Do you need a good credit score for a student bank account?

What do you need for a student bank account

They'll also need to bring the following:Proof of U.S. residency. Ex: U.S. government-issued ID, student/employer photo ID, current utility bill or rental agreement(documents must show your name and U.S. physical address)One primary photo ID.One secondary ID.Two forms of ID for you.

What is a normal credit score for a student

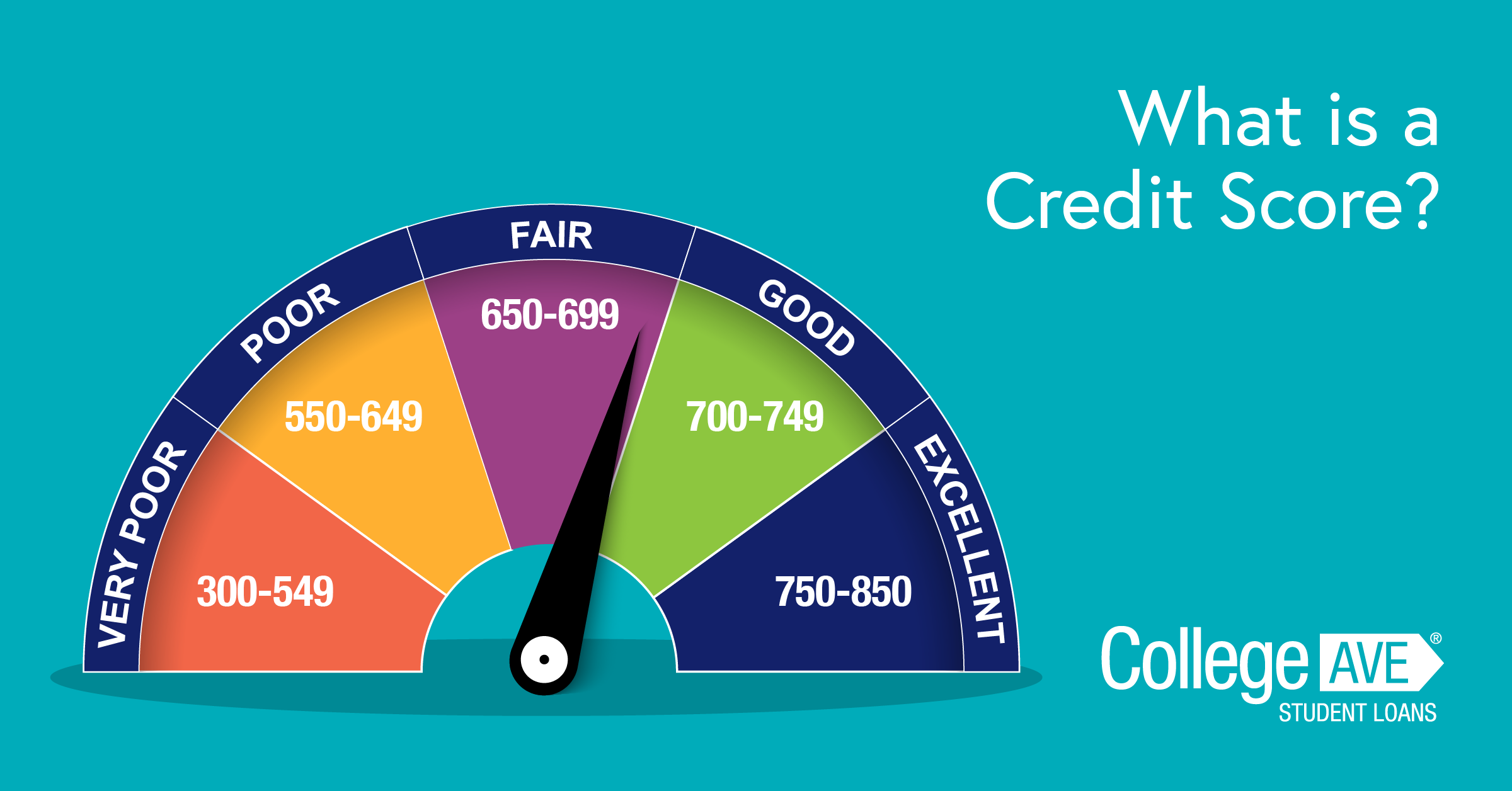

A good credit score for college students — and for anyone — would be anything 670 or over. Anything over 739 is considered 'very good,' and 800 or higher is considered 'excellent. ' However, students with scores lower than 670 shouldn't feel discouraged.

