Do lenders look at payment history?

Can lenders see your payment history

Lenders need to see you are a responsible borrower, so they might look at how long you've been at your job, debt repayment history and other credentials.

Cached

Why do lenders care about payment history

That's because your payment history is an important factor used to calculate your credit scores. Lenders and creditors use your credit score to help determine your creditworthiness and make decisions about offering you things like credit cards, auto loans and mortgages.

Cached

How far back do mortgage lenders look at payment history

6 years

Most mortgage lenders will look as far back as 6 years when assessing your creditworthiness. This is because any adverse information stays on your credit report for 6 years.

What do lenders see when they check your credit

Lenders report on each account you have established with them. They report the type of account (credit card, auto loan, mortgage, etc.), the date you opened the account, your credit limit or loan amount, the account balance and your payment history, including whether or not you have made your payments on time.

Who can see your payment history

Many of the organizations you owe money to can report your payment history to one or more of the three main credit bureaus. Lenders who report the information include personal loan lenders, auto loan lenders, credit card companies, mortgage lenders and stores where you have a credit card or have financed purchases.

Do lenders watch your bank account

The underwriter will review your bank statements, look for unusual deposits, and see how long the money has been in there. The industry term for this underwriting guideline is the “Source and Seasoning” of your funds being used to close.

Is 100 percent payment history good

There is a very slim margin allowing for late payments before your credit score starts to suffer: 100% – Great. 99% – Good.

How do I fix bad payment history

To get an incorrect late payment removed from your credit report, you need to file a dispute with the credit bureau that issued the report containing the error. Setting up automatic payments and regularly monitoring your credit can help you avoid late payments and spot any that were inaccurately reported.

Do mortgage lenders look at spending habits

They will look at things like how much you spend on credit cards, how much you spend on groceries, and how much you spend on entertainment. Mortgage lenders want to see that you are living within your means and that you are not spending more than you can afford.

