Do lenders look at paid collections?

Do lenders look at collections

Having a plan in place that addresses credit issues is always a good idea and the positive news is that a collection account usually does not prevent you from qualifying for a mortgage. Approval guidelines for collection accounts vary by loan program.

Cached

Does a paid collection affect a credit score

In general, collections accounts stay on your credit report for up to seven years, even when they're paid off in full. That means that paid collections can continue to hurt your creditworthiness for that length of time. However, the impact of collection accounts on your score lessens with time.

Cached

Does paying off collections look good

And if you have multiple debt collections on your credit report, paying off a single collections account may not significantly raise your credit scores. But if you have a recent debt collection and it's the only negative item on your credit report, paying it off could have a positive effect on your score.

Cached

Does paid collection look better than unpaid

A fully paid collection is better than one you settled for less than you owe. Over time, the collections account will make less difference to your credit score and will drop off entirely after seven years.

Do you have to pay collections before buying a house

The FHA does not require collections to be paid off entirely in order for a borrower to be approved. However, they do recognize that collections can impact a borrower's ability to repay their loan, which is something they take into consideration.

Should I pay off a 2 year old collection

Any action on your credit report can negatively impact your credit score, even paying back loans. If you have an outstanding loan that's a year or two old, it's better for your credit report to avoid paying it.

What happens when a collection is paid off

Paying won't take a collections account off your credit reports. Many people believe paying off an account in collections will remove the negative mark from their credit reports. This isn't true; if you pay an account in collections in full, it will show up on your credit reports as “paid,” but it won't disappear.

How do I remove paid collections from my credit report

A goodwill deletion is the only way to remove a legitimate paid collection from a credit report. This strategy involves you writing a letter to your lender. In the letter, you need to explain your circumstances and why you would like the record of the paid collection to be removed from your credit report.

How do I get collections removed after paying

A goodwill deletion is the only way to remove a legitimate paid collection from a credit report. This strategy involves you writing a letter to your lender. In the letter, you need to explain your circumstances and why you would like the record of the paid collection to be removed from your credit report.

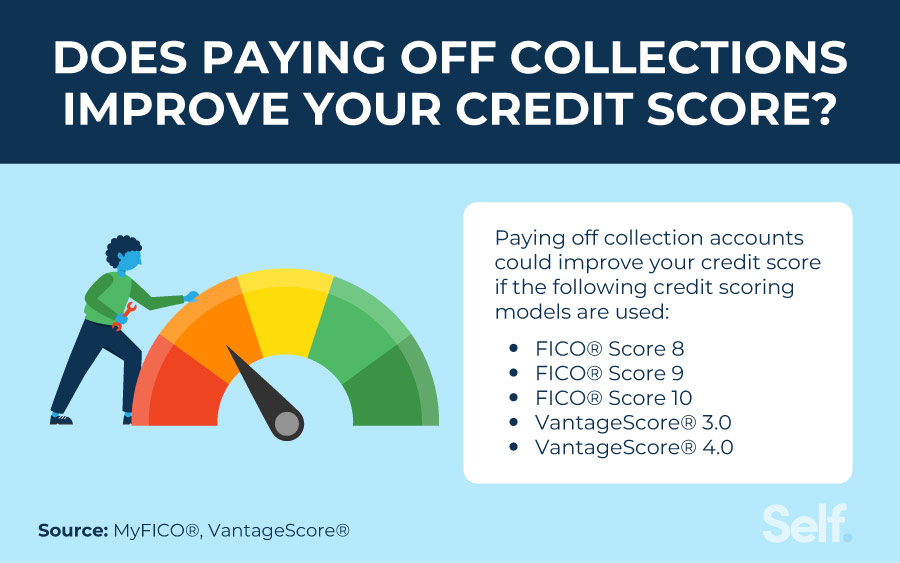

How many points will my credit score increase when I pay off collections

With most of the current standard credit scoring models, paying a collection account off likely won't increase your credit score since the item will remain on your credit report. It will show up as “paid” instead of “unpaid,” which might positively influence a lender's opinion.

Does FHA require collections to be paid off

The FHA does not require collections to be paid off entirely in order for a borrower to be approved. However, they do recognize that collections can impact a borrower's ability to repay their loan, which is something they take into consideration.

Why did my credit score drop when I paid off collections

This is because your total available credit is lowered when you close a line of credit, which could result in a higher credit utilization ratio. Additionally, if the account you closed was your oldest line of credit, it could negatively impact the length of your credit history and cause a drop in your scores.

Do collections go away once paid

How long will collections stay on your credit report Like other adverse information, collections will remain on your credit report for 7 years. A paid collection account will remain on your credit report for 7 years as well.

How do I delete a paid collection

A goodwill deletion is the only way to remove a legitimate paid collection from a credit report. This strategy involves you writing a letter to your lender. In the letter, you need to explain your circumstances and why you would like the record of the paid collection to be removed from your credit report.

Do collections get removed once paid

Once you've paid off an account in collections, it will eventually fall off your credit report. If you'd like to expedite the process, you can request a goodwill removal. Removing a paid collection account is up to the discretion of your original creditor, who doesn't have to agree to your request.

What happens after I pay off a collection

Paying won't take a collections account off your credit reports. Many people believe paying off an account in collections will remove the negative mark from their credit reports. This isn't true; if you pay an account in collections in full, it will show up on your credit reports as “paid,” but it won't disappear.

Can I buy a house after paying off collections

A common question we hear is, "Can I buy a home if I have collections on my credit report" Fortunately, the answer is yes.

What is the collection limit for FHA loans

FHA Guidelines on Non-Medical Collections

FHA guidelines stipulate that you do not have to pay any non-medical collections that are on your credit report if their combined total is less than $2,000. However, those collections may count towards your debt to income ratio.

How long after paying off collections can you buy a house

Charged-off debt is not forgiven and will show up on your credit report for seven years. Lenders may also sell charge-offs to collection agencies who may try to collect the debt until the statute of limitations runs out in your state.

What happens when you pay off collections

Paying or settling collections will end the harassing phone calls and collection letters, and it will prevent the debt collector from suing you. The debt collector will then update your credit reports to show the collection account now has a zero balance.