Do you get better car insurance with a good credit score?

Does a good credit score help car insurance

According to the III, if you have a better credit-based insurance score, an excellent driving history, and zero claims on your record, you'll typically qualify for lower rates.

Cached

What is the best credit score for car insurance

between 670 and 739

What, then, is a good credit score to get a car insurance policy with competitive prices A score in the “good” range — between 670 and 739, according to the FICO scoring model — is generally considered to be the baseline for competitive pricing.

What does your credit score have to do with your insurance

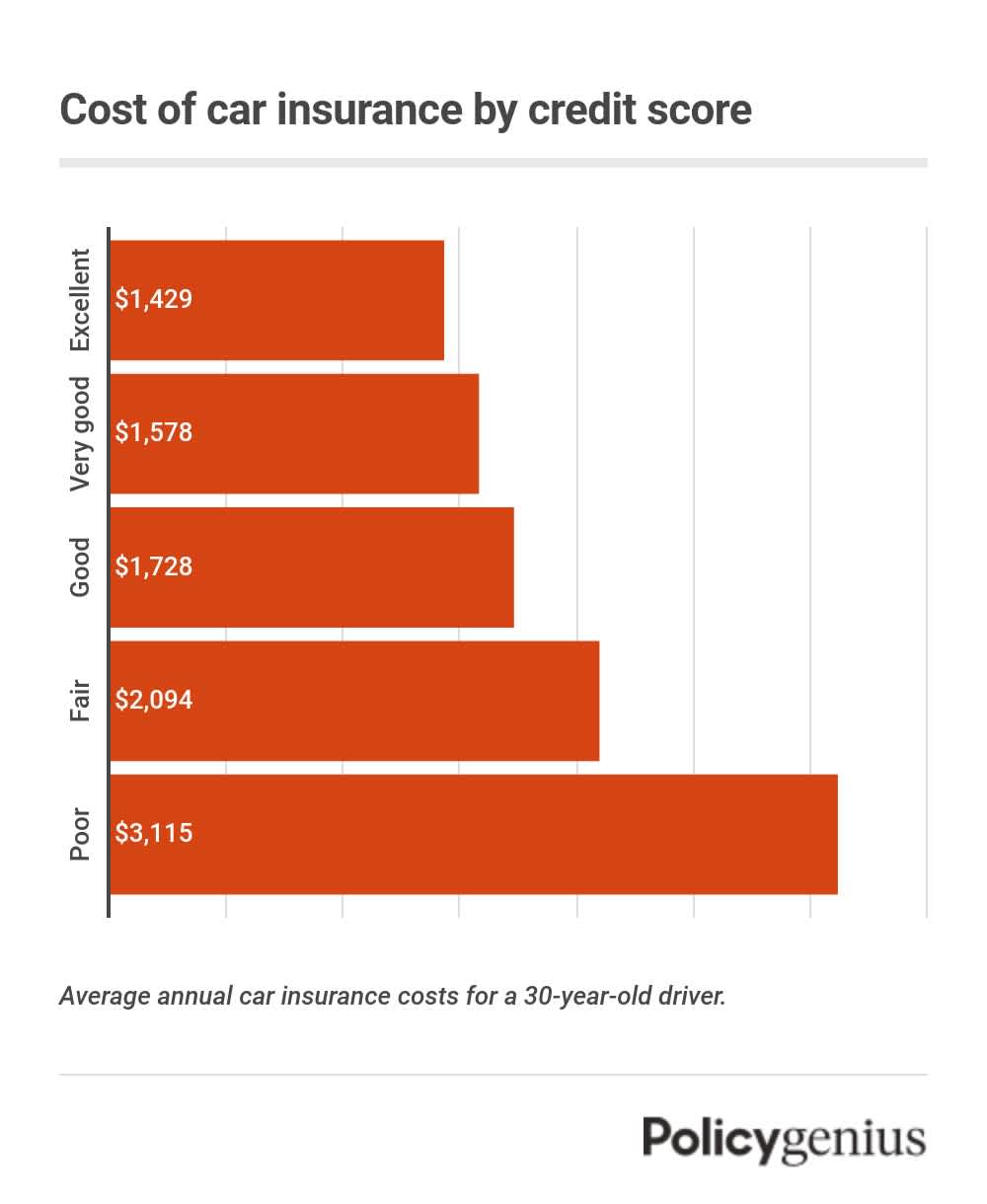

Most insurance companies using credit information will include it as a factor in determining your rate. For example, someone with a relatively high credit score may pay a lower premium than someone with a relatively low credit score.

