Do I need Credit Karma for TurboTax?

Do I have to do Credit Karma after TurboTax

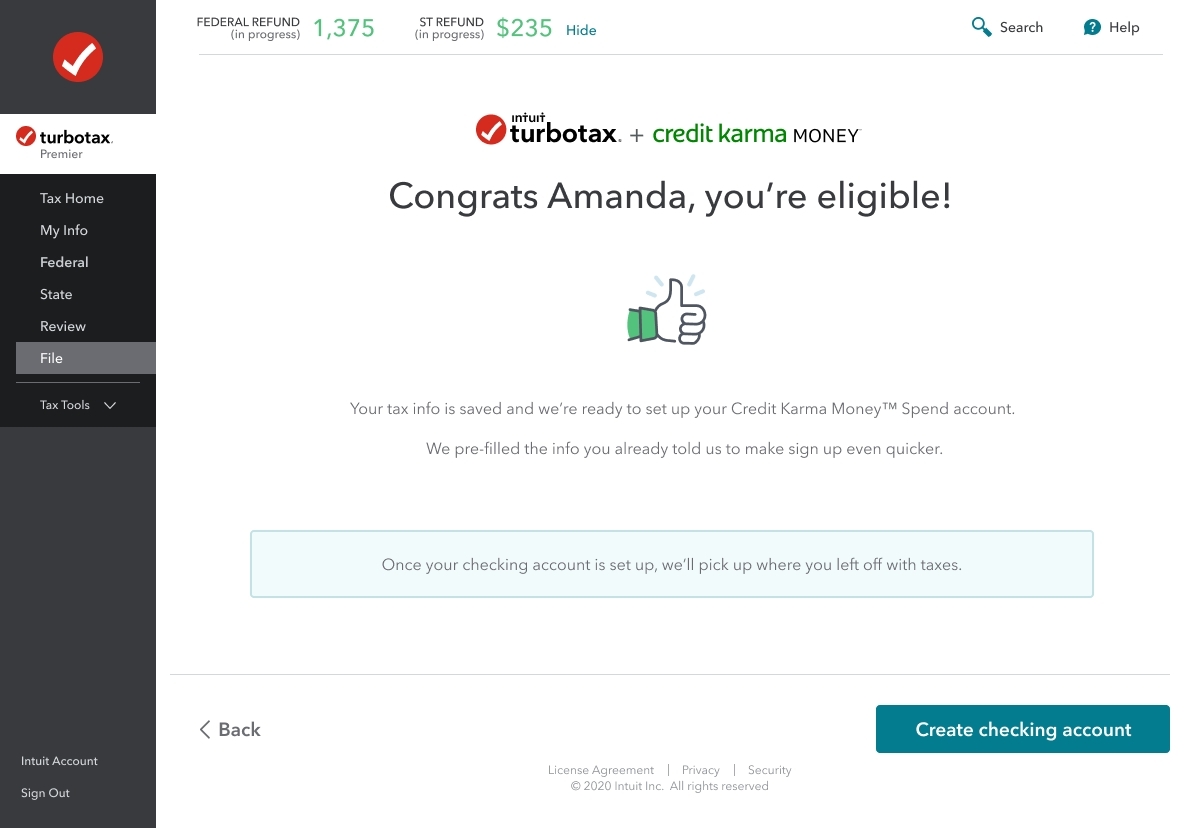

It is required that the TurboTax filer be the Credit Karma Money primary account holder. Make sure you are using your own Credit Karma account, or sign up for Credit Karma to open a Credit Karma Money Spend account and/or Save account.

Cached

Should I use Credit Karma for my tax return

Credit Karma offers a free, online tax preparation program that you can access from your web browser or phone. All you need is a Credit Karma account. It's a worthy competitor to popular services like TurboTax and H&R Block, especially since it costs $0 to file a federal and state return.

Is Credit Karma and TurboTax the same company

The company now offers tax filing through TurboTax—another product provided by Credit Karma's current parent company, Intuit. TurboTax is one of the easiest to use tax software platforms, but it often charges a fee to file your taxes—unlike Credit Karma Tax, which was completely free for all users.

Cached

What information do I need to use TurboTax

What tax forms do I need for online tax filingForm W-2, Wage and Tax Statement.Form W-2G, Certain Gambling Winnings.Form 1099-DIV, Dividends and Distributions.Form 1099-INT, Interest Income.Form 1099-MISC, Miscellaneous Income.Form 1099-NEC, Nonemployee Compensation.SSA-1099, Social Security Benefit Statement.

