Do you need credit for Apple pay later?

Do you have to qualify for Apple Pay later

Be 18 years of age or older. Be a U.S. citizen or a lawful resident with a valid, physical U.S. address that's not a P.O. Box. Set up Apple Pay with an eligible debit card on your device. You can only make Apple Pay Later down payments using a debit card.

Cached

Why can’t i use Apple Pay later

To use Apple Pay Later, you must have an iPhone or iPad updated to the latest version of iOS or iPadOS. Update to the latest version by going to Settings > General > Software Update.

Cached

How do you get Apple Pay later

To use Apple Pay Later, you must have an iPhone or iPad updated to the latest version of iOS or iPadOS. Update to the latest version by going to Settings > General > Software Update. Tap Download and Install.

Will Apple Pay later affect my credit score

Another unique feature of Apple Pay Later is that it will report loan and payment history to credit bureaus, which could affect users' credit scores.

Do you need SSN for Apple Pay later

To help protect your identity, you may be asked to provide additional information for verification, such as uploading the front and back of your government-issued identification, providing your full SSN, or entering a verification code sent to a phone number that Apple's identity verification service provider has …

Can Apple Pay by installments

You can choose to pay for a new iPhone, iPad, Mac, or other eligible Apple product with Apple Card Monthly Installments — instead of paying all at once — in order to enjoy interest-free, low monthly payments.

How do I use Paylater

SIGN UP. Download PAYLATER App. Create a PAYLATER account in few simple steps.SHOPPING. Look for our partnered merchants and shop in-store. Checkout with PAYLATER.PAYMENT. Your first instalment will be processed immediately during your purchase.GET ITEM. Enjoy your purchase.

Is pay later bad for credit

If a buy now, pay later provider chooses to report your account activity to one or more of the three major credit bureaus, that information can show up on your credit reports, and in turn, affect your credit score.

