Do mortgage lenders look at soft inquiries?

Do mortgage lenders see soft credit pulls

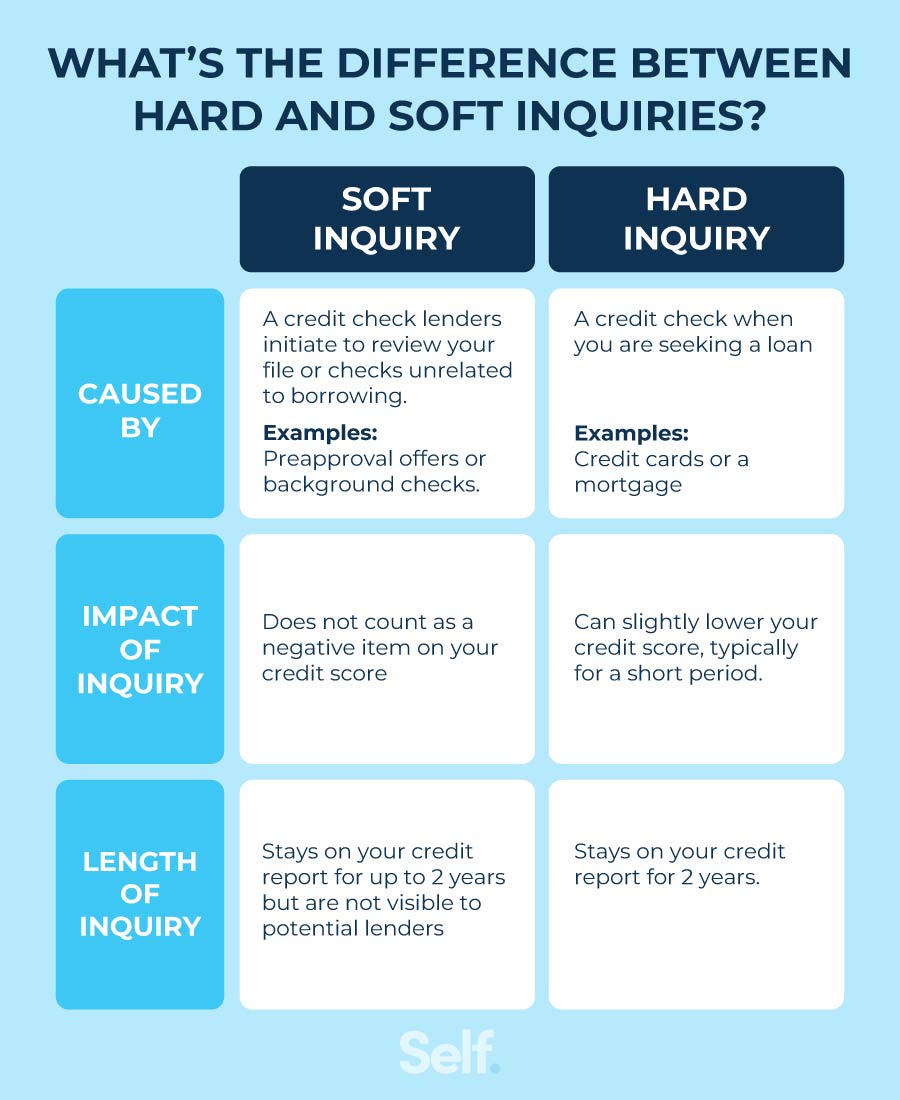

If a lender checks your credit report, soft credit inquiries won't show up at all. Soft inquiries are only visible on consumer disclosures—credit reports that you request personally. The following types of credit checks are examples of soft inquiries.

Cached

Do soft inquiries affect approval

Soft inquiries do not affect credit scores and are not visible to potential lenders that may review your credit reports. They are visible to you and will stay on your credit reports for 12 to 24 months, depending on the type. The other type of inquiry is a “hard” inquiry.

What is a soft credit pull before closing on house

Soft Credit Inquiry

This type of credit check is normally conducted by a mortgage broker to prequalify potential buyers before sending them to a lender. Soft inquiries only provide surface-level details, such as estimated credit score, address confirmation, open credit lines, and flags with no details.

Can banks see soft pulls

Credit card companies can also pull a soft copy of your credit to service and manage any existing relationships you may have with them. Soft checks do not affect your credit score or show up on your credit report.

How many soft inquiries is too many

Soft inquiries don't drop your credit score, so there isn't a number that could be considered too much.

Do soft inquiries count

Unlike hard inquiries, soft inquiries won't affect your credit scores. (They may or may not be recorded in your credit reports, depending on the credit bureau.) Since soft inquiries aren't connected to a specific application for new credit, they're only visible to you when you view your credit reports.

Does a soft pull affect buying a house

Unlike a hard pull, a soft pull won't impact your credit score. Your mortgage lender wants to make sure that both credit reports match, and if they don't, you may need to provide additional documentation or send your loan application through underwriting a second time.

Do they run your credit the day of closing

The answer is yes. Lenders pull borrowers' credit at the beginning of the approval process, and then again just prior to closing.

What is a soft credit pull before closing

Soft Credit Inquiry

This type of credit check is normally conducted by a mortgage broker to prequalify potential buyers before sending them to a lender. Soft inquiries only provide surface-level details, such as estimated credit score, address confirmation, open credit lines, and flags with no details.

Do soft inquiries go away

Soft inquiries will only stay on your credit reports for 12-24 months. And remember: Soft inquiries won't affect your credit scores. Lenders may be concerned if you have too many hard inquiries on your credit report within a short period of time. However, there are some exceptions to this.

Are multiple soft inquiries bad

Soft inquiries have no effect on your credit score. Lenders can't even see how many soft inquiries have been made on your credit report.

Is too many soft inquiries bad

Soft inquiries have no effect on your credit score. Lenders can't even see how many soft inquiries have been made on your credit report.

Can you get a pre-approval from a soft pull

Essentially, the pitch is a soft credit inquiry does not impact your credit score and the lender will be able to pre-qualify you, or even PRE-APPROVE you without a hard credit inquiry, which is the kind that does MINIMAL impact to a credit score.

What is a soft inquiry before closing

Soft Credit Inquiry

This type of credit check is normally conducted by a mortgage broker to prequalify potential buyers before sending them to a lender. Soft inquiries only provide surface-level details, such as estimated credit score, address confirmation, open credit lines, and flags with no details.

How long before closing do they run your credit

Lenders typically do last-minute checks of their borrowers' financial information in the week before the loan closing date, including pulling a credit report and reverifying employment.

Do soft inquiries affect buying a house

Unlike a hard pull, a soft pull won't impact your credit score. Your mortgage lender wants to make sure that both credit reports match, and if they don't, you may need to provide additional documentation or send your loan application through underwriting a second time.

How accurate is a soft inquiry

To put it simply, a soft pull credit check is as accurate as a hard pull credit check. They are both very accurate.

Do soft inquiries do anything

Soft inquiries do not affect your credit score. Hard inquiries can lower your credit score, though it is one of the less influential credit score factors. The impact of hard inquiries on your credit score tends to lessen over time.

How many inquiries is too many for a mortgage

There's no such thing as “too many” hard credit inquiries, but multiple applications for new credit accounts within a short time frame could point to a risky borrower. Rate shopping for a particular loan, however, may be treated as a single inquiry and have minimal impact on your creditworthiness.

How do I get rid of soft inquiries

Request removal of erroneous inquiries

If you find an inquiry on your credit report that you don't recognize, contact the creditor or the credit bureau to request its removal. You'll need to provide proof that the inquiry was unauthorized or fraudulent.