Why is Credit Karma attached to TurboTax

Credit Karma wants to help members file their taxes and get cash instantly with TurboTax Refund Advance. Credit Karma teams up with TurboTax to launch refund-focused tax experience to help Americans seamlessly file their taxes and apply to get a Refund Advance loan in as little as 1 minute after IRS acceptance.

Does TurboTax give you your full refund

TURBOTAX ONLINE GUARANTEES

Maximum Refund Guarantee / Maximum Tax Savings Guarantee – or Your Money Back – Individual Returns: If you get a larger refund or smaller tax due from another tax preparation method by filing an amended return, we'll refund the applicable TurboTax federal and/or state purchase price paid.

How do I remove Credit Karma from TurboTax

How do I unlink my credit karma accountGo to your Credit Karma Money Save account.Find the Credit Karma Money Save Account Settings page at the bottom of the savings hub.Select Close Savings Account.Select Continue on the following screen.You will see a screen where you can tell us your reason for closing.

Why did Credit Karma merge with TurboTax

Indeed, combining with Intuit gives Credit Karma access to much of the same valuable information that its tax-prep offering did—insight into customers' income and ability to make loan payments—allowing it to improve its financial product recommendations.

Is it hard to file taxes on TurboTax

Whether you're an experienced tax preparer or have little knowledge of tax law beyond knowing you need to file, TurboTax makes tax filing easy by walking you through the process with interview-style questions and options for live, on-screen support when needed.

How much does TurboTax take out of your refund

#1 Best Selling Tax Software: Based on aggregated sales data for all tax year 2023 TurboTax products. Deduct From Your Federal Refund: A $40 Refund Processing Service fee applies to this payment method.

When did Credit Karma switch to TurboTax

(Nasdaq:INTU), TurboTaxⓇ. The integration comes on the heels of Intuit's acquisition of Credit Karma in December 2023 and is the first time the two companies have teamed up to accomplish their combined goal of helping consumers pay down debt, build wealth and get access to their money faster.

How fast does TurboTax get you your money

within 21 days

Your entire federal and state refunds (minus any TurboTax fees) will be loaded into the account as soon as the IRS or state tax authorities distributes your refund (typically within 21 days from IRS acceptance).

How quickly does TurboTax refund take

Most refunds will be issued in less than 21 days. You can start checking the status of your refund within 24 hours after you have e-filed your return.

What happens if I delete my Credit Karma account

Keep in mind, if you cancel your Credit Karma membership, then you'll no longer have access to the tools and information on Credit Karma, such as any previous credit scores or report history from TransUnion and Equifax.

Is TurboTax not free anymore

Millions of taxpayers file their taxes free each year. Unfortunately, two of the biggest tax preparation services, TurboTax and H&R Block, are no longer participating in the IRS's official Free File program,which means you could be hit with a credit card fee if you are not careful.

Is TurboTax easy for beginners

Whether you're an experienced tax preparer or have little knowledge of tax law beyond knowing you need to file, TurboTax makes tax filing easy by walking you through the process with interview-style questions and options for live, on-screen support when needed.

How much should it cost to file taxes on TurboTax

TurboTax Plan Prices

| Products Offered | Price | Additional State Fees |

|---|---|---|

| Free Edition | Free | Free |

| Deluxe | $59 and Up | $59 and Up Per State |

| Premier | $89 and Up | $59 and Up Per State |

| Self-Employed | $119 and Up | $59 and Up Per State |

Jun 1, 2023

How will I get my money from TurboTax

How to get your TurboTax settlement check. You don't need to do anything, according to the settlement website. If you are eligible, you should receive an email from the settlement fund administrator that informs you of the approximate amount of your payment. Payments will be mailed throughout May, the site says.

Why would you get denied for a refund advance

Your approval is based on the size of your federal refund and your tax information, along with other factors. You may not receive the Refund Advance if one of these factors doesn't meet the qualifying standards of the lender.

Does TurboTax tell you when your refund is approved

tool to track your federal refund status. The tool will show “Return Received” once the IRS has begun processing your return. Keep in mind: you will not see a refund date until the IRS finishes processing and approves your tax refund.