Do you build credit if you don’t use your card?

Will it hurt my credit score if I don’t use my credit card

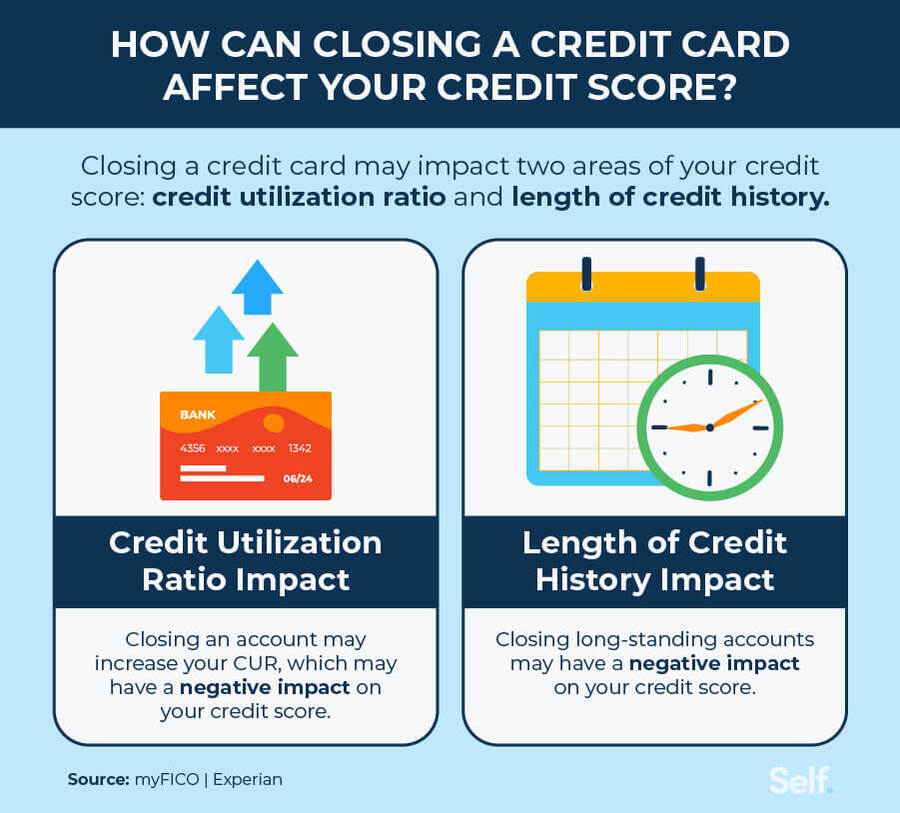

If you don't use your credit card, your card issuer can close or reduce your credit limit. Both actions have the potential to lower your credit score.

Cached

Is it bad to have a lot of credit cards and not use them

Yes. As long as you continue to make all your payments on time and are careful not to over-extend yourself, those open credit card accounts will likely have a positive impact on your credit scores.

What is the no 1 way to raise your credit score

One of the best things you can do to improve your credit score is to pay your debts on time and in full whenever possible. Payment history makes up a significant chunk of your credit score, so it's important to avoid late payments.

What builds your credit score

You can improve your credit score by opening accounts that report to the credit bureaus, maintaining low balances, paying your bills on time and limiting how often you apply for new accounts.

How to get 850 credit score fast

I achieved a perfect 850 credit score, says finance coach: How I got there in 5 stepsPay all your bills on time. One of the easiest ways to boost your credit is to simply never miss a payment.Avoid excessive credit inquiries.Minimize how much debt you carry.Have a long credit history.Have a good mix of credit.

How to build a 700 credit score

How To Get A 700 Credit ScoreLower Your Credit Utilization.Limit New Credit Applications.Diversify Your Credit Mix.Keep Old Credit Cards Open.Make On-Time Payments.

What builds credit the fastest

Paying bills on time and paying down balances on your credit cards are the most powerful steps you can take to raise your credit. Issuers report your payment behavior to the credit bureaus every 30 days, so positive steps can help your credit quickly.

What are 3 things that will raise your credit score

But here are some things to consider that can help almost anyone boost their credit score:Review your credit reports.Pay on time.Keep your credit utilization rate low.Limit applying for new accounts.Keep old accounts open.

Why is it so hard to get a 800 credit score

Since the length of your credit history accounts for 15% of your credit score, negative, minimal or no credit history can stop you from reaching an 800 credit score. To solve this problem, focus on building your credit. You can do this by taking out a credit-builder loan or applying for your first credit card.

How to get a 900 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How to get a 700 credit score in 30 days

Best Credit Cards for Bad Credit.Check Your Credit Reports and Credit Scores. The first step is to know what is being reported about you.Correct Mistakes in Your Credit Reports. Once you have your credit reports, read them carefully.Avoid Late Payments.Pay Down Debt.Add Positive Credit History.Keep Great Credit Habits.

How to build credit from $500

Ways to start rebuilding from a credit score of 500Pay your bills on time. Payment history is an important factor in calculating your credit scores.Maintain a low credit utilization ration.Consider a secured credit card.Look into credit counseling.

What is the quickest way to raise your credit score

Steps to Improve Your Credit ScoresBuild Your Credit File.Don't Miss Payments.Catch Up On Past-Due Accounts.Pay Down Revolving Account Balances.Limit How Often You Apply for New Accounts.

What can a 700 credit score do

A credit score of 700 can help you achieve some of your financial goals, such as buying a house, replacing your car, or even plans like remodeling your home. That's because you are more likely to qualify for loans that will help you achieve these goals than someone with a fair credit score or worse.

How long does it take to build a credit score of 700

The time it takes to increase a credit score from 500 to 700 might range from a few months to a few years. Your credit score will increase based on your spending pattern and repayment history. If you do not have a credit card yet, you have a chance to build your credit score.

How to get a 720 credit score in 30 days

Best Credit Cards for Bad Credit.Check Your Credit Reports and Credit Scores. The first step is to know what is being reported about you.Correct Mistakes in Your Credit Reports. Once you have your credit reports, read them carefully.Avoid Late Payments.Pay Down Debt.Add Positive Credit History.Keep Great Credit Habits.

How long does it take to go from 550 to 750 credit score

How Long Does It Take to Fix Credit The good news is that when your score is low, each positive change you make is likely to have a significant impact. For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use.

How long does it take to build credit from 500 to 750

Average Recovery Time

For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use. Once you've made it to the good credit zone (670-739), don't expect your credit to continue rising as steadily.

How long does it take to go from a 500 credit score to a 700

around 12 to 18 months

Average Recovery Time

For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use. Once you've made it to the good credit zone (670-739), don't expect your credit to continue rising as steadily.