Do you need an EIN for a Chase business card?

Do you need an EIN to apply for Chase business credit card

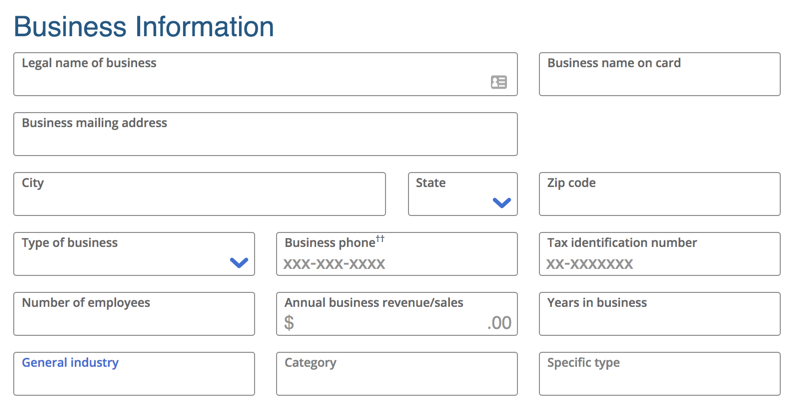

No matter the size or scope of your business, you may be eligible for a business credit card. If you don't have an EIN, you can use your Social Security number. As a business owner, you may find that keeping your personal and business expenses separate is helpful.

Cached

Do I need an EIN for a business card

No, you don't necessarily need an EIN to get approved for a business credit card. You may be able to get approved using your Social Security number without an EIN. In these cases, you're typically applying for a business credit card as a sole proprietorship, which requires only your Social Security number.

Cached

How to get business credit without EIN number

If you don't have an Individual Taxpayer Identification Number (ITIN) or an Employer Identification Number (EIN), you can apply for a business card using your Social Security number (SSN), just as you would for a personal card.

Is it easy to get approved for Chase business card

Yes, it is hard to get a Chase business credit card because these cards require at least good credit for approval. Unless your credit score is 700 or higher and you have enough income to make monthly minimum payments, it will be difficult to get approved for a Chase business credit card.

What is the easiest Chase business credit card to get

The easiest business credit card to get is the Business Advantage Unlimited Cash Rewards Secured credit card because it accepts applicants with bad credit. This card also rewards cardholders with 1.5% cash back on all purchases and has a $0 annual fee.

Does Chase do a hard pull for business cards

Q: Does Chase pull credit reports from when you apply for a business credit card A: As with most card issuers, Chase may do a hard pull on your personal credit when you apply. But the issuer does not report subsequent credit activity to consumer bureaus unless you are delinquent.

Do I need an EIN for my business bank account

You can open a business bank account once you've gotten your federal EIN. Most business bank accounts offer perks that don't come with a standard personal bank account.

Does Chase run personal credit for business cards

The credit score needed for a Chase business card is typically 700 or higher. This means you need at least good credit for high chances of approval. Your personal credit score will still be taken into account, even though you're applying for a business credit card.

What can I use if I don’t have an EIN

If you are the owner, manager, and director of your home-based business, you do not need an EIN. Instead, you can use your social security number (SSN). However, once you decide to hire employees, you must have an EIN.

What is the 1 30 rule for business cards Chase

What is the Chase 1/30 rule The 1/30 rule is short for "1 card every 30 days," meaning your chances of being approved for a Chase business card are slim to none if you've applied for any card in the last 30 days.

What credit score is needed for a Chase business card

670 or above

What credit score do you need to get a Chase Ink business card To qualify for Chase's Ink business cards, you must have good to excellent credit, which is defined as a FICO credit score of 670 or above. Although these are business cards, Chase will use your personal credit score when considering your application.

How long does it take to get an EIN

The processing timeframe for an EIN application received by mail is four weeks. Ensure that the Form SS-4PDF contains all of the required information. If it is determined that the entity needs a new EIN, one will be assigned using the appropriate procedures for the entity type and mailed to the taxpayer.

Is a tax ID number required to open a bank account

To open a checking or savings account, the bank or credit union will need to verify your name, date of birth, address, and ID number. An ID number can be a social security number or an Individual Taxpayer Identification Number (ITIN).

Who does Chase pull for business cards

Experian

Chase primarily uses Experian as its credit bureau, but also uses TransUnion and Equifax for certain cards in certain states.

Do I need an EIN for a business bank account

An Employer Identification Number is necessary to open a business bank account, unless your business is registered as a sole proprietorship or a single-member LLC. In this case, you may open a business account using your Social Security Number if you have not obtained an EIN yet.

Can I use my SSN as my EIN

A sole proprietor without employees and who doesn't file any excise or pension plan tax returns doesn't need an EIN (but can get one). In this instance, the sole proprietor uses his or her social security number (instead of an EIN) as the taxpayer identification number.

Can I get EIN immediately

You can get an EIN immediately by applying online. International applicants must call 267-941-1099 (Not a toll-free number). If you prefer, you can fax a completed Form SS-4 to the service center for your state, and they will respond with a return fax in about one week.

Does the IRS charge to get an EIN number

Applying for an Employer Identification Number (EIN) is a free service offered by the Internal Revenue Service.

Can I get a business bank account without EIN

EIN number

If you haven't filed for a tax ID number, you may still be able to open a business bank account with your personal Social Security number. Depending on your type of business, you may not need to apply for an EIN. A sole proprietorship with no employees typically doesn't require one.

Do I need my EIN to open a business bank account

You can open a business bank account once you've gotten your federal EIN. Most business bank accounts offer perks that don't come with a standard personal bank account.