Do mortgage lenders look at hard inquiries?

Will a hard inquiry affect my mortgage approval

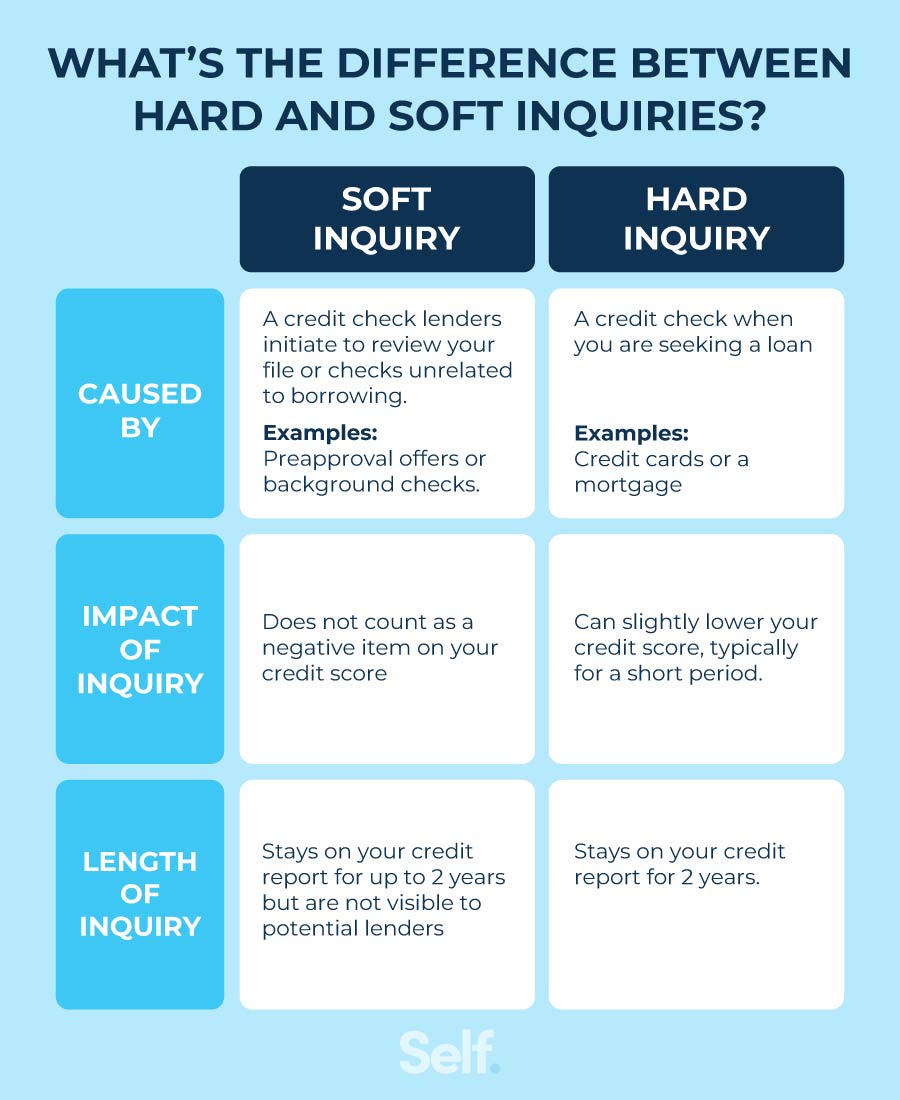

Your credit score might take an initial hit when you apply for a mortgage because the lender will have to open up a hard inquiry into your credit report. A hard inquiry (a.k.a., a “hard pull”) is when a lender pulls your credit report from one of the three main credit bureaus (Experian, Equifax or TransUnion).

How many inquiries is too many for a mortgage

There's no such thing as “too many” hard credit inquiries, but multiple applications for new credit accounts within a short time frame could point to a risky borrower. Rate shopping for a particular loan, however, may be treated as a single inquiry and have minimal impact on your creditworthiness.

