Do you get retention money back?

What is the treatment of retention money

Retention payable is recorded by owners and general contractors and is the amount owing to contractors or subcontractors for retention. Since these funds aren't due until the project is completed, they are recorded in a separate account on the general ledger.

What is the advantage of retention money

The advantages

It provides a fund for rectifying defects. It provides an incentive to the contractor to complete the project on time and without defects. It provides an incentive to the contractor to return to site during the defects liability period to remedy any defects or deal with snagging items.

How does retention payment work

When a contractor wins a bid for a large construction project, some of the money immediately goes to fund the start of the project. A construction retention payment (also called retainage) is the amount of money held back until the project is complete. Retainage is usually a percentage of the total project cost.

Cached

When should retention money be paid out

Retained money is usually withheld from all parties until the very, very end of the project. On average, that means that general contractors wait about 99 days to get withheld money, and subcontractors (who likely finish before the general contractor) wait an average of 167 days.

Cached

What is a retention money guarantee

Introduction. It is the written document issued to the owner or the buyer from Bank of China to guarantee that applicant will continue to fulfill contract obligation after withdrawing final payment of the contract price in advance, at the request of construction contractor or supplier.

What is a cash retention

cash retention means monies which are withheld from monies which would otherwise be due under a construction contract, the effect of which is to provide VM Interiors Ltd with security for the current and future performance by the Sub-Contractor of any or all of the latter's obligations under the contract, and “ …

What are the cons of retention

Limitations of Employee RetentionRetaining Less-Qualified Employees.Groupism.Toxicity in Work Environment.Affecting Workplace Productivity.

What are the disadvantages of retention

The downsides to high employee retention are disengaged employees who remain in their roles, hurt productivity, create toxic work environments, and drive good employees away. High retention can also lead to difficulty implementing change, less innovation, and a lack of diversity and inclusion.

Should you accept a retention bonus

In conclusion, retention bonus agreements are a great way to keep key employees on board during difficult times. They can also be used to incentivize employees to stay with a company during a period of transition or change.

How much do you get for employee retention

For tax year 2023, the refundable tax credit is: 70% of qualified wages paid per employee (up to a maximum amount of $7000 per employee, per quarter and up to $21,000 for the entire year)

What is a typical retention payment

Typical retention bonuses can be anywhere from 10% to 25% of the base salary, depending on the industry. Your employer might also choose to pay a flat rate, such as $5000. A retention bonus is commonly paid as a lump sum amount, but some employers may break it down to ensure their benefits in case you're dismissed.

What does $2500 retention mean

A retention bonus, also called retention pay or a retention package, is a lump sum of money a company pays to an employee to stay with the company for a specific amount of time.

What is a retention free amount

You retain retention at the retention percentage rate from each payment of the amount due to the contractor, that is the price for work done to date. However, if there is a retention-free amount, you do not retain retention until the price for work done to date has reached that amount − see clause X16.

What is the difference between security deposit and retention money

So security deposit is in excess to the contractual payments whereas retention money is part of contractual payments withheld subject to certain compliances.

What is a $500 retention

A retention bonus, also called retention pay or a retention package, is a lump sum of money a company pays to an employee to stay with the company for a specific amount of time.

Is employee retention good or bad

Effective employee retention can save an organization from productivity losses. High-retention workplaces tend to employ more engaged workers who, in turn, get more done. Engaged employees are more likely to improve customer relationships, and teams that have had time to coalesce also tend to be more productive.

Is retention good or bad

Students who are held back tend to get into trouble, dislike school, and feel badly about themselves more often than children who go on to the next grade. The weakened self-esteem that usually accompanies retention plays a role in how well the child may cope in the future.

What does $2500 retention bonus mean

A retention bonus, also called retention pay or a retention package, is a lump sum of money a company pays to an employee to stay with the company for a specific amount of time.

How are retention bonuses paid out

Retention bonus rates typically range between 10% and 15% of an employee's base pay, and companies often offer them in one sum or biweekly or biannual installments. They're powerful retention tools as long as business and employee needs align.

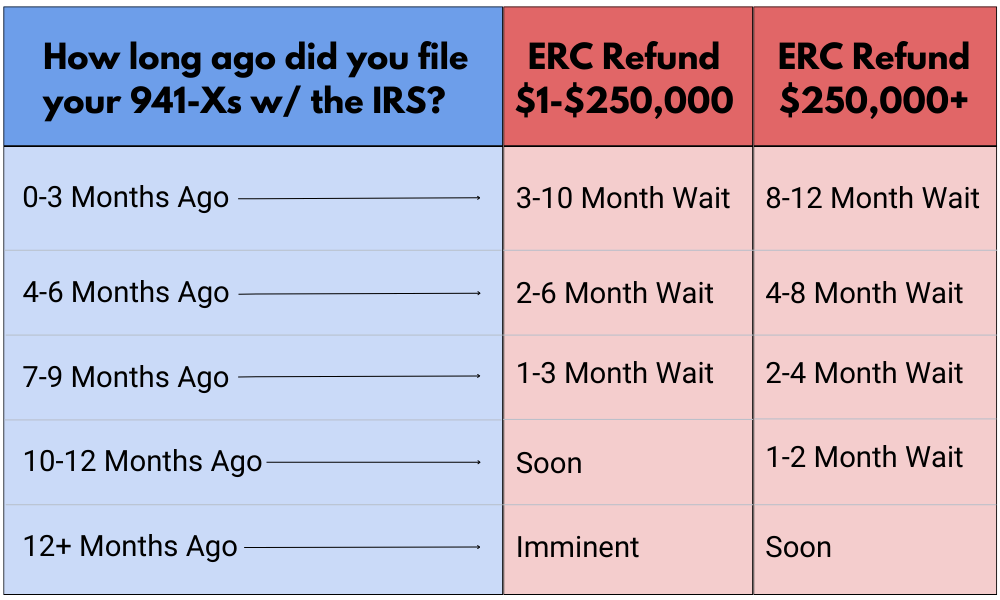

How will I receive my employee retention credit refund

The ERC is a refundable tax credit that was designed to encourage employers to keep their employees on payroll during the pandemic. ERC refunds are claimed via an amended payroll tax return, Form 941-X, for each applicable qualifying quarter in 2023 and 2023.