Do investment tax credits expire?

Will the investment tax credit be extended

In August 2023, Congress passed an extension of the ITC, raising it to 30% for the installation of which was between 2023-2032.

Cached

When did investment tax credit end

After 2032, the residential ITC will start to phase out to 26% in 2033, 22% in 2034, and will end in 2035.

Does a tax credit expire

Nonrefundable tax credits are valid in the year of reporting only, expire after the return is filed, and may not be carried over to future years. 7 Because of this, nonrefundable tax credits can negatively impact low-income taxpayers, as they are often unable to use the entire amount of the credit.

Cached

How do investment tax credits work

Investment tax credits are basically a federal tax incentive for business investment. They let individuals or businesses deduct a certain percentage of investment costs from their taxes. These credits are in addition to normal allowances for depreciation.

What will happen if the Congress passes an investment tax credit

The correct answer is option (a)

Assume Congress enacted a tax credit for investment. Funds that can be borrowed investment will be much more profitable as a consequence of tax credits. As a result, the demand for loanable cash will rise. Both the interest rate and the quantity of money will rise.

How do I get a $10000 tax refund 2023

How to Get the Biggest Tax Refund in 2023Select the right filing status.Don't overlook dependent care expenses.Itemize deductions when possible.Contribute to a traditional IRA.Max out contributions to a health savings account.Claim a credit for energy-efficient home improvements.Consult with a new accountant.

What is the current investment tax credit

The Investment Tax Credit (ITC) is currently a 30 percent federal tax credit claimed against the tax liability of residential (under Section 25D) and commercial and utility (under Section 48) investors in solar energy property.

What happens to unused federal tax credits

The unused nonrefundable credits will not entitle the taxpayer to a refund. Low-income taxpayers often are unable to use the entire amount of their nonrefundable credits. Nonrefundable tax credits are valid only in the year when they are generated; they expire if unused and may not be carried over to future years.

How long can you carry a tax credit

Some tax carryforwards have no time limit and can be used as long as the taxpayer is alive. Other tax carryforwards expire after just a few years, depending on each carryforward rule.

What is the limitation on the investment tax credit

In any taxable year, the investor could claim no more than 50 percent of the amount of credit for investments and the credit could not exceed 50 percent of the taxpayer's income tax liability.

What are the advantages of investment tax credits

It stimulates the economy. It makes more money available for other businesses to invest in their projects through the tax credits they earn. These tax credits can act as savings to offset the total costs of projects. This makes possible new investments in expansion or new projects more feasible.

How to get the biggest tax refund in 2023

Follow these six tips to potentially get a bigger tax refund this year:Try itemizing your deductions.Double check your filing status.Make a retirement contribution.Claim tax credits.Contribute to your health savings account.Work with a tax professional.

What is the largest tax refund

Utah has the largest average federal tax refund. Note: This is based on 2023 IRS data for federal tax refunds issued. Utah's average federal tax refund for 2023 was $1,812.

