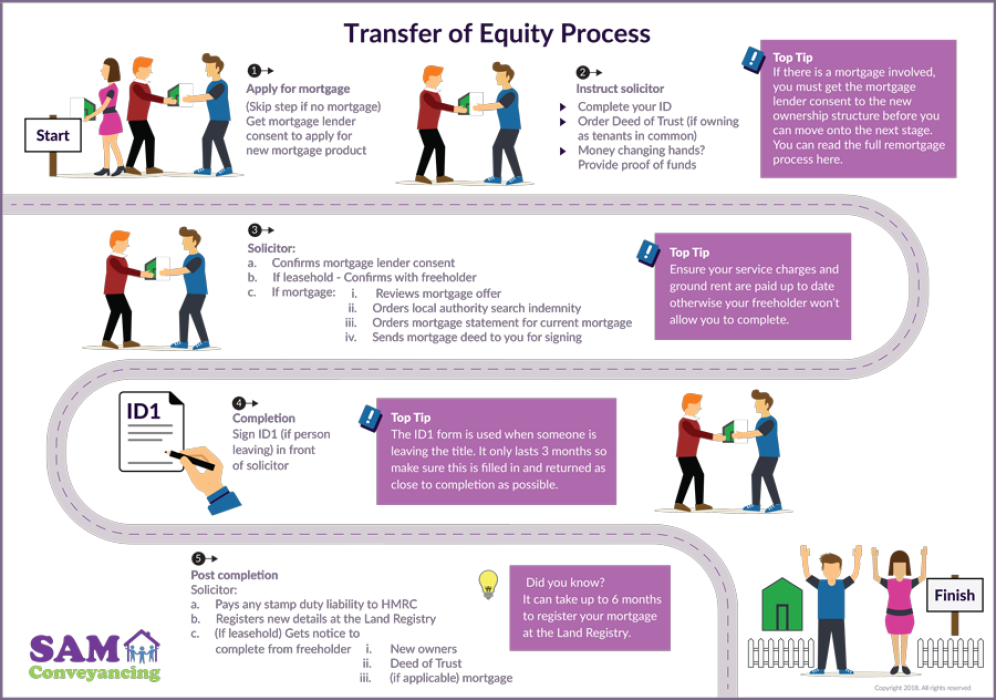

Transfer of equity: step by stepApply for a remortgage/new mortgage (if you need one).Instruct a conveyancer.All parties will need to provide thorough identification.Let your conveyancer take care of the legal work.Complete.

How long does it take to complete transfer of equity

A simple transfer of equity can take around 4-6 weeks to complete. However, each transaction is different, and the time taken to complete the transfer can vary greatly. If there is a mortgage on the property, the transfer will take longer as you will have to wait to receive written consent from any lenders involved.

How do I transfer property in Louisiana

The most common form of transferring property ownership in Louisiana is done via a voluntary contract through the owner, also known as the seller, and the transferee, also know as the buyer. Real estate ownership is transferred using a valid contract, also known as an authentic act.

How do I transfer ownership of a property in Texas

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located. To ensure a legal change to the property title, you'll want the services of an attorney. A qualified attorney will prepare and file the real estate transfer deed.

Can you transfer equity from one house to another

You can pull the equity out of your current home with a home equity line of credit. This option would allow you to have a line of credit to use as you wish for the new home purchase.

How do you receive money from equity

Select the payout option (cash pickup, Bank Deposit or Mobile Money). Key in the receiver's details as prompted. To receive money via WorldRemit from abroad, request for the transaction reference number from the sender and visit any Equity Bank Branch to collect the cash.

How do I file a succession in Louisiana without a lawyer

Succession ProcessFile an Affidavit of Death, Domicile, and Heirship with the court in the parish where the decedent lived.A Petition for Probate of Testament is filed to requests that the court recognize the will.The court appoints a succession representative to handle the administration of the estate.

What documents are needed for succession in Louisiana

File the following documents: Petition for Possession, Affidavit of Death, Domicile, and Heirship, Sworn Descriptive List of Assets and Liabilities, Renunciations or donations (if applicable), and Judgment of Possession. They open the succession in court and begin the process to divide the estate.

How much does it cost to transfer property title in Texas

all property deeds – $195

Any Property Deed needed to transfer real estate in Texas. Prepared by an attorney licensed in the state of Texas. Board-certified in residential real estate law.

How much does it cost to transfer deed of a house in Texas

The county clerk will charge a recording fee of about $30 to $40, depending on the county. The fee should be paid by a cashier's check or money order. Once a Deed has been recorded by the county clerk, the clerk's office will return the Deed to the new owner.

Can I take equity out of my house without refinancing

Sale-Leaseback Agreement. One of the best ways to get equity out of your home without refinancing is through what is known as a sale-leaseback agreement. In a sale-leaseback transaction, homeowners sell their home to another party in exchange for 100% of the equity they have accrued.

What happens to equity when you move house

You can usually use the equity in your home as a deposit on the new property. If your house has increased in value or if you've paid off a chunk of the mortgage (so owe less), you will have built up equity in your property – the money that would be yours if you sold the house and settled the mortgage.

What happens when you cash out your equity

A cash-out refinance is a type of mortgage refinance that takes advantage of the equity you've built over time and gives you cash in exchange for taking on a larger mortgage. In other words, with a cash-out refinance, you borrow more than you owe on your mortgage and pocket the difference.

Can you convert equity to cash

A cash-out refinance is a mortgage refinancing option that lets you convert home equity into cash. A new mortgage is taken out for more than your previous mortgage balance, and the difference is paid to you in cash.

How much does it cost to file a succession in Louisiana

For simple successions, court costs can range from $300.00 to $600.00 depending on the parish where the succession will be filed. When an administration is needed for an estate, court costs will be higher depending on the filings necessary to complete the administration and can range from $1,500.00 up to $3,000.00.

How do I transfer property after death in Louisiana

The executor/executrix transfers the decedent's property through a court-supervised process called probate. To begin the probate process, the executor/executrix must first get legal authority to transfer the decedent's estate. The document that grants the executor/executrix this power is called letters testamentary.

Do you need a lawyer to open succession in Louisiana

In some cases, the process is simple, but in other cases, it can get very complicated very quickly. In all but the simplest situations, you should work with a succession attorney to ensure that the process is as efficient as possible and that, as an heir, your rights are protected.

How long does it take to transfer a property title in Texas

It usually takes four to six weeks to complete the legal processes involved in the transfer of title.

Do I need a notary to transfer a title in Texas

While some states require the signatures to be notarized, Texas doesn't. You can have your signatures notarized if you wish, but this isn't a required step to legally transfer a title in your state.

Who can prepare a deed in Texas

Your deed will be prepared by a Texas licensed attorney in about an hour. This fee does not include the county recording fee. The county recording fee is approximately $15 to $40, depending on the county the property is located in.