Do revenues increase on the debit side?

Is revenue increased by a debit or credit

Revenue. In a revenue account, an increase in debits will decrease the balance. This is because when revenue is earned, it is recorded as a debit in the bank account (or accounts receivable) and as a credit to the revenue account. An increase in credits will increase the balance in a revenue account.

Cached

What side does revenue increase on

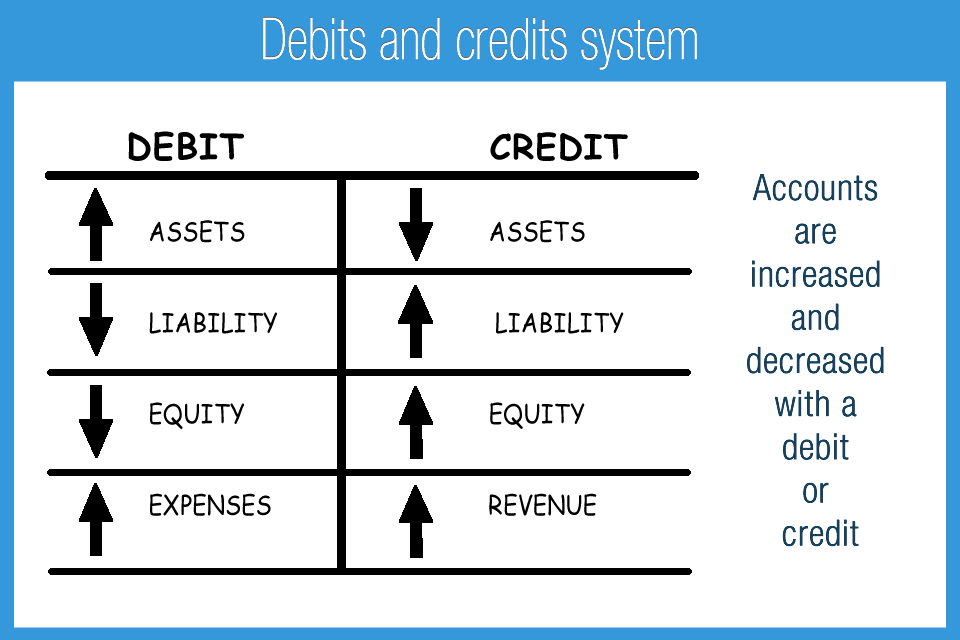

Debits (abbreviated Dr.) always go on the left side of the T, and credits (abbreviated Cr.) always go on the right. Accountants record increases in asset, expense, and owner's drawing accounts on the debit side, and they record increases in liability, revenue, and owner's capital accounts on the credit side.

CachedSimilar

Why is revenue increase on the credit side

In bookkeeping, revenues are credits because revenues cause owner's equity or stockholders' equity to increase. Recall that the accounting equation, Assets = Liabilities + Owner's Equity, must always be in balance.

What do you debit with revenue

Debit entries in revenue accounts refer to returns, discounts and allowances related to sales. In revenue types of accounts credits increase the balance and debits decrease the net revenue via the returns, discounts and allowance accounts.

Which of the following accounts increases with a debit

Debits increase asset and expense accounts.

Why does revenue increase

Revenue growth is affected by many factors, including market conditions, customer demand, pricing strategies, product/service offerings, and competition. Each of these factors can have a direct or indirect effect on a company's ability to generate revenue.

What accounts are increased by debits

A debit entry increases an asset or expense account. A debit also decreases a liability or equity account. Thus, a debit indicates money coming into an account. In terms of recordkeeping, debits are always recorded on the left side, as a positive number to reflect incoming money.

How does revenue increase

Revenue is the amount of money that a business brings in, including income from sales and any additional income from bank interest or investments. A company can increase its revenue by increasing sales, adding other sources of income and increasing the amount of money that each sale produces.

Is an increase in revenue is recorded with a debit True or false

Increases in revenue accounts are recorded as debits because they increase the owner's capital account. 25. The normal balance side of an accounts receivable account is a credit.

Do credits increase both revenues and expenses

Revenues are increased by credits and decreased by debits. Expenses are increased by debits and decreased by credits. Debits must always equal credits after recording a transaction.

Is a debit to revenue a decrease

To record revenue from the sale from goods or services, you would credit the revenue account. A credit to revenue increases the account, while a debit would decrease the account.

What is revenue credit or debit example

For example, a company sells $5,000 of consulting services to a customer on credit. One side of the entry is a debit to accounts receivable, which increases the asset side of the balance sheet. The other side of the entry is a credit to revenue, which increases the shareholders' equity side of the balance sheet.

In which account are debits increases and credits decreases

In asset accounts, a debit increases the balance and a credit decreases the balance. For liability accounts, debits decrease, and credits increase the balance. In equity accounts, a debit decreases the balance and a credit increases the balance.

Which of the following is true a debit increases

Debit entries will always increase assets and expense accounts, while credit entries will always increase revenue, liabilities, and shareholder equity accounts. This is true for all companies in all industries.

Does revenue increase or decrease

Effect of Revenue on the Balance Sheet

Generally, when a corporation earns revenue there is an increase in current assets (cash or accounts receivable) and an increase in the retained earnings component of stockholders' equity .

What causes revenue to decrease

Revenues decrease for any number of reasons. Manufacturing or delivery problems result in reduced product availability. Consumer tastes change and demand for your goods declines. Economic conditions force consumers to spend less on discretionary purchases.

Why is revenue credit and expense debit

Revenues have a normal balance of credit because this account is presented as part of the equity. On the other hand, expenses are recorded as debits because these are contra-revenue accounts.

Which accounts are increased by using debits quizlet

Liability accounts are increased by debits. The normal balance of the drawing account is a debit.

What increases and decreases revenue

A price increase will therefore increase total revenue while a price decrease will decrease total revenue. Finally, when the percentage change in quantity demanded is equal to the percentage change in price, demand is said to be unit elastic.

Is revenue a debit or credit on the balance sheet

credit

Revenues cause owner's equity to increase. Since the normal balance for owner's equity is a credit balance, revenues must be recorded as a credit.