Do medical bills hurt your credit 2023?

Will medical debt affect credit score 2023

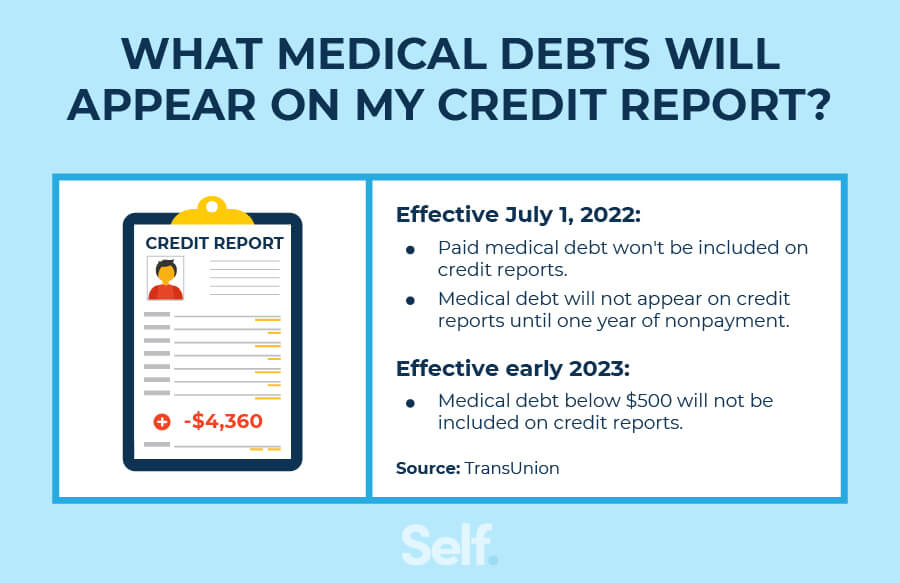

This last step went into effect on April 11, 2023, and with this change, it's estimated that roughly half of those with medical debt on their reports will have it removed from their credit history.

Cached

What is the new credit law in 2023

March 30, 2023: Reporting of Medical Debt

Reporting of Medical Debt: The three major credit bureaus (Equifax, Transunion, and Experian) will institute a new policy by March 30, 2023, to no longer include medical debt under a dollar threshold (the threshold will be at least $500) on credit reports.

Cached

Can your credit be ruined by medical bills

A medical bill by itself will not affect your credit. Unpaid medical bills may be sent to debt collectors, at which point they may show up on your credit reports and hurt your score. A low credit score could mean a higher mortgage rate or prevent you from qualifying for a mortgage.

Cached

Is medical debt being wiped off credit reports

On Tuesday, the three major credit bureaus — Equifax, Experian, and TransUnion — announced that medical collections with balances of $500 or less would no longer appear on consumer credit reports.

Cached

How to get out of debt in 2023

5 Steps to Get Out of Debt in 2023Build a better budget. If you don't have a budget, now is the time to create one—and if you do have a budget already in place, make some tweaks and hold force yourself to follow it.Pay down credit cards.Save your money.Make an appointment with a credit counselor.Educate yourself.

Will medical debt be forgiven

It's unlikely you'll get your medical debt forgiven, but there are ways to get some financial relief for those who qualify. Consider hospital forgiveness programs, assistance from specialized organizations and government assistance programs.

Does credit matter in 2023

Prices for FICO-issued mortgage credit scores for most in the lending industry will be increasing by 400% in 2023 — but the costs aren't rising as much for a small select group.

What is the highest credit score possible 2023

850

The perfect credit score number is 850. The highest FICO credit score you can have is 850, and the highest possible VantageScore is 850, too. That said, anything over 800 is basically perfect.

What bills affect your credit score

Only those monthly payments that are reported to the three national credit bureaus (Equifax, Experian and TransUnion) can do that. Typically, your car, mortgage and credit card payments count toward your credit score, while bills that charge you for a service or utility typically don't.

How long does medical debt affect credit score

seven years

Unpaid medical debt can stay on your credit report for seven years from the original delinquency date.

Is it better to pay off debt or save 2023

Paying Down Debt Is Likely the Better Choice

And if you're investing the money you could use to pay down debt into a CD, money market account or high-yield savings, the amount of interest you're charged on your credit card or other debt will almost certainly mitigate any returns you manage to accrue from your deposits.

How to get out of $25,000 debt

5 options to pay off debtConsider the debt snowball approach.Tackle high-interest debt first with the debt avalanche approach.Start a side hustle to throw more money at your debt.Do a balance transfer.Take out a personal loan.

Can medical bills be removed from credit report due to Hipaa

Answer: No. The Privacy Rule's definition of “payment” includes disclosures to consumer reporting agencies. These disclosures, however, are limited to the following protected health information about the individual: name and address; date of birth; social security number; payment history; and account number.

Does FHA require medical collections to be paid off

The FHA does not require collections to be paid off entirely in order for a borrower to be approved. However, they do recognize that collections can impact a borrower's ability to repay their loan, which is something they take into consideration.

What is a great credit score in 2023

According to FICO, a good credit score is 670-739 or above, while a very good credit score is 740-799. A credit score that is 800 or above is considered exceptional.

How rare is a 750 credit score

Your credit score helps lenders decide if you qualify for products like credit cards and loans, and your interest rate. You are one of the 46% of Americans who had a score of 750 or above in 2023, according to credit scoring company FICO. Here's how your 750 credit score can affect your financial life.

Can you build a 700 credit score in 3 months

The time it takes to increase a credit score from 500 to 700 might range from a few months to a few years. Your credit score will increase based on your spending pattern and repayment history. If you do not have a credit card yet, you have a chance to build your credit score.

What are 3 items not included in a credit score

Your credit report does not include your marital status, medical information, buying habits or transactional data, income, bank account balances, criminal records or level of education.

What brings up your credit score the most

One of the best things you can do to improve your credit score is to pay your debts on time and in full whenever possible. Payment history makes up a significant chunk of your credit score, so it's important to avoid late payments.

How much does a medical collection drop your credit score

Most healthcare providers do not report to the three nationwide credit bureaus (Equifax, Experian and TransUnion), which means most medical debt billed directly by physicians, hospitals or other healthcare providers is not typically included on credit reports and does not generally factor into credit scores.