Do you have to pay balance in full on Discover Card?

What happens if I don’t pay my Discover card in full

A missed payment can result in late fees and increased interest rates, which will cost you more money in the long run. A missed or late payment will show up on your credit report and may impact your credit score.

Does Discover have to be paid in full every month

Any amount not paid in full by the due date becomes part of your next billing cycle. If your credit card offers a grace period during which you don't pay interest on purchases, you will usually lose the grace period if you don't pay your balance in full each month.

How does Discover card balance work

Your credit card balance is the sum of your posted activity (including purchases, payments, balance transfers, cash advances, interest, and fees). If you had an outstanding balance from the previous month, your current balance is calculated by adding new activity to the outstanding balance.

How long do I have to pay off my Discover card

The Discover card grace period is at least 25 days from the end of each billing period until the payment due date. Billing periods that begin in February get a minimum of 23 days. Discover will not charge interest during the grace period as long as there's a $0 balance at the start of the billing period.

Should I pay off my credit card in full or leave a small balance

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

What happens if you pay the entire amount owed on a credit card

When you pay your credit card balance in full, your credit score may improve, which means lenders are more likely to accept your credit applications and offer better borrowing terms.

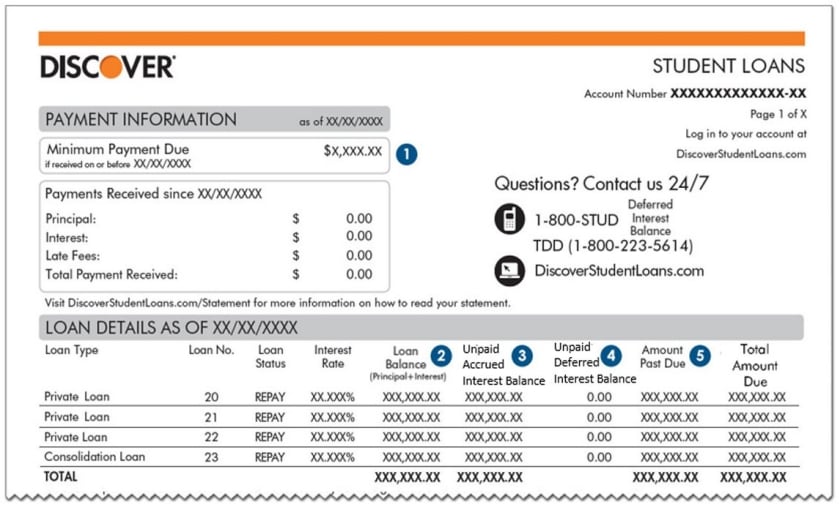

What is the minimum payment for Discover it

Editorial and user-generated content is not provided, reviewed or endorsed by any company. The Discover it Secured Credit Card minimum payment is $20, $15 plus past due amounts, or 3% of the statement balance plus past due amounts –– whichever is higher.

Should I pay statement balance or full balance

Should I pay my statement balance or current balance Generally, you should prioritize paying off your statement balance. As long as you consistently pay off your statement balance in full by its due date each billing cycle, you'll avoid having to pay interest charges on your credit card bill.

How do I pay my Discover balance

The easiest way to make a Discover card payment is to log in to your online account or call (800) 347-2683. You can also mail payments to Discover Financial Services, P.O. Box 6103, Carol Stream, Illinois 60197. For fastest service, you should submit your payment online or by phone.

What is the minimum payment on Discover it

The Discover it Secured Credit Card minimum payment is $20, $15 plus past due amounts, or 3% of the statement balance plus past due amounts –– whichever is higher.

What happens if I pay my Discover card 1 day late

There is no fee for the first late payment, and there is no penalty APR. Discover offers a grace period of up to 25 days from the end of the billing period to make at least the minimum payment and avoid any late fees. A payment received after the grace period is considered late.

Is it bad to max out a credit card and pay it off immediately

Under normal economic circumstances, when you can afford it and have enough disposable income to exceed your basic expenses, you should pay off your maxed-out card as soon as possible. That's because when you charge up to your credit limit, your credit utilization rate, or your debt-to-credit ratio, increases.

Is it better to pay off the smallest balance or get all credit cards under 30% utilization

The bottom line

Reporting a balance on your cards of more than about 30 percent of its maximum credit line will hurt your score and carries additional risks. The lower your balances, the better your score — and a very low balance will keep your financial risks low.

Does not paying your full credit card bill ruin your credit

Carrying a balance does not help your credit score, so it's always best to pay your balance in full each month. The impact of not paying in full each month depends on how large of a balance you're carrying compared to your credit limit.

Is it OK to keep money owed on your credit if you pay minimum

Minimum payments themselves may not affect your credit score. But paying the minimum due on credit cards can lead to utilization problems.

Does the Discover it card build credit

With the Discover it® Secured Credit Card, you provide a refundable security deposit to back your credit line. You still make monthly payments, and can build credit with responsible use. Discover shows your FICO® Credit Score9 for free, so you can track it.

Why does my Discover card not have a minimum payment

Your credit card likely says “no minimum payment due” because the statement balance was paid in full by the most recent due date or there was no account activity during the billing period. As long as the statement balance is paid by the due date, there will be no payment due until the next billing period ends.

What happens if I only pay the statement balance

Paying the statement balance means you're paying exactly what's due. You won't be bringing any of your last billing cycle's balance into the next month, which means you'll pay no interest on those purchases (as long as you pay by the due date).

Should I pay off my balance before statement

If you're in a position to do so, pay off most of your credit card balance early and/or often, ideally before the statement even closes. This will help keep your credit utilization low, which is a major factor that can impact your credit score.

How can I pay off my Discover card faster

To pay off debt fast, figure out what you owe and how much you're paying in interest and fees. Trim expenses so you can pay more than the minimum on all your balances. Avoid adding any new revolving debt. Use the avalanche or snowball debt management methods to decide which balances to pay off first.