Do multiple auto loan inquiries count as one?

How many inquiries is too many when buying a car

There's no such thing as “too many” hard credit inquiries, but multiple applications for new credit accounts within a short time frame could point to a risky borrower. Rate shopping for a particular loan, however, may be treated as a single inquiry and have minimal impact on your creditworthiness.

How do I get rid of multiple auto loan inquiries

How Do You Dispute (and Remove) Unauthorized InquiriesObtain free copies of your credit report.Flag any inaccurate hard inquiries.Contact the original lender.Start an official dispute.Include all essential information.Submit your dispute.Wait for a verdict.

Cached

Can you do multiple hard inquiries at once

A single hard inquiry will drop your score by no more than five points. Often no points are subtracted. However, multiple hard inquiries can deplete your score by as much as 10 points each time they happen.

Cached

Does having 2 car loans hurt your credit

Your debt load will also increase after financing a second car. Since your credit utilization rate accounts for 30 percent of your credit score, your score will likely go down.

Do car dealerships run your credit multiple times

Dealerships can, and will, check with multiple lenders to see what rates and terms they'll offer you. If your credit isn't great, multiple inquiries may be necessary to find you a loan. The good news is that multiple auto loan inquiries in a two-day span won't hurt your credit that much or for that long.

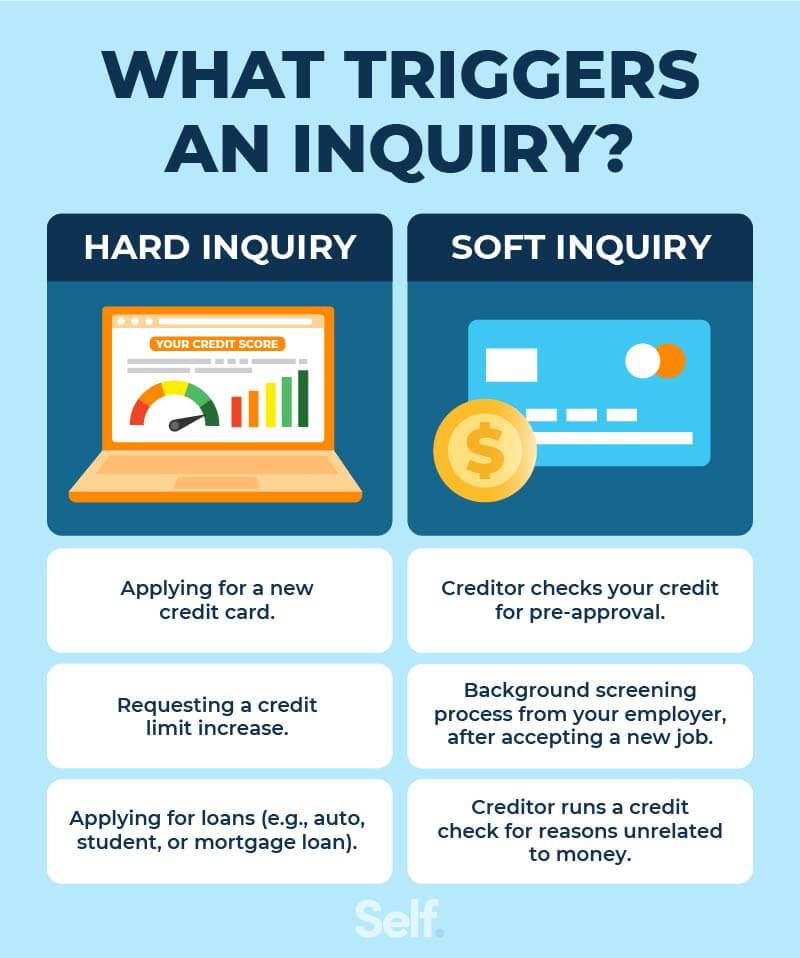

Do car dealerships do hard or soft inquiries

A dealership checking your credit score is a soft inquiry and won't affect your credit. Any hard credit check triggered by a loan application will appear on your credit report, shaving points from your credit score.

Can you get auto loan inquiries removed

If you find an unauthorized or inaccurate hard inquiry, you can file a dispute letter and request that the bureau remove it from your report. The consumer credit bureaus must investigate dispute requests unless they determine your dispute is frivolous.

Why do I have so many hard inquiries after buying a car

Dealerships can, and will, check with multiple lenders to see what rates and terms they'll offer you. If your credit isn't great, multiple inquiries may be necessary to find you a loan. The good news is that multiple auto loan inquiries in a two-day span won't hurt your credit that much or for that long.

How long should I wait before another hard inquiry

Bottom line. Generally, it's a good idea to wait about six months between credit card applications. Since applying for a new credit card will result in a slight reduction to your credit score, multiple inquiries could lead to a significantly decrease.

Can you dispute auto loan inquiries

If you find an unauthorized or inaccurate hard inquiry, you can file a dispute letter and request that the bureau remove it from your report. The consumer credit bureaus must investigate dispute requests unless they determine your dispute is frivolous.

How many car loans can you get at once

two car loans

You can have two car loans at once, and while no legal restrictions prevent you from doing so, getting approved for a second car loan can be challenging. Lenders will only approve you if your income, credit score, and debt-to-income can handle the added monthly expense.

Does your credit go down when a dealership checks it

A dealership checking your credit score is a soft inquiry and won't affect your credit. Any hard credit check triggered by a loan application will appear on your credit report, shaving points from your credit score.

How many points is a hard inquiry for auto loan

five points

A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant. As FICO explains: “For most people, one additional credit inquiry will take less than five points off their FICO Scores.”

How many points does a car loan inquiry affect credit score

five to 10 points

Does buying a car with a loan hurt your credit In short, slightly, but only temporarily, if you make timely payments. Remember, when you apply for an auto loan, a hard inquiry is performed on your credit that lowers your FICO score by five to 10 points.

Is 3 hard inquiries in a year bad

This heightened credit risk can damage a person's credit options and lower one's credit score. Hard inquiries are listed on your credit report for 24 months. However, they are used to determine a FICO score for only 12 months. Therefore, several hard credit inquiries within 12 months or less can impact your score.

How many inquiries is too many in 6 months

A hard inquiry occurs when a lender or creditor pulls your credit report to make a lending decision. Too many hard inquiries on your credit report can lower your credit score and suggest that you're a high-risk borrower. Generally, having more than six hard inquiries within a six-month period is considered too many.

How do I clear all loan inquiries

You can raise a dispute online with the credit agency on their website. Visit the 'dispute resolution' section and fill in the form with accurate details. Since the credit bureaus cannot make such changes on their own, they will verify the dispute with the financial institution.

Can a dealership run your credit multiple times

Dealerships can, and will, check with multiple lenders to see what rates and terms they'll offer you. If your credit isn't great, multiple inquiries may be necessary to find you a loan. The good news is that multiple auto loan inquiries in a two-day span won't hurt your credit that much or for that long.

Do hard inquiries affect getting a car loan

Hard inquiries CAN negatively affect your credit score. These kinds of inquiries are usually done when a lender or financial institution checks your credit report to make a lending decision. They happen for things like mortgages, car loans and credit card applications.

Can I apply for 2 car loans at the same time

The answer is a big yes! You can have two car loans at once, and while no legal restrictions prevent you from doing so, getting approved for a second car loan can be challenging. Lenders will only approve you if your income, credit score, and debt-to-income can handle the added monthly expense.