CachedSimilar

Does it hurt your credit score to get car insurance quotes

It is true that insurance companies check your credit score when giving you a quote. However, what they're doing is called a 'soft pull' — a type of inquiry that won't affect your credit score. You'll be able to see these inquiries on your personal credit reports, but that's it.

Cached

Will my car insurance go down if my credit score goes up

As long as you have poor credit, your car insurance rates can be affected. The best way to keep your credit from increasing your auto insurance premiums is to raise your score. Once you've successfully bumped your score higher, it's a good time to compare car insurance quotes.

What is a good insurance score

According to Progressive, insurance scores range from 200 to 997, with everything below 500 considered a poor score, and everything from 776 to 997 considered a good score.

Do car insurance companies run your credit

Do all auto insurance companies check your credit Most insurers use credit checks to create a credit-based insurance score to help set your rate. Some insurers provide auto insurance with no credit check, which might seem appealing if you have a poor credit history.

Why is car insurance based on credit

The reason insurers check your credit is because studies have shown that credit rating tends to be a good indicator of how many claims a driver will file. That allows insurers to match more expensive rates with drivers who will likely use their insurance more.

What is the 80% rule in insurance

The 80% rule describes a policy in which insurers only cover the costs of damage to your house or property if you've purchased coverage that equals at least 80% of the property's total replacement value.

What factors affect car insurance premiums

Some factors that may affect your auto insurance premiums are your car, your driving habits, demographic factors and the coverages, limits and deductibles you choose. These factors may include things such as your age, anti-theft features in your car and your driving record.

Do insurance companies run your credit for a quote

Insurance quotes do not affect credit scores. Even though insurance companies check your credit during the quote process, they use a type of inquiry called a soft pull that does not show up to lenders. You can get as many inquiries as you want without negative consequences to your credit score.

What is the 10 10 rule insurance

The most commonly cited is the "10/10 rule." This rule states that a contract passes the threshold if there is at least a 10 percent probability of sustaining a 10 percent or greater present value loss (expressed as a percentage of the ceded premium for the contract).

What factors can reduce insurance premiums

One of the best ways to keep your auto insurance costs down is to have a good driving record.Shop around.Before you buy a car, compare insurance costs.Ask for higher deductibles.Reduce coverage on older cars.Buy your homeowners and auto coverage from the same insurer.Maintain a good credit record.

What are the biggest factors for car insurance

The three main factors for the car insurance policy are age, Coverage level, limits and deductibles, and driver's history. Age: Reports show older drivers are safer and less involved in accidents. However, younger drivers are considered reckless and prone to accidents and other risks.

What are 6 other factors that can affect the cost of auto insurance

What factors are most important for car insurance ratesAge. Age is a very significant rating factor, especially for young drivers.Driving history. This rating factor is straightforward.Credit score.Years of driving experience.Location.Gender.Insurance history.Annual mileage.

Why is car insurance based on credit score

The reason insurers check your credit is because studies have shown that credit rating tends to be a good indicator of how many claims a driver will file. That allows insurers to match more expensive rates with drivers who will likely use their insurance more.

What is the 80% rule with insurance companies

The 80/20 Rule generally requires insurance companies to spend at least 80% of the money they take in from premiums on health care costs and quality improvement activities. The other 20% can go to administrative, overhead, and marketing costs.

What makes car insurance high

Common causes of overly expensive insurance rates include your age, driving record, credit history, coverage options, what car you drive and where you live. Anything that insurers can link to an increased likelihood that you will be in an accident and file a claim will result in higher car insurance premiums.

What are 3 specific factors that will influence car insurance premiums

Some factors that may affect your auto insurance premiums are your car, your driving habits, demographic factors and the coverages, limits and deductibles you choose. These factors may include things such as your age, anti-theft features in your car and your driving record.

What are 3 factors that lower your cost for car insurance

Some factors that may affect your auto insurance premiums are your car, your driving habits, demographic factors and the coverages, limits and deductibles you choose. These factors may include things such as your age, anti-theft features in your car and your driving record.