Do you need credit card app?

Is it safe to have credit card app on iPhone

When you add a credit, debit, prepaid, or transit card (where available) to Apple Pay, information that you enter on your device is encrypted and sent to Apple servers. If you use the camera to enter the card information, the information is never saved on your device or photo library.

How safe are credit card apps

Security pitfalls

Even though an app may be safe in itself, certain security issues could compromise its safety. For example, if you use a public network, the information you provide could be hacked. That would give criminals access to your card information and put your data at risk.

Cached

Do all credit cards have an app

Every major credit card issuer and even some of the smaller ones offer smartphone apps to help you manage your account.

Cached

Do you have to link a credit card to App Store

To make purchases from the App Store and use subscriptions like iCloud+ and Apple Music, you need at least one payment method on file.

Do iphones demagnetize credit cards

In general new credit cards with EMV technology are far less likely to become demagnetized by cell phones or other magnetic items. However, Wireless charging has a much stronger magnetic field, so it's worth removing hotel key cards, subway, and other travel cards from a phone case before charging.

Can anyone see my card on iPhone

Unless you are sharing an account with someone, or unless you hand your phone to someone, no one else can see that information.

Do credit apps hurt your credit score

If a credit-tracking app or website does make an inquiry into your file as part of its credit monitoring process, it will be a soft inquiry that will have no effect on your credit score. You also don't need to worry about lowering your credit by checking your credit report.

Do credit card applications hurt your credit score

When you apply for a new card, the credit company may perform a hard pull of your credit report for review as part of the approval process. The inquiry on your credit history may lower your score but generally the impact is low on your FICO score (for most, this means fewer than 5 points).

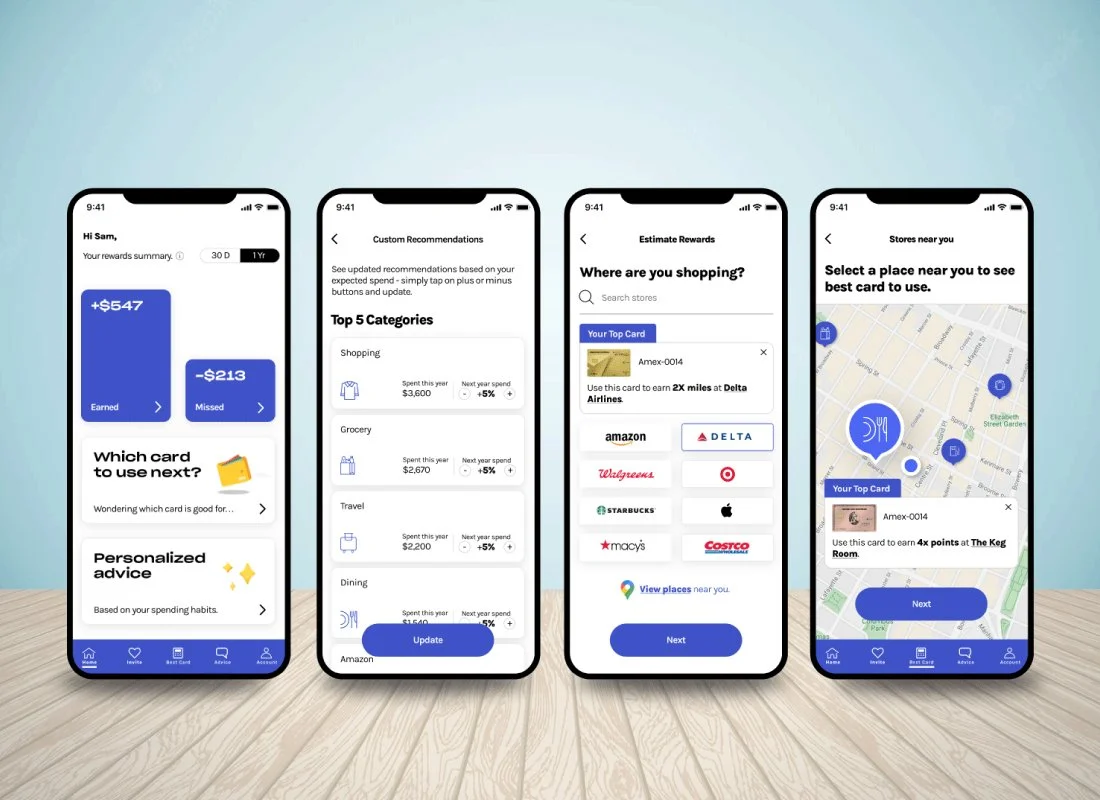

What are the benefits of credit card apps

These apps help you in building your credit card score, tracking your bills and expenses, designing your budget, and thus managing your finances. With these credit card apps, you can get a clear insight into your credit card expenses, receive discounts and be aware through prompt reminders.

Which app to use for credit card

Paytm is one of India's largest payment platforms. You can pay bills for Mastercard, Amex, Diners, and RuPay credit cards via this platform. Key Benefits: Free credit score check.

Why does the App Store keep asking for my credit card

You get this message when a payment method has failed, or if the particular device has never purchased a paid app, or downloaded a free app, or if there is a pending unpaid balance on the account. As you can see, the leading cause for the 'Verification Required' message on your iPhone or iPad is a faulty credit card.

How do I bypass the billing info on the App Store

In iOS and iPadOS:Go to Settings > account name > Payment & Shipping.Tap the Edit button.Tap the remove (minus in a red circle) button for each method.Tap Done.

Is it safe to scan credit card on phone

Yes, storing a credit card on your phone is safe. In fact, it's one of the most secure ways to pay.

Will iPhone 12 ruin credit cards

“Don't place credit cards, security badges, passports, or key fobs between your iPhone and MagSafe Charger, because this might damage magnetic strips or RFID chips in those items,” Apple said.

Can someone read my credit card in my Wallet

With a pocket-sized radio frequency scanner that can cost less than $100 or a smartphone equipped with near field communications capabilities, thieves can obtain the data from a credit card right through your wallet and purse, providing they stand close enough to you for a sensor to register the information.

Can someone steal credit card info from Apple Pay

But instead of simply sharing your card information, Apple Pay creates a unique transaction code and device-specific code for every purchase. This means that even if you make a purchase on a shady website, scammers can't steal your credit card numbers.

Is it bad to check your credit score on Capital One app

CreditWise from Capital One provides your VantageScore® 3.0 credit score and monitors credit reports from TransUnion® and Experian®, two of the three major credit bureaus. It's free for everyone—whether you have a Capital One card or not—and using it won't hurt your credit scores.

What is the #1 way to hurt your credit score

Making a late payment

Your payment history on loan and credit accounts can play a prominent role in calculating credit scores; depending on the scoring model used, even one late payment on a credit card account or loan can result in a decrease.

Why did my credit score drop 50 points after opening a credit card

You applied for a new credit card

Card issuers pull your credit report when you apply for a new credit card because they want to see how much of a risk you pose before lending you a line of credit. This credit check is called a hard inquiry, or “hard pull,” and temporarily lowers your credit score a few points.

How much will my credit score drop if I apply for a credit card

5 points

When you apply for a new card, the credit company may perform a hard pull of your credit report for review as part of the approval process. The inquiry on your credit history may lower your score but generally the impact is low on your FICO score (for most, this means fewer than 5 points).