Do you need a down payment with Carvana?

Why are Carvana down payments so high

Often a large down payment often signifies the selling price is far above what the lender feels is its' worth. Not to point fingers at Carvana but it could also be with the higher than normal market for used cars the lenders may be a bit skittish on loaning above normal market condition…

Is it hard to get approved for Carvana

99% of customers who apply get approved and your terms are good for 45 days. There's no impact to your credit and you can see your actual down payment and monthly payment on all vehicles in our inventory.

What are the financial problems with Carvana

Overall, Carvana's losses ballooned to $806 million, or $7.61 per class A share of stock, compared to $89 million in the last quarter of 2023. For the full year, the company lost $1.6 billion compared to a loss of $135 million in 2023.

How long does Carvana take to approve

How long does Carvana take to approve Approving a car for sale takes between two and fifteen minutes to approve. Around 99 percent of online car sellers who apply get approved, and their contracts and terms are good for 45 days.

Does Carvana deny anyone

Carvana considers working with consumers regardless of their credit history — although there are age and income minimums. Because it doesn't require people to have minimum credit scores for a car loan, you might qualify for a Carvana loan even if you have low credit scores.

What proof of income does Carvana require

You can upload your 2 most recent, consecutive pay stubs for your proof of income or address verification. We may also look at pay stubs as part of your employment verification. You may be asked to submit pay stub documents during the purchase process.

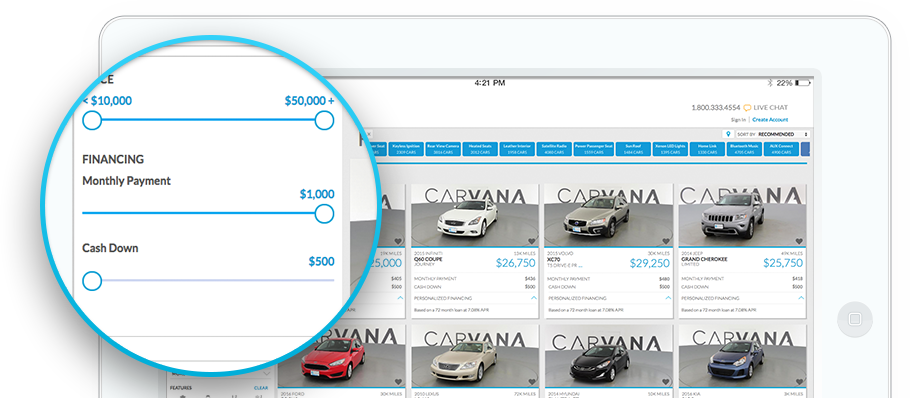

How does Carvana down payment work

Your down payment is due when you place your order. When scheduling your delivery or pickup appointment, you'll receive a prompt authorizing us to complete the transaction. Please ensure funds are available when you place your order even though it may take 3-5 business days to be withdrawn from your account.

How does Carvana verify income

You can upload your 2 most recent, consecutive pay stubs for your proof of income or address verification. We may also look at pay stubs as part of your employment verification. You may be asked to submit pay stub documents during the purchase process.

What is better CarMax or Carvana

Which Is Better: Carvana or CarMax Carvana is a better option if you look for convenience and ease of use in your purchases and trades. On the other hand, CarMax is ideal for people who want to test drive the car beforehand and who do not mind going to their nearest CarMax location to do it.

Does Carvana have a lot of debt

Carvana has a total debt pile of $8,309 million. With negative stockholder's equity of over $1 billion the situation looks bleak for equity holders.

Can I get a car with a 530 credit score

Can you finance a car with a 530 credit score You can finance a car with a 530 credit score. Lenders will charge a higher interest rate, but you can still get a vehicle.

Can I finance a car with a 500 credit score

And, yes, if you are in that 500–600 credit score range, obtaining the financing to buy a car is doable. Even a small percentage of individuals with deep subprime credit scores – 500 or below – obtained auto financing in 2023.

How does Carvana verify down payment

To verify funds, you can link your bank account through Plaid from your Order Placed Dashboard or provide photos of a cashier's check for the down payment made out to Carvana.

Can you be denied by Carvana

You may have been denied due to a change in your credit or even a simple clerical error or typo. So, here's what you should do: Reach out and ask: Contact Carvana, and ask why you were denied. They should have details about the situation.

Does Carvana call your bank

We recommend this method, as it reduces the amount of time it takes for our underwriting team to approve your purchase. If you do not use Plaid, you will need to call Carvana so that we can initiate a 3-way call with your bank to confirm you have enough funds in your bank account.

How much is the deposit for Carvana

The refundable $100 is treated as a temporary hold for 7 calendar days. Similar to a hotel reservation, the hold will automatically be removed from your bank account after 7 days and will not be billed.

Is it more expensive to buy a car on Carvana

Carvana's out-the-door prices are usually better than dealership prices. Many online reviews say Carvana's prices are higher than the dealership's. But here's the thing: the dealership's main goal is to make as much money as they can from each sale.

Why is Carvana so much cheaper than CarMax

But having physical locations means CarMax also deals with higher overhead costs, which translate to you paying a higher price for your car. On the other hand, Carvana's process is mainly online, and the lack of overhead costs means you get better rates.

Why did Carvana fail

Unfortunately, Carvana's heavy debt burden indicates that the company is doomed and investors are holding a toxic stock. Bloomberg reported that Carvana “has total debt of about $8.1 billion and cash of about $316 million.” That's alarming, and bear in mind that Carvana will have to pay interest on its debt.

Can I get a car with 500 credit score with no money down

And, yes, if you are in that 500–600 credit score range, obtaining the financing to buy a car is doable. Even a small percentage of individuals with deep subprime credit scores – 500 or below – obtained auto financing in 2023.