Do I need to freeze credit with all 3 agencies?

Do you have to call all three credit bureaus to freeze my credit

You must contact each of the three credit bureaus to freeze your credit. Creating free online accounts with each bureau is the quickest way to manage your freezes. Alternatively, you can contact the bureaus via phone or mail.

Cached

Can I lock all three credit reports at once

Locks are offered as services by the three national credit bureaus of Experian, Equifax, and TransUnion. This means that you might have to pay if you want your credit locked at all three bureaus. And you will have to lock your credit at all three bureaus.

Cached

Do you need to check all 3 credit bureaus

Because lenders choose which bureau they pull from, it's important for you to periodically check your credit report and FICO® Scores based on data from all three credit bureaus to ensure the information reported on you is accurate, up to date and that the FICO® Scores based on each credit bureau's data are reflective …

Does Experian credit lock work for all 3

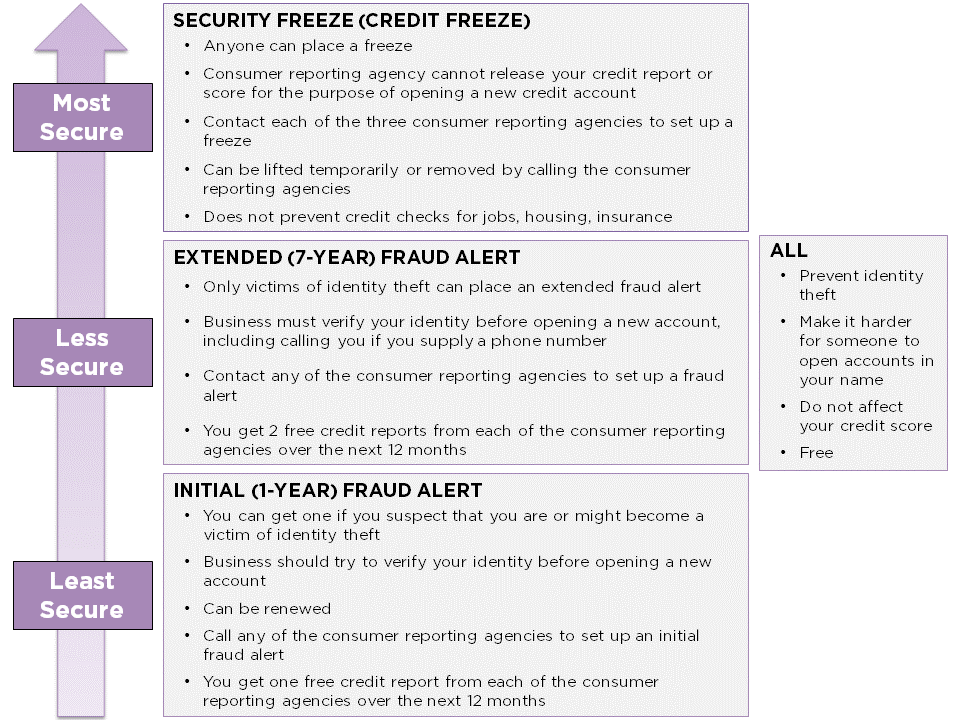

A credit freeze, or security freeze, is a free option that lets you limit access to your credit report at each of the three national credit bureaus (Experian, TransUnion and Equifax).

What is the downside of freezing your credit

A freeze can give you a false sense of security — you may still be susceptible to credit fraud or other fraud involving your Social Security number. A credit freeze won't affect your current accounts, but if a thief steals the information on an existing account, your credit may be used without your permission.

How much does it cost to freeze your credit with the three major credit bureaus

free

Freezing your credit is free, and you'll need to do it with all three credit bureaus to lock down each of your credit reports. And again, the freeze will stay in place until you lift it.

What is a major downside of locking your credit

A freeze can give you a false sense of security — you may still be susceptible to credit fraud or other fraud involving your Social Security number. A credit freeze won't affect your current accounts, but if a thief steals the information on an existing account, your credit may be used without your permission.

What is the safest way to get all three credit reports

You have the right to request one free copy of your credit report each year from each of the three major consumer reporting companies (Equifax, Experian and TransUnion) by visiting AnnualCreditReport.com. You may also be able to view free reports more frequently online.

Which of the 3 credit bureaus is most important

Of the three main credit bureaus (Equifax, Experian, and TransUnion), none is considered better than the others. A lender may rely on a report from one bureau or all three bureaus to make its decisions about approving your loan.

Which credit score matters more TransUnion or Equifax

No credit score from any one of the credit bureaus is more valuable or more accurate than another. It's possible that a lender may gravitate toward one score over another, but that doesn't necessarily mean that score is better.

Are Experian TransUnion and Equifax the three main

The three major credit reporting bureaus in the United States are Equifax, Experian, and TransUnion. They compile credit reports on individuals, which they sell to prospective lenders and others. The three bureaus can have somewhat different information in their reports, depending on which creditors provide it to them.

Is it a good idea to put a freeze on your credit

Locking or freezing your credit file may help prevent criminals from opening fraudulent accounts in your name. If you don't plan on applying for any new credit in the near future and your state doesn't allow credit freezing fees, a freeze may be the way to go.

Will my credit score go down if I freeze my account

No, freezing a credit card doesn't hurt your credit. As long as you keep your account in good standing, your frozen card will still help you improve your credit score. Also, there is no penalty or charge for freezing your account, and you can unfreeze it anytime you want.

How long does a Experian credit freeze last

An initial fraud alert remains for one year, while an extended alert remains for seven. And while freezes must be removed before most access is granted, fraud alerts give lenders access to your credit reports and ask that they verify your identity before processing credit applications made under your name.

Does putting a credit freeze hurt your credit

A credit freeze won't have any impact on your credit score, nor will it impact your current credit accounts. While a credit freeze won't affect your credit score in any way, it will impact your ability to qualify for a loan or credit card unless you thaw your credit file before submitting your application.

Does freezing a credit card hurt your credit

No, freezing your credit doesn't affect your credit score. If you plan to open a new account, you may have to lift your credit freezes first to be able to apply.

What are the 3 free places you should pull your credit score report from

By law, you can get a free credit report each year from the three credit reporting agencies (CRAs). These agencies include Equifax, Experian, and TransUnion.

Which of the 3 credit bureau shows the lowest score

Your Equifax score is lower than the other credit scores because there is a slight difference in what is reported to each credit agency and each one uses a slightly different method to score your data. Your Experian, Equifax and TransUnion credit reports should be fairly similiar.

Is TransUnion or Equifax more important

TransUnion vs. Equifax: Which is most accurate No credit score from any one of the credit bureaus is more valuable or more accurate than another. It's possible that a lender may gravitate toward one score over another, but that doesn't necessarily mean that score is better.

Which is more accurate Experian Equifax or TransUnion

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.