Do paid closed accounts affect your credit score?

How long do paid closed accounts stay on credit

10 years

An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. This generally helps your credit score. Accounts with adverse information may stay on your credit report for up to seven years.

Cached

Is it good to pay closed accounts

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time.

Cached

Can you remove closed accounts from your credit report

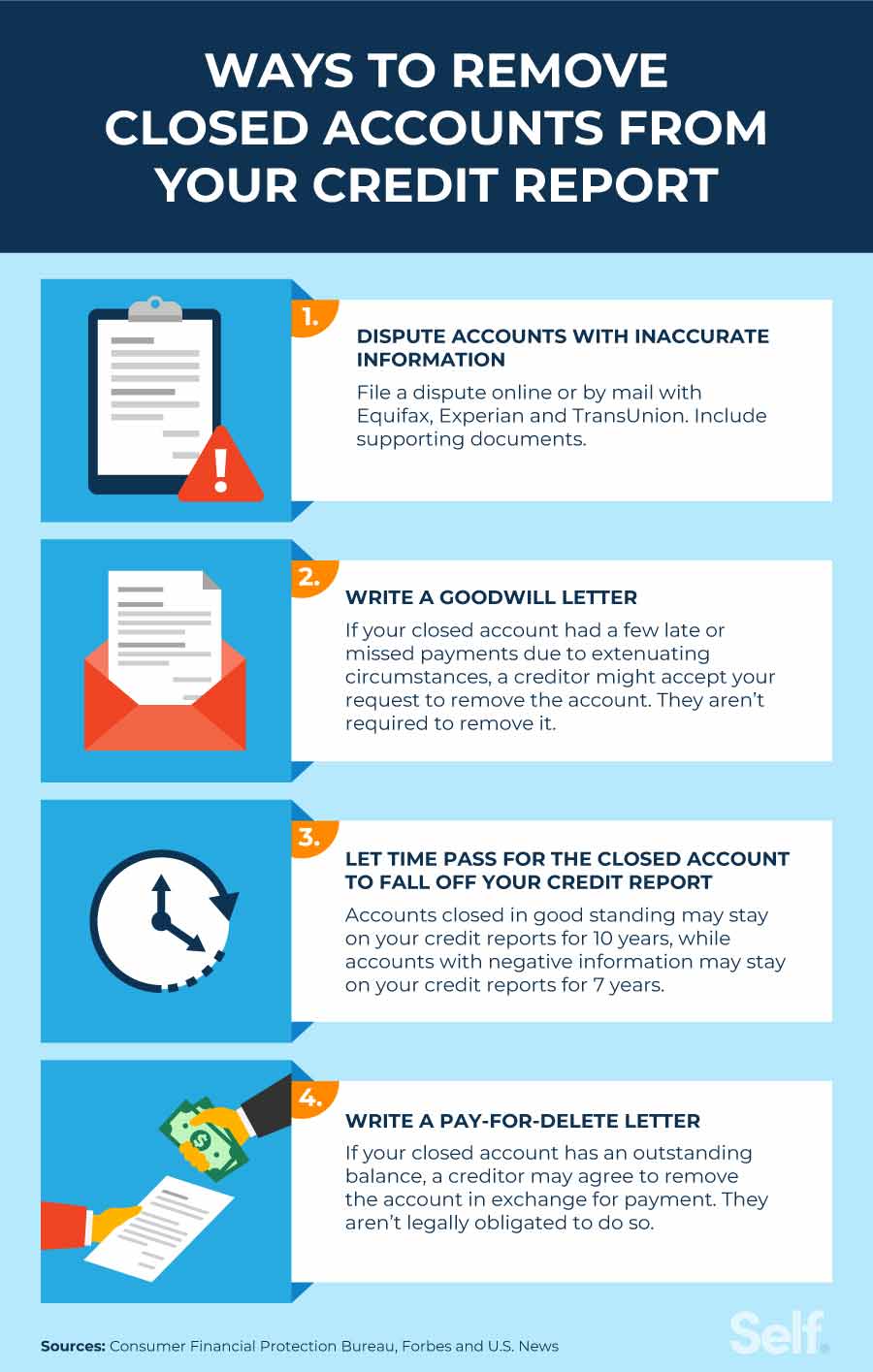

Closed accounts can be removed from your credit report in three main ways: (1) dispute any inaccuracies, (2) write a formal goodwill letter requesting removal or (3) simply wait for the closed accounts to be removed over time.

