Do you have to pay a Discover card off every month?

How often do you pay Discover card

Your due date is at least 25 days after the close of each billing period (at least 23 days for billing periods that begin in February). We will not charge you any interest on purchases if you pay your entire balance by the due date each month.

What happens if I don’t pay my Discover card in full

A missed payment can result in late fees and increased interest rates, which will cost you more money in the long run. A missed or late payment will show up on your credit report and may impact your credit score.

How long do I have to pay Discover

Paying Interest Your due date is at least 25 days after the close of each billing period (at least 23 days for billing periods that begin in February). We will not charge you any interest on purchases if you pay your entire balance by the due date each month.

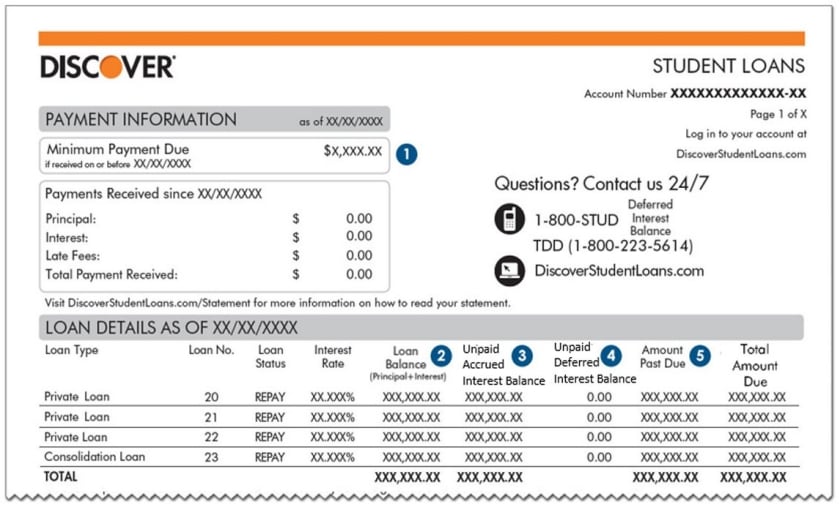

What is the minimum payment on Discover it

The Discover it Secured Credit Card minimum payment is $20, $15 plus past due amounts, or 3% of the statement balance plus past due amounts –– whichever is higher.

What is the minimum payment due on a Discover card

What's the minimum payment. It's the least amount of money you can pay towards your credit card balance ie the total amount of money you owe the credit card company each month. And the exact amount is

How long does Discover give you to pay

Your grace period will be no less than 21 days, in compliance with the Credit CARD Act of 2009. With Discover, your grace period will be at least 25 days from the end of the billing period, or a minimum of 23 days for billing periods that start in February.

What is the minimum balance for Discover

There is no minimum opening deposit required and there is no minimum balance requirement.

How long do I have to pay off my Discover card

The Discover card grace period is at least 25 days from the end of each billing period until the payment due date. Billing periods that begin in February get a minimum of 23 days. Discover will not charge interest during the grace period as long as there's a $0 balance at the start of the billing period.

Do I have to pay the full balance of my Discover it card

How does credit card interest work If you do not pay your statement balance in full each month, your card issuer my charge you interest fees on purchases. If you take a cash advance or make a balance transfer, you may get an interest charge from the date the transaction posts to your account.

Does the Discover it card build credit

With the Discover it® Secured Credit Card, you provide a refundable security deposit to back your credit line. You still make monthly payments, and can build credit with responsible use. Discover shows your FICO® Credit Score9 for free, so you can track it.

What is Discover card credit limit

Editorial and user-generated content is not provided, reviewed or endorsed by any company. Discover credit card limits will always be at least $500, and there's no disclosed maximum. How much you get is determined by your creditworthiness. The only exception is if you have Discover it® Secured Credit Card.

Why did I pay my Discover card but have no available credit

If you've paid off your credit card but have no available credit, the card issuer may have put a hold on the account because you've gone over your credit limit, missed payments, or made a habit of doing these things.

How much does Discover it start you off with

The highest credit card limit we've come across for the Discover it® Cash Back is $56,500. That's much higher than the minimum starting credit limit of $500. The card has a 0% intro APR on new purchases and balance transfers. Once the introductory period ends, the regular interest rates apply.

Why is my Discover card minimum payment so high

If you're carrying a balance on your credit card, the card issuer typically calculates your minimum payment each month as a percentage of what you owe — and that figure will rise if you're charging more to the card each month and growing the balance.

What is the minimum payment for Discover it

Editorial and user-generated content is not provided, reviewed or endorsed by any company. The Discover it Secured Credit Card minimum payment is $20, $15 plus past due amounts, or 3% of the statement balance plus past due amounts –– whichever is higher.

How much should I spend on a $200 credit limit

To keep your scores healthy, a rule of thumb is to use no more than 30% of your credit card's limit at all times. On a card with a $200 limit, for example, that would mean keeping your balance below $60. The less of your limit you use, the better.

How much of my $500 credit limit should I use

Lenders generally prefer that you use less than 30 percent of your credit limit. It's always a good idea to keep your credit card balance as low as possible in relation to your credit limit. Of course, paying your balance in full each month is the best practice.

How does Discover minimum payment work

Typically, a borrower's minimum payment is not a set amount but a percentage of the statement balance, often plus interest and applicable fees. This means your minimum payment can change based on what you owe.

What happens if I don’t pay my credit card for 5 years

If you continue to not pay, your issuer may close your account. But you'll still be responsible for the bill. If you don't pay your credit card bill for a long enough time, your issuer could eventually sue you for repayment or sell your debt to a collections agency (which could then sue you).

Is a $500 credit limit good

A $500 credit limit is good if you have fair, limited or bad credit, as cards in those categories have low minimum limits. The average credit card limit overall is around $13,000, but you typically need above-average credit, a high income and little to no existing debt to get a limit that high.