What is the advantage of Apple Pay later

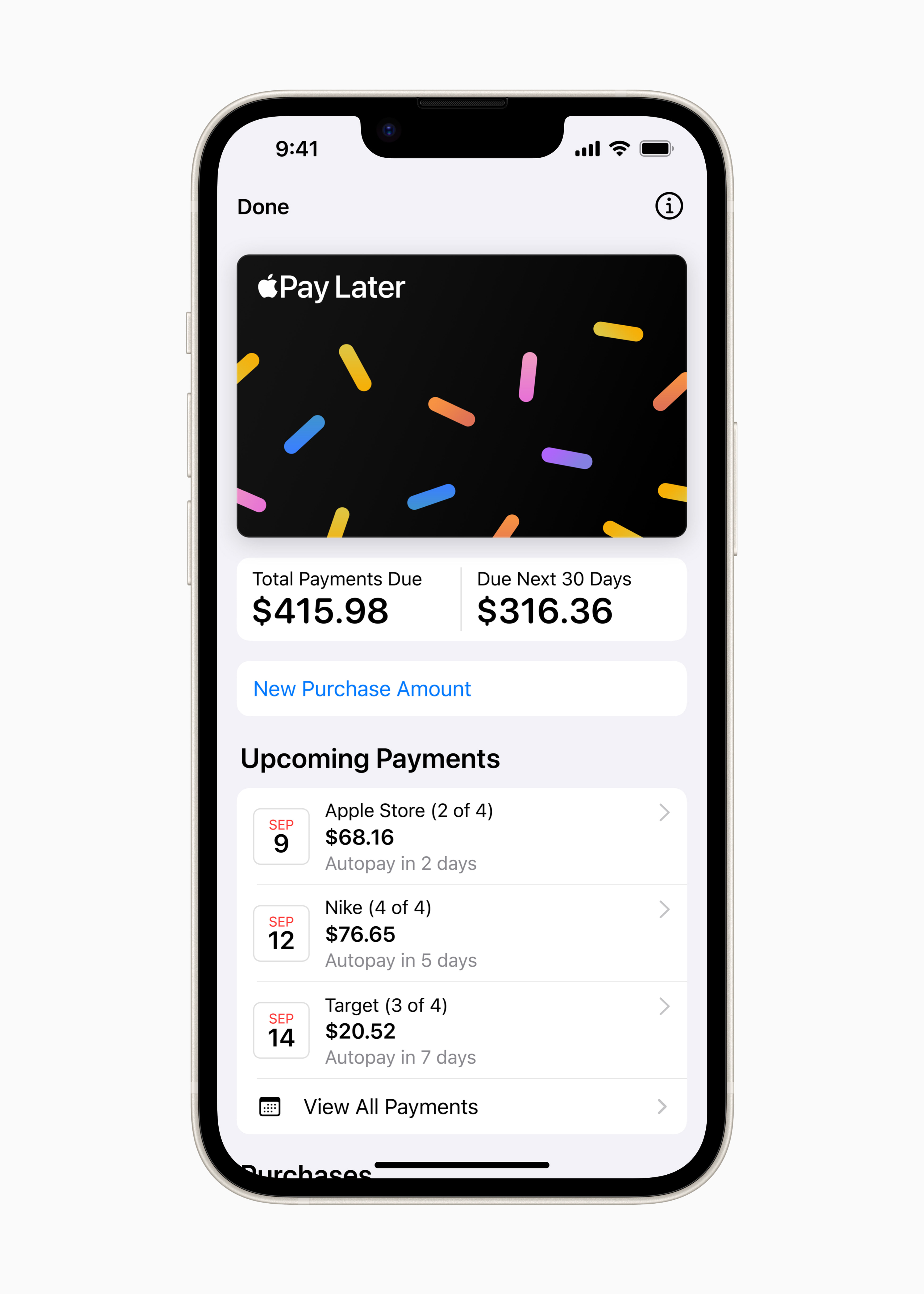

Benefits of Apple Pay Later for Consumers

With no interest or fees, users can easily manage their finances and make informed, responsible borrowing decisions. The integration of Apple Pay Later into the Apple Wallet allows users to effortlessly keep track of their loans and manage their payments.

How do I bypass Apple Pay identity verification

You'll need either a state issued ID or drivers license to verify your identity. There is no workaround or alternative to verification.

Why won t Apple Pay verify my identity

You may have submitted expired documents. You may not have correctly taken and submitted a 'selfie'. You may have submitted an unreadable document. You may have submitted a phone number that is not associated with your name and address.

How do Apple payment plans work

The total amount that you finance for your new device is divided into interest-free monthly installments. Each installment is included in your Apple Card minimum payment and is due every month for the duration of the installment plan. The total amount that you finance increases if you buy an AppleCare+ plan.

Can I do installment with debit card

Get what you want now, pay for it later. Enjoy flexible payments up to 4 months 0% interest using debit card. Flexible payment options with high shopping limit for 3, 6 or 12 months. 3 or 6 months instalment plan.

How much can I borrow from PayLater

With Paylater Plus, say goodbye to long and inefficient processes and get a loan of up to NGN500,000 with complete convenience. Cut out the middleman: Paylater Plus puts the power in your hands, not a sales agent. Paylater Plus requires additional documents to verify the information provided on your application.

Can I borrow money from PayLater

Requesting a loan

You can see much you'll have to pay back in real time. Starting interest is charged at a daily rate of 1% which means that if you borrow ₦10,000 you'll have to pay back ₦11,500, in 15 days, or ₦13,000 in 30 days.

What is the best pay later app without credit score

Freo Pay offers 0% interest for 30 days. Does Freo Pay check my credit score No, Freo Pay doesn't require a credit score to approve your postpaid limit.

Does Afterpay need credit score

There are no credit checks required with Afterpay. Afterpay doesn't even ask for your Social Security number when signing up for its account. Instead, your spending limits will grow based on your on-time payments and responsible use of its platform.

Does pay later improve credit score

As long as you repay the amount on time, your credit score will not be impacted. If you clear the amount on time, you credit score is likely to improve. However, if you miss or delay your payments, then you credit score will fall.

How do I get rid of verification required

How to fix 'Verification Required' message on iPhoneLaunch Settings and tap your name at the top.Tap iTunes & App Store → Tap on Apple ID → View Apple ID.Tap Manage Payments.Tap Edit from top right → Tap on red minus icon → Tap on Remove → Tap on Remove from Popup.

Why is Apple asking for payment verification

If a message says 'billing problem with previous purchase' or 'verification required' If these messages appear, you might be unable to make purchases, download free apps, or use subscriptions. To fix the issue, change your payment method.