Do subscription payments affect credit score?

Do unpaid subscriptions affect credit score

Cable TV, phone, and other utility bills usually aren't reported to credit bureaus or reflected in your credit score. However, if you are seriously delinquent in paying your cable bill, that may show up on your credit report.

Does Apple subscription affect credit score

If you apply for Apple Card and your application is approved, there's no impact to your credit score until you accept your offer. If you accept your offer, a hard inquiry is made. This may impact your credit score.

What payments affect your credit score

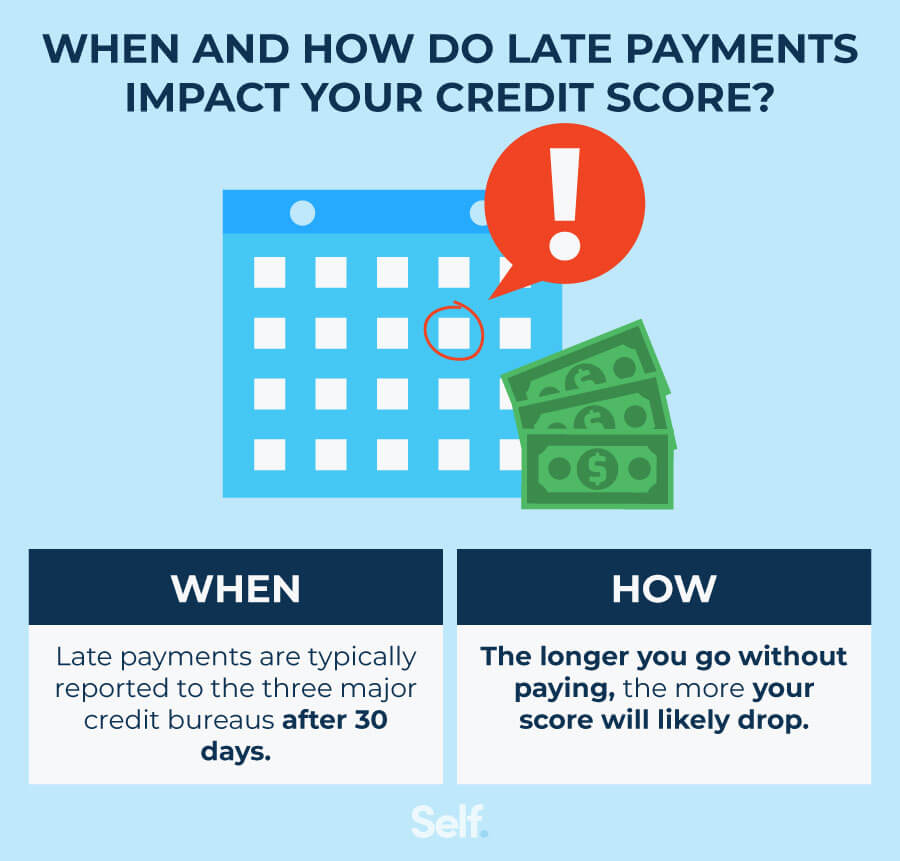

Only those monthly payments that are reported to the three national credit bureaus (Equifax, Experian and TransUnion) can do that. Typically, your car, mortgage and credit card payments count toward your credit score, while bills that charge you for a service or utility typically don't.

Cached

Does paying Netflix increase credit score

Accounts that can be added to your credit report with Experian Boost include utilities such as electricity and gas, telecom accounts such as cellphone and cable, and now Netflix®. You will need at least three months of payment history within the past six months for the account to be added to your credit report.

Do subscriptions count as debt

Mortgage and car payments, child support, student loans, and minimum credit card payments all fall under this category. Notable exceptions include bills that can be easily canceled, such as subscriptions.

Are subscriptions considered debt

Debts may include a mortgage, car loan, student loan and the minimum balance on a credit card. It does not include rent or monthly bills like utilities or subscriptions.

Do subscriptions count to credit

If you're careful with your spending habits and can make payments on time, monthly subscriptions can be a helpful way to build your credit score as they can be another way to show that you are responsible with your money and able to pay off your bills on time.

Why is my credit score going down when I pay on time

Why might my credit scores drop after paying off debts Paying off debt might lower your credit scores if removing the debt affects certain factors such as your credit mix, the length of your credit history or your credit utilization ratio.

Do monthly subscriptions build credit

If you're careful with your spending habits and can make payments on time, monthly subscriptions can be a helpful way to build your credit score as they can be another way to show that you are responsible with your money and able to pay off your bills on time.

What are 3 things that hurt your credit score

5 Things That May Hurt Your Credit ScoresHighlights:Making a late payment.Having a high debt to credit utilization ratio.Applying for a lot of credit at once.Closing a credit card account.Stopping your credit-related activities for an extended period.

Does Spotify boost credit score

It means regular debit payments over the last 12 months related to subscriptions to digital entertainment services can now contribute to credit scores and be factored into mortgage applications to the Society.

Is it good to put subscriptions on credit card

Use a credit card for any recurring payments.

Any recurring payments you have such as subscription services that renew every month or year like Netflix, Amazon Prime, or Spotify are good to put on your credit card, especially an older one that you no longer use as much.

Does Spotify affect credit score

Does Spotify affect credit scores Spotify credit card payments do not affect your credit score because they do not send reports about missed payments. The payment is prepaid, which means it is due by a certain date.

Is subscription income a credit

Your company earns the revenue with every subscription period that goes by. The overall deferred revenue amount can be considered a liability, marked as a credit.

Is subscriptions a debit or credit

In general, subscription transactions can be either debit or credit depending on the type of subscription and the payment method. When a business provides a subscription service, and the customer pays in advance, it is a credit transaction.

Is it better to put subscriptions on credit or debit

Use a credit card for any recurring payments.

Any recurring payments you have such as subscription services that renew every month or year like Netflix, Amazon Prime, or Spotify are good to put on your credit card, especially an older one that you no longer use as much.

Does Spotify affect your credit score

Does Spotify affect credit scores Spotify credit card payments do not affect your credit score because they do not send reports about missed payments.

Why did my credit score drop 40 points after paying off debt

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

Why did my credit score drop 80 points for no reason

Your credit score may have dropped by 80 points because negative information, like late payments, a collection account, a foreclosure or a repossession, was added to your credit report. Credit scores are based on the contents of your credit report and are adversely impacted by derogatory marks.

Is it better to pay annually or monthly for subscriptions

A monthly subscription tends to attract more customers than annual subscriptions. If the provider delivers a great service, these customers often recommend it to other people. The main disadvantage of a monthly model is the potential for a higher churn rate.