Do mobile checks deposit instantly?

Are mobile check deposits available immediately

So how long does a mobile deposit take Mobile deposits can clear in just a few minutes, but it's best to expect about one business day. And by following a couple of quick checkpoints, you can avoid any hitches that could cause a delay.

How long does it take for a mobile deposit check to go through

When you deposit a check using your mobile banking app (assuming you do so before the bank's cut-off time), your check is considered deposited as if you'd made the deposit at the bank branch, and your money should be available in the normal one to two business days.

What checks clear instantly

Cashier's and government checks, along with checks drawn on the same financial institution that holds your account, usually clear faster, in one business day.

What happens after you mobile deposit a check

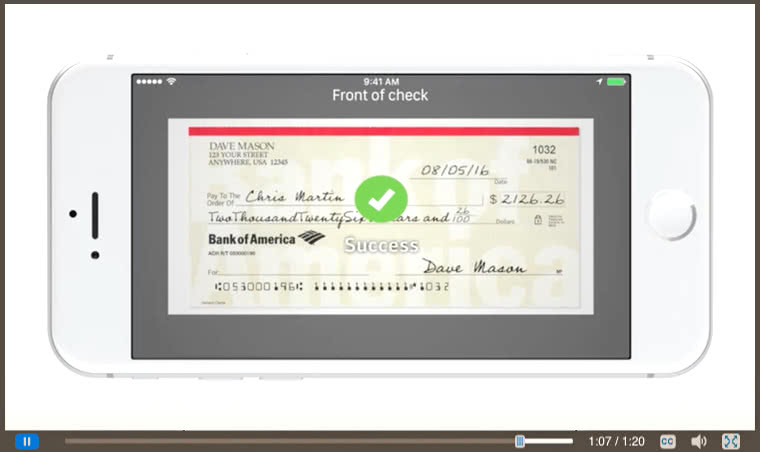

When using the mobile app to Make a Deposit, you will receive confirmation if the check deposit completed successfully. It's a good idea to keep your check for 30 days or until you are sure that the full amount has posted to your account.

What time of day does mobile deposit hit

Are there deposit cutoff times

| Deposits made | Funds are typically available |

|---|---|

| Before 9 pm Pacific Time business days | On the next day after your deposit |

| After 9 pm Pacific Time business days | On the day after the deposit credit date |

| Non-business days | On the day after the deposit credit date |

Is depositing a check in person faster

The Type of Check Matters

How fast you can access the cash, in this case, depends on what kind of deposit you make. Deposits made in person to bank employees work best if you need the funds quickly. You can also deposit it at an ATM or use your mobile device, but those methods might have longer bank hold times.

How do I get a check instantly deposited

Try Visiting the Check-Writer's Bank

The safest and fastest way to get cash is to take your check to the check writer's bank. That's the bank or credit union that holds the check writer's funds, and you can get the money out of the check writer's account and into your hands instantly at that bank.

Will a check clear with insufficient funds

Generally, a bank may attempt to deposit the check two or three times when there are insufficient funds in your account. However, there are no laws that determine how many times a check may be resubmitted, and there is no guarantee that the check will be resubmitted at all.

Is it faster to deposit a check in person or online

And if you bank with an online-only bank with no physical branches, mobile check deposit is generally faster than mailing in a check. Mobile check deposit can also be easy to use. That's because the mobile check deposit feature within apps generally offers a user-friendly experience, even for low-tech customers.

What time of day do checks clear

In general, you can expect most checks to clear the day after you deposit them, as long as you make the deposit on a business day and during bank business hours. So if you make a deposit at 1:00 p.m. on a Tuesday, for example, the check should clear by Wednesday.

Is it faster to deposit a check mobile or ATM

It Can Take Longer for Funds to Hit Your Account

When you deposit a check from your mobile device, it may take a little longer for your funds to become available based on what time of day the deposit was made.

Is mobile deposit faster than teller

Speed. Mobile phone banking generally affords you quick access to your funds than ATMs. Why Because with ATM deposits, a banker may have to retrieve checks from the machine, then manually digitize them.

Do ATMS instantly deposit checks

No. There is no requirement to make funds from a check immediately available for withdrawal.

Are bank checks available immediately

Federal regulations require banks to make funds deposited in an account by cashier's, certified, or teller's checks available for withdrawal not later than the business day after the banking day on which the deposit takes place, the same as for cash deposits, but only if certain conditions are met.

Will a fake check clear

Your check may clear within one or two days, and you can withdraw the check amount, but that doesn't mean the check is necessarily legitimate. The bank may not find an issue with the check until the other bank returns it unpaid.

How long does it take for a fake check to bounce

It may take a bank weeks to discover that the deposited check was fraudulent! The bottom line is that, while the funds may be available in your account within days of your deposit, the check may take weeks to clear or bounce.

Do checks clear faster at ATM or teller

Does it take longer before I can withdraw money if I deposit a check using an ATM instead of inside the bank/credit union Probably. If you deposit a check at an ATM instead of inside a bank or credit union, your bank or credit union has more time under the law to make the funds available.

Can a check bounce after it clears

Technically, once a check clears it can't be reversed, meaning the payer cannot get the funds back. The only exception to this is if the check payer can prove that identity theft or fraud has occurred, in which case they may get their money back.

How can you tell if a check has cleared

How Do I Know If a Check Has Cleared You can call your bank to see if a check has cleared. They'll be able to tell you your available balance and if there are any existing holds.

Do checks deposited at ATMs clear instantly

If you make a check deposit at an ATM at your bank, you can withdraw or use the full amount on the second business day. Your bank or credit union has a cut-off time for what it considers the end of the business day.