Do you call to cancel a credit card?

Can you cancel a credit card over the phone

To cancel a credit card, you simply need to call the phone number on the back of your card and ask. But before you do that, know that canceling a credit card can affect your credit score, so it's not a decision to make lightly.

Cached

Can I immediately cancel my credit card

The bottom line

If you decide you don't want to hold on to a credit card after applying and being approved by the issuer, you can still cancel your account. Think a bit about the consequences before you cancel. If you do decide to cancel, make sure to get a written confirmation of the account closing.

Is it difficult to cancel a credit card

Canceling a credit card might seem like a simple process, but it's best to consider it carefully before you act. In some cases, canceling a card can hurt your credit. Read on for what to consider before you cancel a credit card and how to cancel in the most effective way.

Cached

What happens when you cancel a credit card

Here's what happens to your credit score when you cancel a credit card: Credit score drops: Your credit score often goes down because the average age of your open accounts decreases and your overall utilization increases (since you have less available credit).

What is the proper way to cancel a credit card

Call your credit card issuer to cancel and confirm that your balance on the account is $0. Mail a certified letter to your card issuer to cancel the account. In this letter, request that written confirmation of your $0 balance and closed account status be mailed to you.

Does canceling a credit card hurt your credit

Your entire history with a credit card stays on your credit report for up to seven years, even after you've canceled the card. So don't expect that closing a card in 2023 that you've missed payments on will improve your score.

