Does a closed loan account hurt your credit?

Do closed loans affect credit score

But you may not be aware that long after you close a credit account or pay off a loan, your borrowing history may remain on your credit report. That means the closed account can continue to affect your score, for better or worse, possibly for many years.

Cached

What happens when a loan account is closed

Closed accounts, whether they were closed by you or closed due to payoff or transfer to another lender, are not automatically removed from the credit report. The status of the account will be updated to show that it is no longer open, but the payment history of the account will remain on your report.

Cached

How long does a closed loan stay on your credit report

10 years

Closed loan and credit card accounts can stay on credit reports for up to 10 years and can help or hurt your credit scores as long as they persist.

Do lenders see closed accounts

If you wrote to your creditor, canceled your account and got acknowledgement that the account was closed, it should come as no surprise that it shows up as “closed” on your credit reports. Closed accounts in good standing will typically remain on your report for 10 years.

Cached

Do I still owe money on a closed account

Once your credit card is closed, you can no longer use that credit card, but you are still responsible for paying any balance you still owe to the creditor. In most situations, creditors will not reopen closed accounts.

Should I pay off a closed account

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn't.

Do I still owe if the account is closed

Once your credit card is closed, you can no longer use that credit card, but you are still responsible for paying any balance you still owe to the creditor. In most situations, creditors will not reopen closed accounts.

What does it mean when a loan is closed on your credit report

Since you can't use the account for anything else, once a loan is paid in full, it is essentially closed. In both cases, the terms indicate a "final status," meaning the account is no longer active and cannot be used again. Occasionally the terms are interchanged on accounts, but the underlying meaning is the same.

How do I remove a closed loan from my credit report

You have to pay the entire outstanding amount on your debt to get a clearance from the lender or financial institution. Get an NOC (No Objection Certificate) from the lender after you pay off your dues to get the status of “Settled” removed from your CIBIL credit report.

How much does credit score drop with closed account

While the closed account will still count toward your credit age in that part of the equation, if you close a credit card you may lose points in the credit utilization scoring factor, which counts for 30% of your FICO score.

Do closed accounts get removed

An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. This generally helps your credit score. Accounts with adverse information may stay on your credit report for up to seven years.

How do I remove a closed account from my credit report

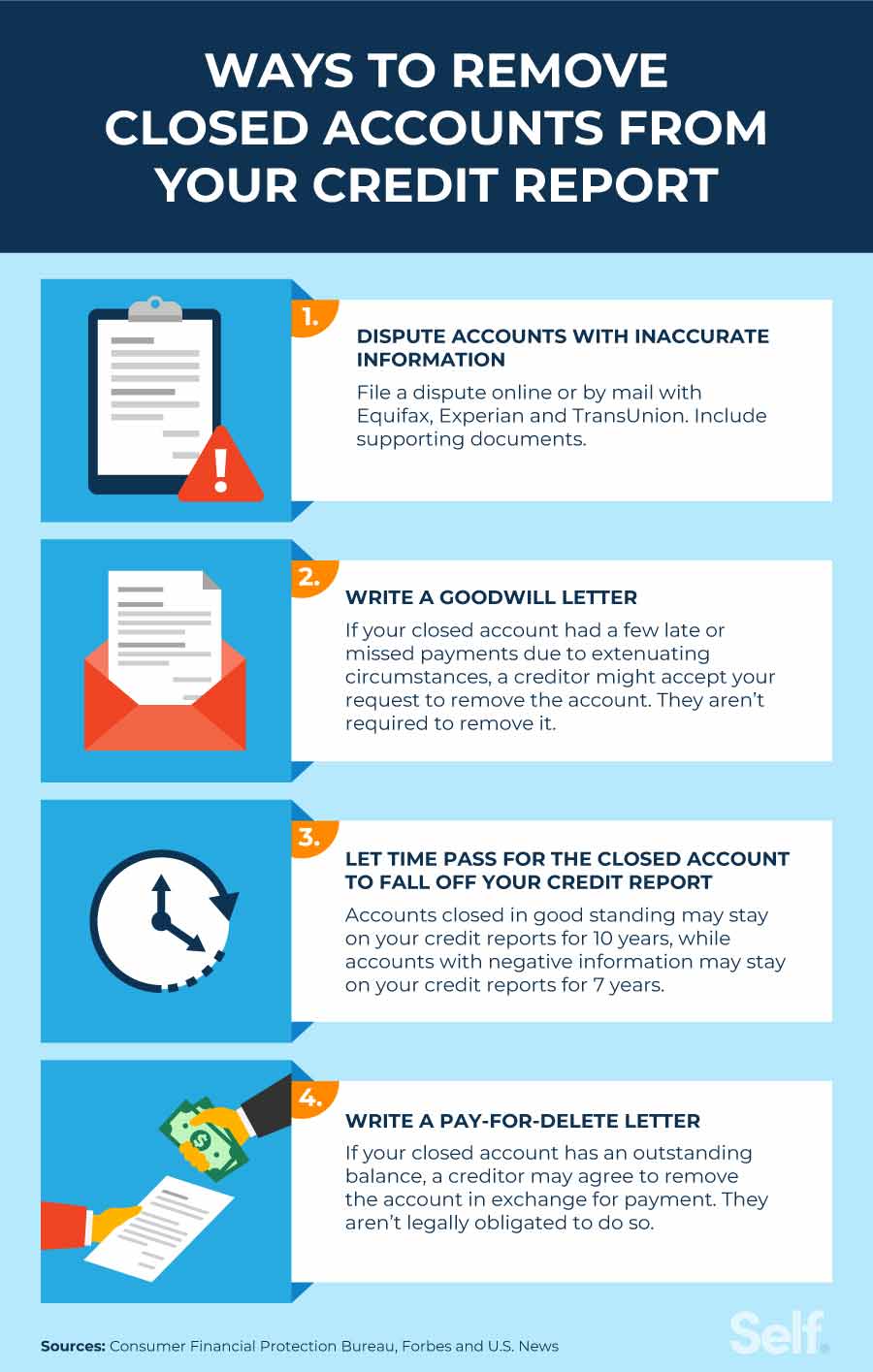

Closed accounts can be removed from your credit report in three main ways: (1) dispute any inaccuracies, (2) write a formal goodwill letter requesting removal or (3) simply wait for the closed accounts to be removed over time.

Do I still owe money if my account is closed

When a bank closes your account with a negative balance, you will be responsible for paying the amount owed. If you do not pay the amount in a timely manner, the bank may send your account to a collections agency and report your debt to credit bureaus, which could lower your credit score.

Do closed accounts affect buying a house

In closing, for most applicants, a collection account does not prevent you from getting approved for a mortgage but you need to find the right lender and program.

Should I still pay off a closed account

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn't.

Should I continue to pay on a closed account

It's important that you keep making at least the minimum payment on time each month, even after the account is closed, to protect your credit score. Late payments will hurt your credit score just as if the credit card was still open.

Do you still need to pay off a closed account

You can still make payments on a closed credit card account, you just cannot make purchases with it. To pay off a balance, continue making payments the same way you did before it was closed. You can usually do this online or, if you get a paper bill, via check.

Does a closed account look bad

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn't.

Is it OK to have closed accounts on your credit report

Closed accounts on your credit report can affect your credit score, but the words “account closed by creditor" aren't cause to panic. Several key factors make up your credit score : Payment history. Credit usage (or utilization ratio)

Does closed accounts look bad

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn't.