Cached

What is the average credit score for a 18 year old

roughly 679

What's the average credit score by age 18 According to Experian, the average credit score for 18 year olds is roughly 679.

Do you have to have good credit for a student loan

Federal student loans don't have a minimum credit score. If you need a private student loan after exhausting federal aid, you'll typically need a FICO score above 690 to qualify.

Cached

How much money should a 17 year old have saved

“A good rule to live by is to save 10 percent of what you earn, and have at least three months' worth of living expenses saved up in case of an emergency.” Once your teen has a steady job, help them set up a savings program so that at least 10 percent of earnings goes directly into their savings account.

What does a 17 year old need to open a bank account

Parents – opening with a teen Remember, teens 13 – 17 years old must open at a branch and bring a state-issued ID or passport. Teens without ID need both a Social Security card and a birth certificate.

What is a bad credit score for a 20 year old

With the FICO credit scoring model, credit scores ranging from 300 to 579 are considered poor. Scores that range from 580 to 669 are considered fair. Anywhere between 670 to 739 is considered good. A credit score between 740 to 799 is considered very good.

What credit score should a 22 year old have

In your 20s and 30s, a good credit score is between 663 and 671, while in your 40s and 50s, a good score is around 682. To get the best interest rates, terms and offers, aim for a credit score in the 700s.

What should my credit score be at 19

What's the average credit score for an 18-19-year-old The average credit score in the U.S. for those between 18 and 23 is 674.

Is 643 a good credit score for an 18 year old

Your score falls within the range of scores, from 580 to 669, considered Fair. A 643 FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline their credit applications.

What is the minimum credit score for FAFSA

Federal: There are no minimum credit score requirements for federal student loans. Though there is a credit history check for federal PLUS loans.

Can you get student loans if you have bad credit

Federal and private student loan options are available to borrowers with bad credit scores. Federal student loans typically don't require any credit checks. A co-signer can help you qualify for a private student loan.

How much should I have saved for college by age 18

The “2 in 10” Rule

As a quick rule of thumb, Fidelity offers another shorthand to tell whether or not you're on track. The “2 in 10” Rule states that for every $10,000 per year of college help you want to offer, you multiply your child's age by $2,000. That's how much you should have saved at each age.

How much of my paycheck should I save at 16

“A good rule to live by is to save 10 percent of what you earn, and have at least three months' worth of living expenses saved up in case of an emergency.” Once your teen has a steady job, help them set up a savings program so that at least 10 percent of earnings goes directly into their savings account.

How much money should a 16 year old have

Teens should save 20% and have an emergency fund

Ideally, teenagers, like adults, should be saving 20% of their income, whether that's earned or pocket money, or a combination of both. Teens should also have an emergency fund.

Can I open a bank account with bad credit

Let's start with the good news. Having a poor credit score will not prevent you from opening a bank account. Your credit score is taken from information on your credit reports, documents that track your history as a borrower, and are compiled by the three major credit bureaus: Experian TransUnion and Equifax.

Can a 21 year old have a 700 credit score

So, given the fact that the average credit score for people in their 20s is 630 and a “good” credit score is typically around 700, it's safe to say a good credit score in your 20s is in the high 600s or low 700s.

Can you have a bad credit score under 18

Typically, only people over the age of 18 have a credit score — but it is possible for minors to have a credit report. A person under 18 can have a credit report if : Their identity was stolen and used to open one or more credit accounts. A credit agency erroneously created a credit profile in the minor's name.

Can a 20 year old have a 750 credit score

So, given the fact that the average credit score for people in their 20s is 630 and a “good” credit score is typically around 700, it's safe to say a good credit score in your 20s is in the high 600s or low 700s.

What credit score do most 21 year olds have

The average FICO credit score for those in their 20s is 660.

| Age | Average FICO Score |

|---|---|

| 20 | 681 |

| 21 | 670 |

| 22 | 664 |

| 23 | 662 |