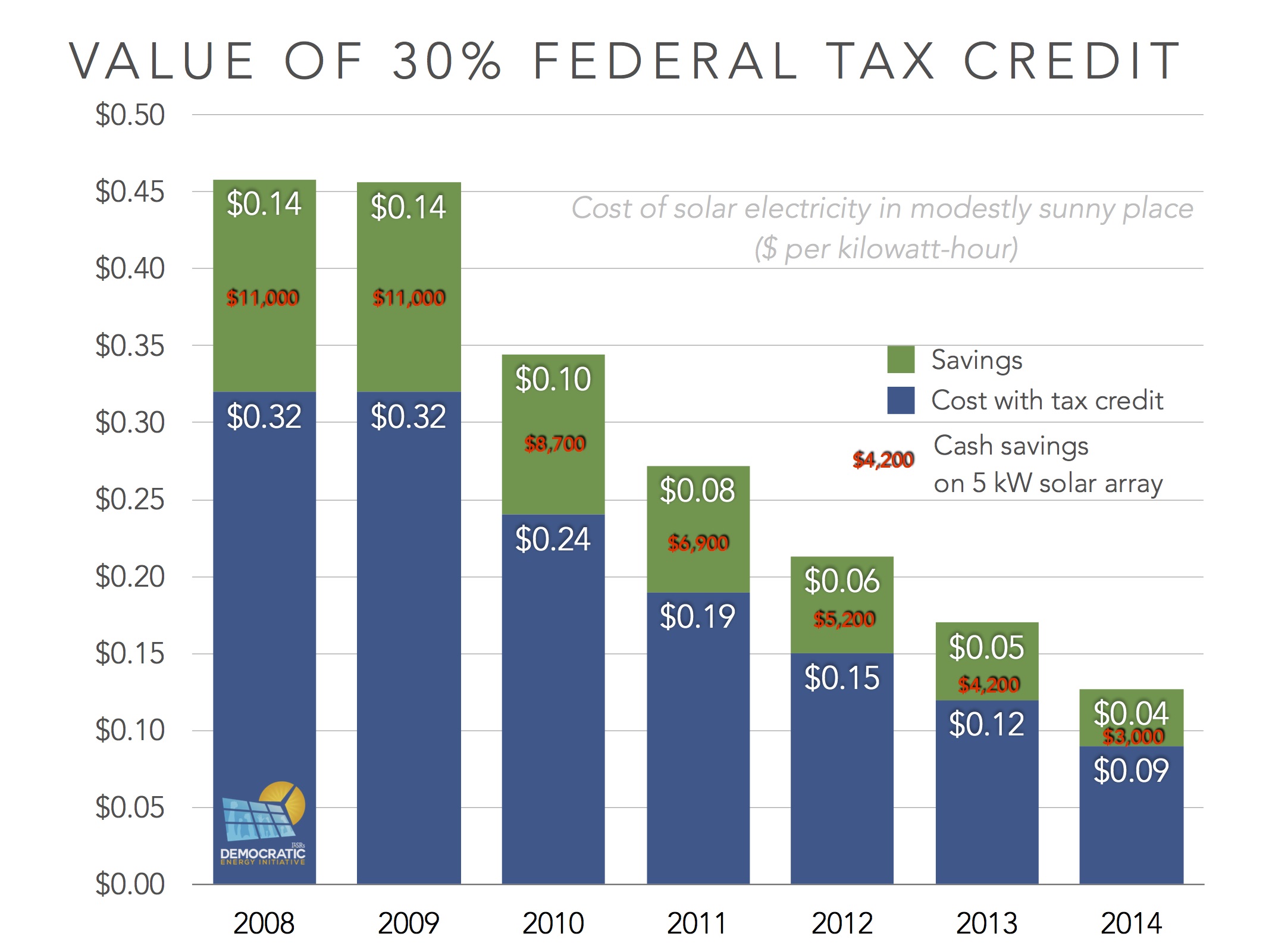

What is the 30 percent investment tax credit

At 30%, the tax credit is worth $7,500 for a $25,000 solar system — effectively knocking the price down to $17,500. The credit was previously at 26% for systems installed in 2023 and scheduled to step down to 22% in 2023 before going away entirely in 2024.

Can you carry over unused tax credits

An unused credit is a carryback to each of the 3 taxable years preceding the unused credit year and a carryover to each of the 7 taxable years succeeding the unused credit year. An unused credit must be carried first to the earliest of those 10 taxable years.

Can you carry over any unused amount of tax credit to the next tax year

A carryforward credit is the application of a tax credit to a future tax year. This provision exists so that businesses can take advantage of tax credits that were unused because of operating losses or IRS imposed limits on how much can be claimed in a single year.

What is an example of an investment tax credit

Effect on taxes

For example, if you owe the IRS $3,000 and claim an investment tax credit of $1,000, your tax liability drops to $2,000 ($3,000 taxes you owed – $1,000 of tax credit = $2,000 total taxes owed).

Is investment tax credit refundable

If the tax credit exceeds my tax liability, will I get a refund This is a nonrefundable tax credit, which means you will not get a tax refund for the amount of the tax credit that exceeds your tax liability. 15 However, you can carry over any unused amount of tax credit to the next tax year.

What are the IRS tax changes for 2023

For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900, and for heads of households, the standard deduction will be $20,800 for tax year 2023, up $1,400 from the amount for tax year 2023.

How to get $7,000 tax refund

Below are the requirements to receive the Earned Income Tax Credit in the United States: Have worked and earned income less than $59,187. Have investment income less than $10,300 in tax year 2023. Have a valid Social Security number by the due date of your 2023 return.