How do I cancel my credit card officially

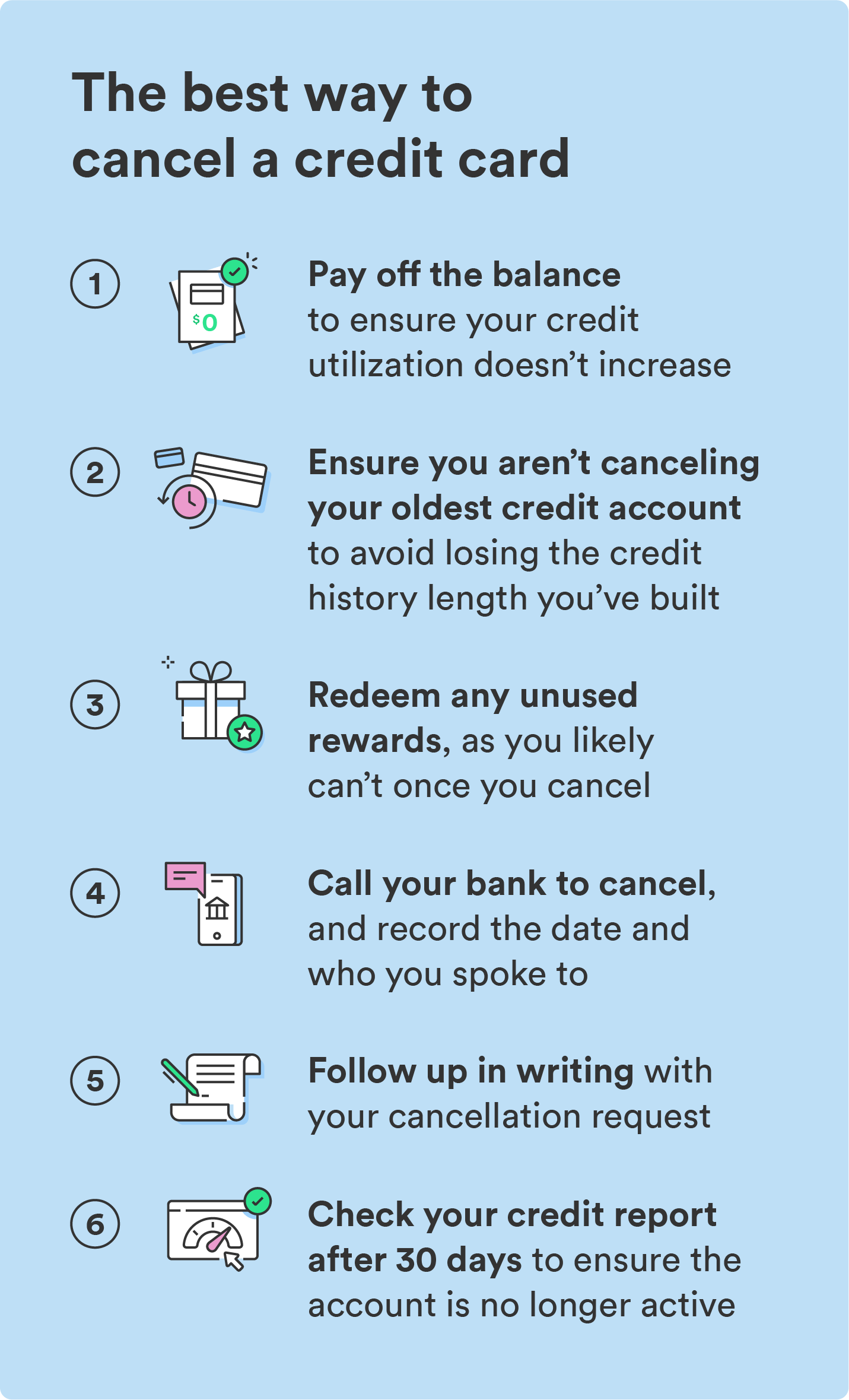

Below, CNBC Select explains the six steps you should follow if you want to cancel a credit card.Pay off any remaining balance.Redeem any rewards.Call your bank.Send a cancellation letter.Check your credit report.Destroy your old card.

Is it better to cancel a credit card or just cut it up

It is better to keep unused credit cards open than to cancel them because even unused credit cards with a $0 balance will still report positive information to the credit bureaus each month. It is especially worthwhile to keep an unused credit card open when the account does not have an annual fee.

Is it better to cancel a credit card or just stop using it

It is better to keep unused credit cards open than to cancel them because even unused credit cards with a $0 balance will still report positive information to the credit bureaus each month. It is especially worthwhile to keep an unused credit card open when the account does not have an annual fee.

Does closing a credit card affect your credit

Closing a credit card could lower the amount of overall credit you have versus the amount of credit you're using (your debt to credit utilization ratio), which could impact your credit scores.

Is it better to cancel unused credit cards or keep them

It is better to keep unused credit cards open than to cancel them because even unused credit cards with a $0 balance will still report positive information to the credit bureaus each month. It is especially worthwhile to keep an unused credit card open when the account does not have an annual fee.

How do I close my credit card account

In general, you should be able to close your account by calling the credit card company and following up with a written notice. If you still have a balance when you close your account, you are required to pay off any balance on schedule. The card company is allowed to charge interest on the amount you still owe.

How long does it take to close a credit card

Make sure to note that you want the account closed at your request, and keep a copy on file just in case. It can take a few weeks for your request to be processed, but if you haven't received a confirmation letter within a month, call your credit card issuer to follow up.

Does closing a credit card affect your credit score

Closing a credit card could lower the amount of overall credit you have versus the amount of credit you're using (your debt to credit utilization ratio), which could impact your credit scores.

Is it worse to close a credit card or never use it

It is better to keep unused credit cards open than to cancel them because even unused credit cards with a $0 balance will still report positive information to the credit bureaus each month. It is especially worthwhile to keep an unused credit card open when the account does not have an annual fee.

Will it hurt my credit score if I don’t use my credit card

If you don't use your credit card, your card issuer can close or reduce your credit limit. Both actions have the potential to lower your credit score.

Is it better to close a credit card or let it close

In general, it's best to keep unused credit cards open so that you benefit from a longer average credit history and a larger amount of available credit. Credit scoring models reward you for having long-standing credit accounts, and for using only a small portion of your credit limit.

How do I stop unused credit cards

If you still want to cancel your credit card after reviewing your options, follow our step-by-step guide.Pay off any remaining balance. Pay off your credit card balance in full prior to canceling your card.Redeem any rewards.Call your bank.Send a cancellation letter.Check your credit report.Destroy your old card.

How long does it take to close a credit card account

Make sure to note that you want the account closed at your request, and keep a copy on file just in case. It can take a few weeks for your request to be processed, but if you haven't received a confirmation letter within a month, call your credit card issuer to follow up.

How long should you wait to close a credit card

If you've just started using credit and recently got your first credit card, it's best to keep that card open for at least six months. That's the minimum amount of time for you to build a credit history to calculate a credit score.