Cached

Do hard inquiries matter when buying a house

Here's why comparing rates can lower your credit score: Each time you apply for a home loan, a mortgage lender does an in-depth review of your credit report. This action is referred to as a hard inquiry, and it can impact your score. Read: Best FHA Loans.

Cached

Do mortgage lenders do hard inquiries

Hard inquiries are common when you apply for a mortgage, auto loan loan, personal loan, student loan, or a credit card. Soft inquiries occur when a person or entity checks your credit as part of a background check. Unlike hard inquiries, soft inquiries will not negatively affect your credit scores.

Cached

Do lenders do a hard pull before closing

The answer is yes. Lenders pull borrowers' credit at the beginning of the approval process, and then again just prior to closing.

How many points is a hard inquiry for mortgage

3-5 points

The effect of a mortgage inquiry on your credit score is small. Here's why: Your FICO® Score is typically used (credit scores rank from 300-850) with a mortgage credit inquiry estimated to lower your credit score a mere 3-5 points.

How do I get rid of hard inquiries on my mortgage

If you find an unauthorized or inaccurate hard inquiry, you can file a dispute letter and request that the bureau remove it from your report. The consumer credit bureaus must investigate dispute requests unless they determine your dispute is frivolous.

How far back do mortgage lenders look at credit inquiries

The typical timeframe is the last six years. Your credit history is one of the many factors that can affect your ability to get approved for a mortgage and a lender can pull up one of your credit reports to see financial information about you, within minutes.

Can I be denied a mortgage after being pre approved

Getting pre-approved for a loan only means that you meet the lender's basic requirements at a specific moment in time. Circumstances can change, and it is possible to be denied for a mortgage after pre-approval. If this happens, do not despair.

How many hard inquiries are bad for financing

In general, six or more hard inquiries are often seen as too many. Based on the data, this number corresponds to being eight times more likely than average to declare bankruptcy. This heightened credit risk can damage a person's credit options and lower one's credit score.

Will lender pull credit before closing

The answer is yes. Lenders pull borrowers' credit at the beginning of the approval process, and then again just prior to closing.

Do they run your credit the day of closing

The answer is yes. Lenders pull borrowers' credit at the beginning of the approval process, and then again just prior to closing.

How many days before closing is credit checked

Lenders will typically pull your credit within seven days before closing. However, most lenders will only check with a “soft credit inquiry,” so your credit score won't be affected.

Can a mortgage lender do a soft pull

To prequalify you for a loan, lenders check your credit report, but conduct a “soft” inquiry, or soft pull, in which they prescreen your report without it affecting your score. A “hard” credit inquiry, in contrast — which happens when you get preapproved or formally apply for a loan — can adversely impact your score.

How many points does credit score drop with hard inquiry for mortgage

five points

How does a hard inquiry affect credit While a hard inquiry does impact your credit scores, it typically only causes them to drop by about five points, according to credit-scoring company FICO®.

How much of a loan can I get with a 650 credit score

You can borrow as much as $40,000 – $100,000+ with a 650 credit score. The exact amount of money you will get depends on other factors besides your credit score, such as your income, your employment status, the type of loan you get, and even the lender.

What would stop you from getting pre-approved for a mortgage

Too High of a Debt to Income Ratio

Most lenders want a debt to income ratio of 36% for all of your debt, and 28% for your housing. If lenders look at how much you're making and you don't fit in those numbers, and you don't have enough for a mortgage payment, it's possible that you not be pre-approved for a mortgage.

What can mess up a pre-approval

So here are the six biggest mistakes to avoid once you have been pre-approved for a mortgage:Late payments. Be sure that you remain current on any monthly bills.Applying for new lines of credit.Making large purchases.Paying off and closing credit cards.Co-signing loans for others.Changing jobs.

How do you get rid of hard inquiries fast

The only way to get hard inquiries removed from your credit report in a single day is to dispute them as errors.

Is having 10 inquiries bad

However, multiple hard inquiries can deplete your score by as much as 10 points each time they happen. People with six or more recent hard inquiries are eight times as likely to file for bankruptcy than those with none. That's way more inquiries than most of us need to find a good deal on a car loan or credit card.