Do overdrafts hurt your credit rating?

Does paying overdraft help build credit

In fact, if you stay within your limit and pay back your overdraft regularly, it might even boost your credit score as lenders can see you're managing your money responsibly.

Is it OK to overdraft your account

How an Overdraft May Impact Your Credit. There is one instance in which an overdraft can hurt your credit: if it's sent to collections. If you pay the fees and negative balance after an overdraft, you'll be fine. But if you don't pay back what you owe, the financial institution can send that debt to collections.

Cached

Why is bank overdraft bad

Disadvantages of bank overdraft

The biggest disadvantage of the bank overdraft is that it is very expensive, as banks pay very well for providing this short-term credit. The longer an account is unbalanced – that is, in negative territory – the higher the interest payments.

Is a credit card or overdraft better for credit score

Is an overdraft or credit card better for your credit score Both will appear on your credit report. But neither will negatively affect your credit score as long as you use them sensibly and keep up with any necessary repayments.

Why is it good to have an overdraft

Advantages of an overdraft

An overdraft is flexible – you only borrow what you need at the time which may make it cheaper than a loan. It's quick to arrange. There is not normally a charge for paying off the overdraft earlier than expected.

What are the disadvantages of overdraft

Disadvantages of an overdraftInterest rates can be high, making it a costly way to borrow.Borrowing limits are much lower than with a loan.Your bank can reduce the limit or cancel your overdraft at any time.As there is no repayment term, it can be easy to stay in your overdraft permanently.

What happens if you overdraft too much

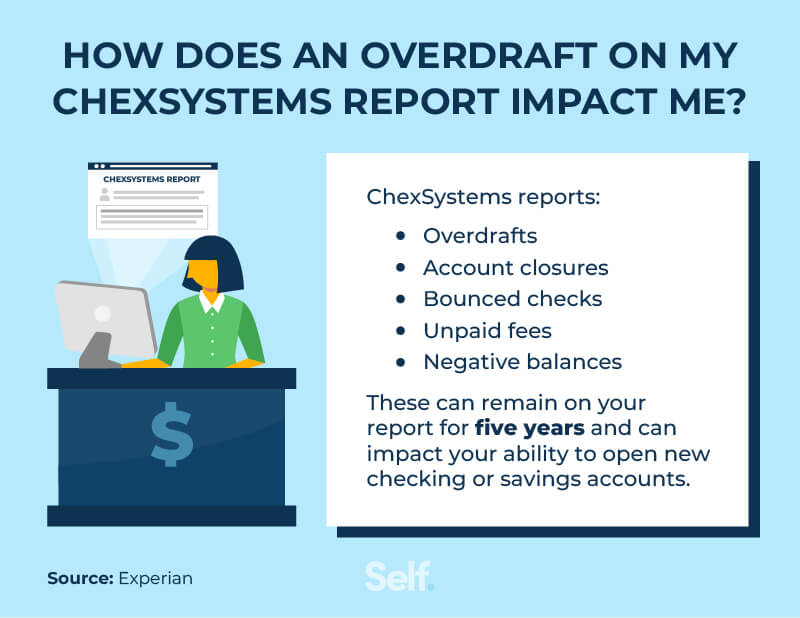

Your bank may close your account and send you to collections if you're always in overdraft and/or don't bring your account up to date. Monitoring your account closely and linking your checking account to a backup savings account can help you avoid overdraft fees.

Does overdraft affect anything

Overdrafts in checking are not reported on your credit report, because your checking account is not generally included in your credit report.

How many times can I overdraft my account

In extreme cases, you may even run into savings account fees: use overdraft protection more than 5 or 6 times in a month, and the bank may charge you a penalty for exceeding the federal limit on savings account withdrawals.

Is it better to have a loan or overdraft

In summary—overdrafts are good for short-term operating expenses and loans are better for longer term higher value purchases.

What are two disadvantages of an overdraft

However, there are also some drawbacks to using an overdraft. The fees can add up quickly, and if you regularly exceed your limit, it can damage your credit rating. Additionally, some banks may cancel your overdraft facility if you miss a payment on another product, such as a loan or credit card.

Is it OK to use your overdraft every month

Make sure you don't spend all your overdraft each month. Speak with your lender to make sure the amount you decide to pay is enough to get you out of your overdraft. You could consider transferring the balance to a credit card which has a lower, more affordable interest rate.

How many times can you overdraft

You can commonly expect banks to charge a maximum of 4 to 6 overdraft fees per day per account, though a few outliers do allow as many as 12 in one day.

How long can you have an overdraft

In most cases you have 5 business days or 7 calendar days to fix your balance before the extended overdraft fee takes your account even deeper into the red. Some banks charge this fee once every 5 days, while others go so far as to assess the fee every day until you bring your balance back above zero.

Does negative balance affect credit score

No, a negative balance does not affect a credit score. Most credit models consider negative balances equivalent to a $0 balance, which means negative balances don't hurt credit scores.

Can I overdraft $1,000 dollars

Your bank might offer you an overdraft line of credit that you can draw against. Say you have a checking account and the bank grants you a $1,000 overdraft limit. That means you can spend all the money in your account, plus up to $1,000 more before the bank will block any further transactions.

What is the benefit of overdraft

An overdraft loan gives you immediate access to extra funds when you don't have any left. Ideal for temporary financial issues, unexpected expenses or emergency costs, an overdraft gives you the comfort of knowing you will always have financial back-up.

How many times does a bank allow you to overdraft

Every bank and credit union has its own limit on the number of overdraft fees it will charge in one day. You can commonly expect banks to charge a maximum of 4 to 6 overdraft fees per day per account, though a few outliers do allow as many as 12 in one day.

How long can your account stay in overdraft

In most cases, banks will close a checking account after 60 days of being overdrawn.

Is it OK to have a negative balance

What happens if you have a negative balance Ultimately, nothing really happens if you have a negative credit card balance. It doesn't hurt you. But still, you want to check in on your account regularly to make sure you don't wind up with a negative balance.