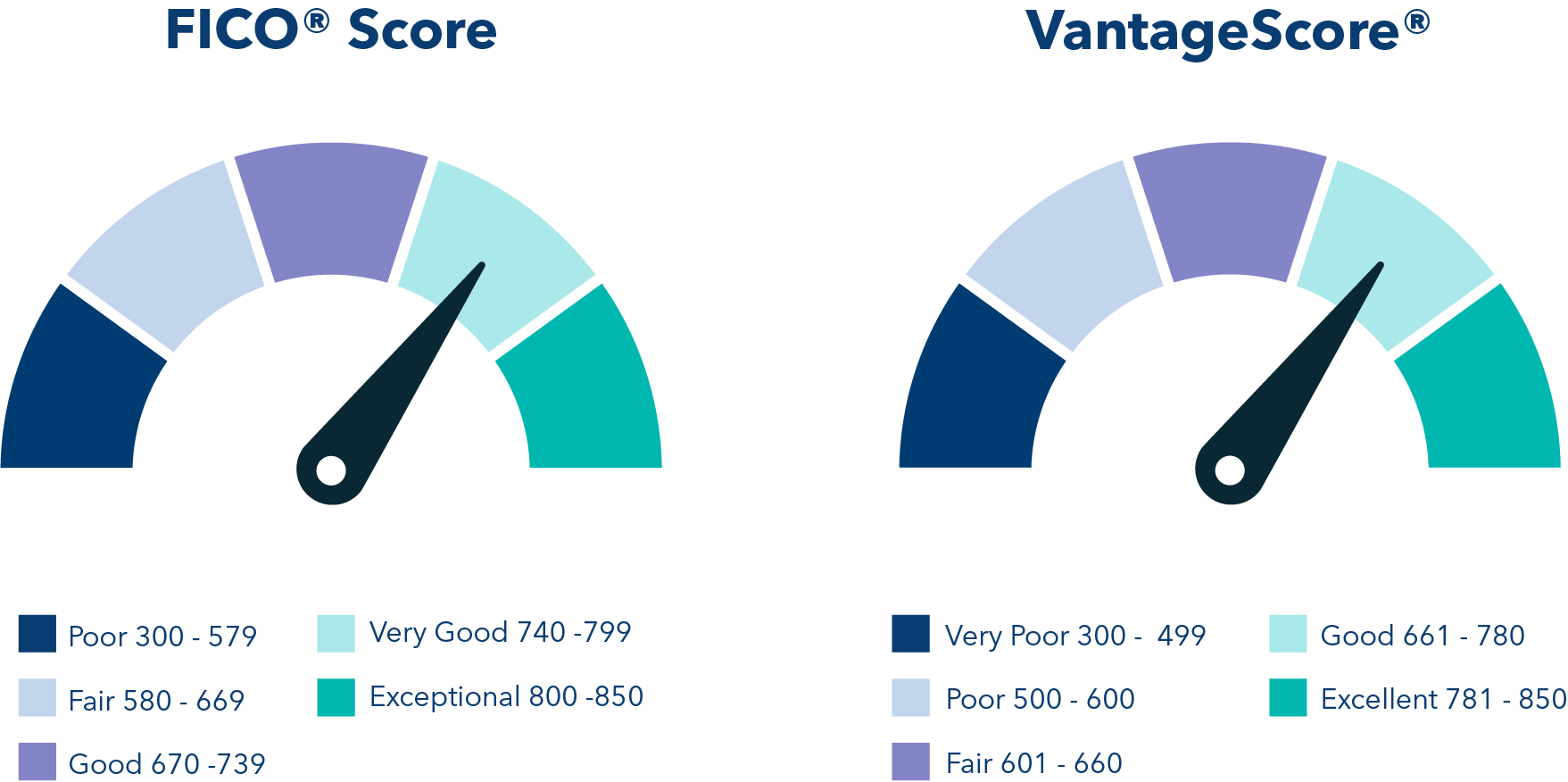

Can I buy a house with 661 credit score

Can I get a mortgage with an 661 credit score Yes, your 661 credit score can qualify you for a mortgage. And you have a couple of main options. With a credit score of 580 or higher, you can qualify for an FHA loan to buy a home with a down payment of just 3.5%.

Can lenders see how much debt you have

Too Much Debt: A lender may tally up your monthly debt obligations, per your credit report, and compare that total with your income. This comparison is known as your debt-to-income (DTI) ratio.

Do lenders look at total debt

Lenders will use your monthly debt totals when calculating your debt-to-income (DTI) ratio, a key figure that determines not only whether you qualify for a mortgage but how large that loan can be. This ratio measures how much of your gross monthly income is eaten up by your monthly debts.

How long does payment history stay on credit report

approximately seven years

Generally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, accounts not being paid as agreed, or bankruptcies stays on credit reports for approximately seven years.

Can creditors see my bank transactions

Can debt collectors see your bank account balance A judgment creditor cannot see your online account balances. But a creditor can ascertain account balances using post-judgment discovery. The judgment creditor can subpoena a bank for bank statements or other records which reveal a typical balance in the account.

How much money do lenders want to see in your account

Each lender has its own standards for how much you should have in savings, but they'll often want to see at least a few months' worth of payments in your account. They'll also want to see that you have assets sufficient for the down payment and closing costs without help.

Do mortgage lenders look at your spending

They will look at things like how much you spend on credit cards, how much you spend on groceries, and how much you spend on entertainment. Mortgage lenders want to see that you are living within your means and that you are not spending more than you can afford.

What has biggest impact on credit score

Payment History

1. Payment History: 35% Your payment history carries the most weight in factors that affect your credit score, because it reveals whether you have a history of repaying funds that are loaned to you. This component of your score considers the following factors:3.

How much does payment history make up credit score

35%

The five pieces of your credit score

Your payment history accounts for 35% of your score. This shows whether you make payments on time, how often you miss payments, how many days past the due date you pay your bills, and how recently payments have been missed.

Is a 96 percent payment history bad

98% – Fair. 97% – Poor. <97% – Very Poor.

Can you remove bad payment history from credit report

To get an incorrect late payment removed from your credit report, you need to file a dispute with the credit bureau that issued the report containing the error. Setting up automatic payments and regularly monitoring your credit can help you avoid late payments and spot any that were inaccurately reported.