Cached

Why did my credit score drop when I paid off collections

This is because your total available credit is lowered when you close a line of credit, which could result in a higher credit utilization ratio. Additionally, if the account you closed was your oldest line of credit, it could negatively impact the length of your credit history and cause a drop in your scores.

What happens if I paid a closed account

In many cases when someone tries to send money to a closed account, the bank will simply return the funds to the sender or decline the transaction. It can take about five to 10 days for funds to be returned to the sender.

What happens if I pay off a closed account

If the account defaulted, it could be transferred to a collection agency. Paying off closed accounts like these should improve your credit score, but you might not see an increase right away.

How do I remove paid off closed accounts from my credit report

If you want a closed account removed from your credit report, you have a few options: disputing inaccuracies, waiting for it to fall off your report, requesting it by writing a goodwill letter, or writing a pay-for-delete letter.

Do closed accounts affect buying a house

In closing, for most applicants, a collection account does not prevent you from getting approved for a mortgage but you need to find the right lender and program.

Will collections be removed if paid off

Once you've paid off an account in collections, it will eventually fall off your credit report. If you'd like to expedite the process, you can request a goodwill removal. Removing a paid collection account is up to the discretion of your original creditor, who doesn't have to agree to your request.

Why didn t my credit score go up after paying off collections

With most of the current standard credit scoring models, paying a collection account off likely won't increase your credit score since the item will remain on your credit report. It will show up as “paid” instead of “unpaid,” which might positively influence a lender's opinion.

Does a closed account mean I still owe

Once your credit card is closed, you can no longer use that credit card, but you are still responsible for paying any balance you still owe to the creditor. In most situations, creditors will not reopen closed accounts.

Can a closed account still be charged

If you still have a balance when you close your account, you still must pay off the balance on schedule. The card issuer can still charge interest on the amount you owe.

Should I still pay off a closed credit card

What happens to your balance after you close a credit card When you close a credit card that has a balance, that balance doesn't just go away — you still have to pay it off. Keep in mind that interest will keep accruing, so it's a good idea to pay more than the minimum each billing period.

Should you pay off open or closed accounts first

For this reason, leaving your credit card accounts open after you pay them off is usually better for credit scores as their credit limit will continue to factor into your utilization ratio.

Should I pay off a 2 year old collection

Any action on your credit report can negatively impact your credit score, even paying back loans. If you have an outstanding loan that's a year or two old, it's better for your credit report to avoid paying it.

What happens if I pay off all my collections

In general, collections accounts stay on your credit report for up to seven years, even when they're paid off in full. That means that paid collections can continue to hurt your creditworthiness for that length of time. However, the impact of collection accounts on your score lessens with time.

How much will my credit score go up if I pay off a collection

With most of the current standard credit scoring models, paying a collection account off likely won't increase your credit score since the item will remain on your credit report. It will show up as “paid” instead of “unpaid,” which might positively influence a lender's opinion.

Is it better to pay off collections or closed accounts

Newer credit-scoring models from FICO® and VantageScore (like FICO Score 9 and VantageScore 3.0) ignore zero-balance collection accounts. So paying off a collections account could raise your scores with lenders that use these models.

How much will my credit score increase if I pay off collections

With most of the current standard credit scoring models, paying a collection account off likely won't increase your credit score since the item will remain on your credit report. It will show up as “paid” instead of “unpaid,” which might positively influence a lender's opinion.

What happens if I close a paid off credit card

Too many people immediately close a credit card after they've paid it off. True, this will prevent these people from building up credit card debt on those cards. But it also hurts their credit score. That's because closing a card will increase your credit utilization.