Do sellers prefer FHA or conventional?

Why would a seller prefer a conventional loan over an FHA

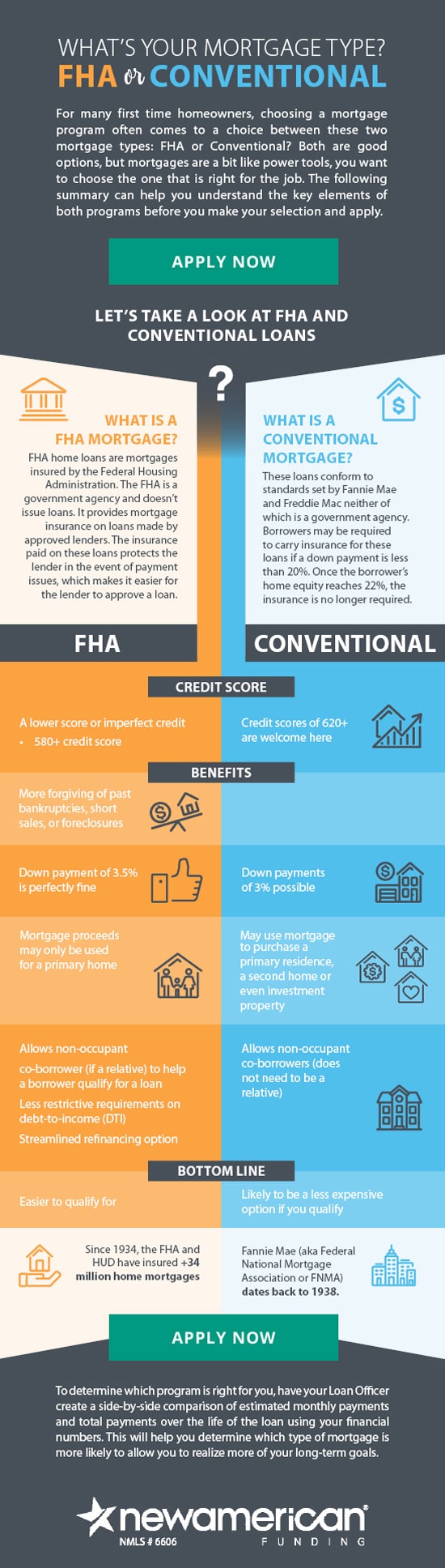

Sellers often prefer conventional buyers because of their own financial views. Because a conventional loan typically requires higher credit and more money down, sellers often deem these reasons as a lower risk to default and traits of a trustworthy buyer.

Cached

Is it better to sell to a FHA or conventional loan

"Conventional loans have higher minimum requirements than FHA and require a larger down payment," Yates said. "Sellers prefer a buyer with conventional financing over FHA financing because they feel the buyer is in a better financial position."

Cached

Why do sellers reject FHA loans

FHA Underwriting Worries Some Sellers

Because FHA loans help low- to moderate-income borrowers with less-than-stellar credit become homeowners, sellers may feel that FHA buyers are less likely to be approved for a loan than conventional borrowers.

Cached

What is the seller downside to FHA loan

The other major reason sellers don't like FHA loans is that the guidelines require appraisers to look for certain defects that could pose habitability concerns or health, safety, or security risks. If any defects are found, the seller must repair them prior to the sale.

Cached

Do sellers avoid FHA loans

The Bottom Line: Sellers Can Refuse FHA Loans And May Be Especially Inclined To Do So In A Seller's Market. Home buyers attempting to get FHA-backed loan offers accepted will probably have a harder time than conventional borrowers until the housing market swings into widespread buyer's market territory.

What is best loan to accept as seller

All sellers should indicate they are willing to accept “Cash” and a “Conventional Loan”. A conventional loan is the most common loan for buyers.

Are sellers less likely to accept FHA loans

According to the National Association of REALTORS® (NAR) 2023 Loan Type Survey, 89% of sellers would be likely to accept an offer from a buyer with conventional financing, but only 30% would be willing to accept an offer backed by the FHA or a U.S. Department of Veterans Affairs (VA) home loan.

How often do FHA loans get denied

How often are FHA loans denied in underwriting According to a 2023 report by the Consumer Financial Protection Bureau (CFPB), FHA borrowers are more likely to be denied for FHA loans than all other loan types: 14.1% of FHA purchase loans and 22.2% of FHA refinance applications were turned down in 2023.

Is it bad to accept an FHA offer

As a seller, you're usually not taking on additional risk by accepting an offer from a buyer pre-approved for an FHA loan than you would with a buyer pre-approved for a conventional loan. In fact, it's even possible for an FHA loan-backed offer to be the best offer in a multiple offer situation.

Which loan is better for the seller

For sellers, owner financing provides a faster way to close because buyers can skip the lengthy mortgage process. Another perk for sellers is that they may be able to sell the home as-is, which allows them to pocket more money from the sale.

Can I switch from FHA to conventional before closing

Yes, you can refinance out of an FHA loan as long as you qualify for a conventional loan with a credit score of 620 or higher and have 5% – 25% equity in your home. If you have 20% equity, you may also be able to remove your mortgage insurance and lower your monthly payment in the process.

Are mortgage payments higher with an FHA loan

FHA mortgage rates are often lower than rates for conventional mortgages. However, a lower interest rate does not always equate to a lower monthly payment. FHA mortgage insurance will increase your payments and the overall cost of the loan, even if the base rate is lower than for other loan types.

What is the safest payment method for sellers

What is the safest way to accept payment Besides cash, a certified check is the safest way you can receive a payment to your business.

Why do people prefer conventional loans

Conventional loans can require less paperwork and can be obtained more quickly than government-insured loans. Mortgage lenders can approve conventional loans without the typical delays incurred with FHA or government-backed loans.

Why do people prefer FHA loans

Federal Housing Administration (FHA) loans are guaranteed by the U.S. government and designed for homeowners who may have lower-than-average credit scores and lack the funds for a big down payment. They require a lower minimum down payment and a lower credit score than many conventional loans.

How often are FHA loans denied

How often are FHA loans denied in underwriting According to a 2023 report by the Consumer Financial Protection Bureau (CFPB), FHA borrowers are more likely to be denied for FHA loans than all other loan types: 14.1% of FHA purchase loans and 22.2% of FHA refinance applications were turned down in 2023.

How fast is a FHA loan approved

approximately 45 days

FHA loans take about the same amount of time to be processed as a conventional or VA loan, approximately 45 days. That includes the entire process, from the loan application to the final approval and closing.

Why do lenders prefer conventional loans

This type of loan uses lower interest rates and less strict credit score requirements. Conventional loans are not backed by a government agency and often use conforming loan limits.

Are FHA closing costs more than conventional

FHA loans tend to have higher closing costs than conventional loans, but because FHA loans allow the seller to pay for more of your closing costs than conventional loans, they may actually be cheaper.

Do FHA loans take longer to close than conventional

Some home buyers (and sellers) believe that the FHA approval and closing process takes a lot longer, due to governmental “red tape.” But that's not entirely true. For the most part, the FHA and conventional mortgage loan processes work the same way. So the timeline can be similar as well.